Massive BTC ETF Inflows Push Bitcoin Price Above $93K — Biggest Since Trump Took Office!

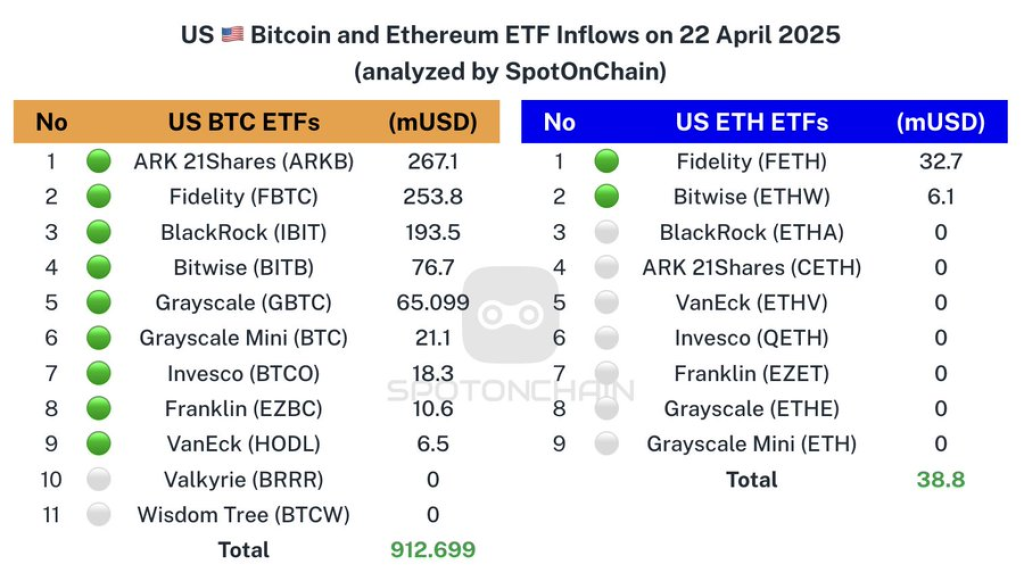

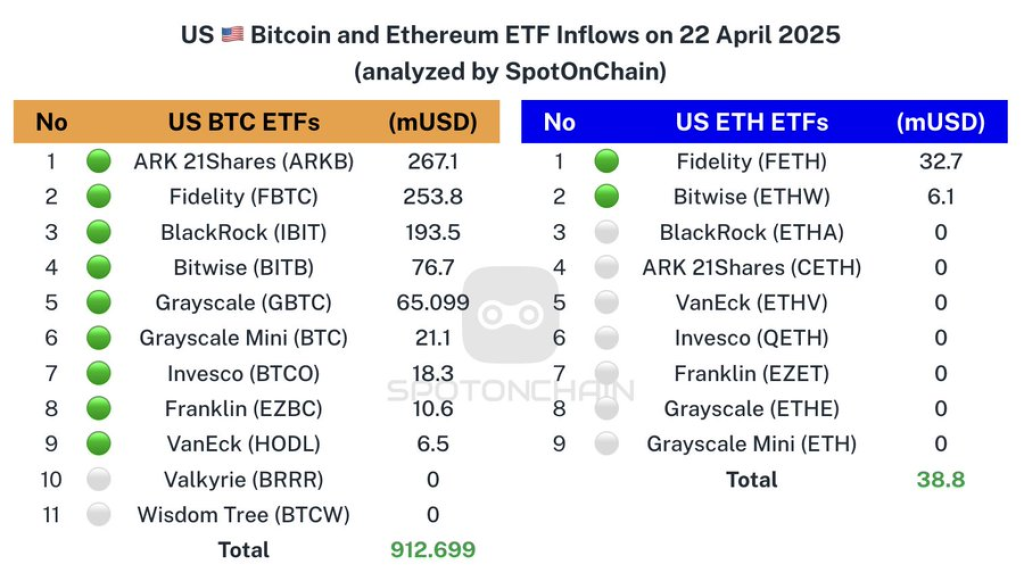

The crypto world just witnessed a major institutional vote of confidence. According to a detailed analysis shared by Spot On Chain, U.S. Bitcoin ETFs recorded their largest single-day net inflow since President Trump first took office. The total inflow? $912.7 million.

This sudden influx of capital didn’t go unnoticed in the market. Bitcoin (BTC) surged back above $93,000 — a level it hadn’t seen in over 50 days. The timing of this move is especially interesting, as it comes alongside a fresh wave of optimism in the market, partly sparked by Trump’s softened tone on China tariffs, which many see as a bullish macro signal.

BTC ETF Inflows: Who Led the Charge?

The breakdown provided by Spot On Chain shows exactly where the money went. Leading the pack was ARK 21Shares (ARKB), pulling in $267.1 million — the second-largest inflow for the ETF since it launched. Right behind it was Fidelity’s FBTC with $253.8 million, and BlackRock’s IBIT brought in a healthy $193.5 million.

In total, 11 BTC ETFs were tracked, but not all saw action. Some, like Wisdom Tree’s BTCW, reported zero inflow on the day. Still, the total number speaks volumes. It wasn’t just a few investors making moves — it was a flood of institutional capital.

Ethereum also saw some love, with $38.8 million flowing into ETH ETFs. Fidelity again dominated here with $32.7 million into FETH, followed by Bitwise’s ETHW with $6.1 million. Other major ETH ETF providers, including BlackRock and ARK, posted no inflows for the day.

BTC Price Outlook: Is $180K Really on the Table?

While ETF data gives us a clear view of institutional activity, crypto analysts like @CryptoELITES are now zooming out to look at the big picture. And according to them, this might just be the beginning of something huge.

Their latest chart suggests that Bitcoin is once again following a familiar pattern — one that’s played out multiple times over the last few years. The chart highlights three major correction-rally cycles:

- First: -23% correction followed by a 200% rally

- Second: -33% drop and a 120% bounce

- Third (most recent): -31% dip — and now, possibly, another explosive move ahead

@CryptoELITES points to the historical accuracy of this trendline, which has acted as dynamic support for years. After each significant correction, BTC has not only recovered but launched into a massive rally. If history repeats — or even rhymes — we could be staring down a 100%+ surge, pushing the Bitcoin price to $180,000.

The chart also shows momentum indicators like RSI repeatedly bouncing from oversold zones, aligning with major reversals in BTC’s price. This technical alignment only strengthens the argument for a new rally phase

Read Also: XRP Price to $33? This Chart Makes a Convincing Case

Growing Optimism for a Rally

Between the record-breaking BTC ETF inflows, the macro optimism around U.S.-China relations, and the strong technical setup laid out by @CryptoELITES, there’s a growing sense that Bitcoin’s next major move could already be underway.

It’s rare to see both fundamental and technical factors line up this neatly. But right now, they seem to be pointing in the same direction — up. Whether it’s the ETF data from Spot On Chain or the historical cycles identified by CryptoELITES, the message is clear:

Bitcoin’s journey to $180,000 might just be getting started.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.