XRP at 20% of E-Commerce by 2029? Here’s the Shocking Price Estimate

- ChatGPT analysis shows XRP needs $570B market cap for $2.28T payment volume

- Velocity models suggest price range between $9.50-$19 based on usage rates

- Speculative premium could drive market cap to $8.55T pushing price to $142

Market analysts continue to debate XRP’s valuation relative to its potential in global payment systems. The cryptocurrency’s current price appears disconnected from its possible role in facilitating cross-border transactions and e-commerce settlements.

E-commerce payment volumes reached $7 trillion in 2024, with projections indicating growth to $11.4 trillion by 2029. This expansion creates opportunities for cryptocurrencies like XRP to capture market share through improved settlement efficiency and reduced transaction costs.

Utility Model Points to $9.50-$19 Price Range

ChatGPT’s analysis examined XRP’s potential if the cryptocurrency processed 20% of global e-commerce payments by 2029. This scenario would require handling approximately $2.28 trillion in annual transaction volume.

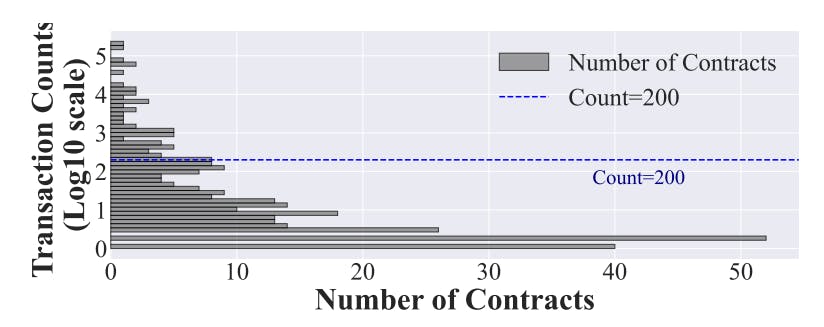

The utility-based model treats XRP as a settlement layer similar to central bank liquidity assets. Using velocity of money calculations, ChatGPT determined XRP would need a $570 billion market cap to support this payment volume.

With 60 billion tokens in circulation and assuming each token moves four times annually, the analysis produces a $9.50 price target. Lower velocity scenarios where tokens circulate only twice per year would push the price to $19.00.

Speculative Premium Could Drive Price to $142

The second model incorporates speculative elements that often drive cryptocurrency valuations beyond pure utility calculations. This approach mirrors Bitcoin’s early price appreciation, which occurred before widespread adoption materialized.

ChatGPT applied a 15x speculative multiplier to the base $570 billion market cap, resulting in an $8.55 trillion valuation. This calculation produces a theoretical XRP price of $142 per token.

The speculative model accounts for investor behavior where market participants price in future utility before actual implementation occurs. This premium reflects expectations about XRP’s eventual role in global payment infrastructure.

Current market conditions show growing institutional interest in cryptocurrency payment solutions, with regulatory clarity improving in multiple jurisdictions. These developments could accelerate XRP adoption in e-commerce applications.

The 20% market share assumption represents an aggressive but achievable target given XRP’s technical capabilities for fast, low-cost international transfers. Traditional payment systems face increasing pressure to improve efficiency and reduce costs.

Real-world implementation would likely fall between the utility and speculative models, with actual price determined by adoption rates, competition from other payment cryptocurrencies, and overall market sentiment toward digital assets in commerce applications.