Ethena (ENA) Pumps 20% — But This Might Just Be the Start

While the broader crypto market is in retreat, Ethena (ENA) is defying the trend, rallying nearly 20% in the past 24 hours and catching the attention of traders across the board.

But what really stands out is the convergence of key signals such as rising whale activity, steady exchange outflows, and a bullish chart setup. All signs suggest that something bigger may be brewing. Could ENA be gearing up for a breakout rally?

Whales Are Gobbling Up Ethena

The most important trend right now is that whales are buying, and not selling. According to Nansen’s dashboard, ENA whale holdings have jumped 8.15% in the last seven days. At the current price, that stands close to $1.87 million.

That’s a sharp increase, and it’s happening while most of the market is either flat or down. This kind of whale behavior usually signals confidence; big players are positioning for a larger move.

At the same time, exchange balances are falling. Over the past week, 1.07 billion ENA tokens have left exchanges.

That means Ethena (ENA) is moving into private wallets, not trading platforms. When this happens, it’s often a sign that holders plan to sit tight. Less supply on exchanges means fewer chances of sudden selling.

In short, big wallets are scooping up ENA, and the token is quietly disappearing from exchanges. That’s a strong bullish setup.

OBV Divergence Hints at Momentum Building Underneath

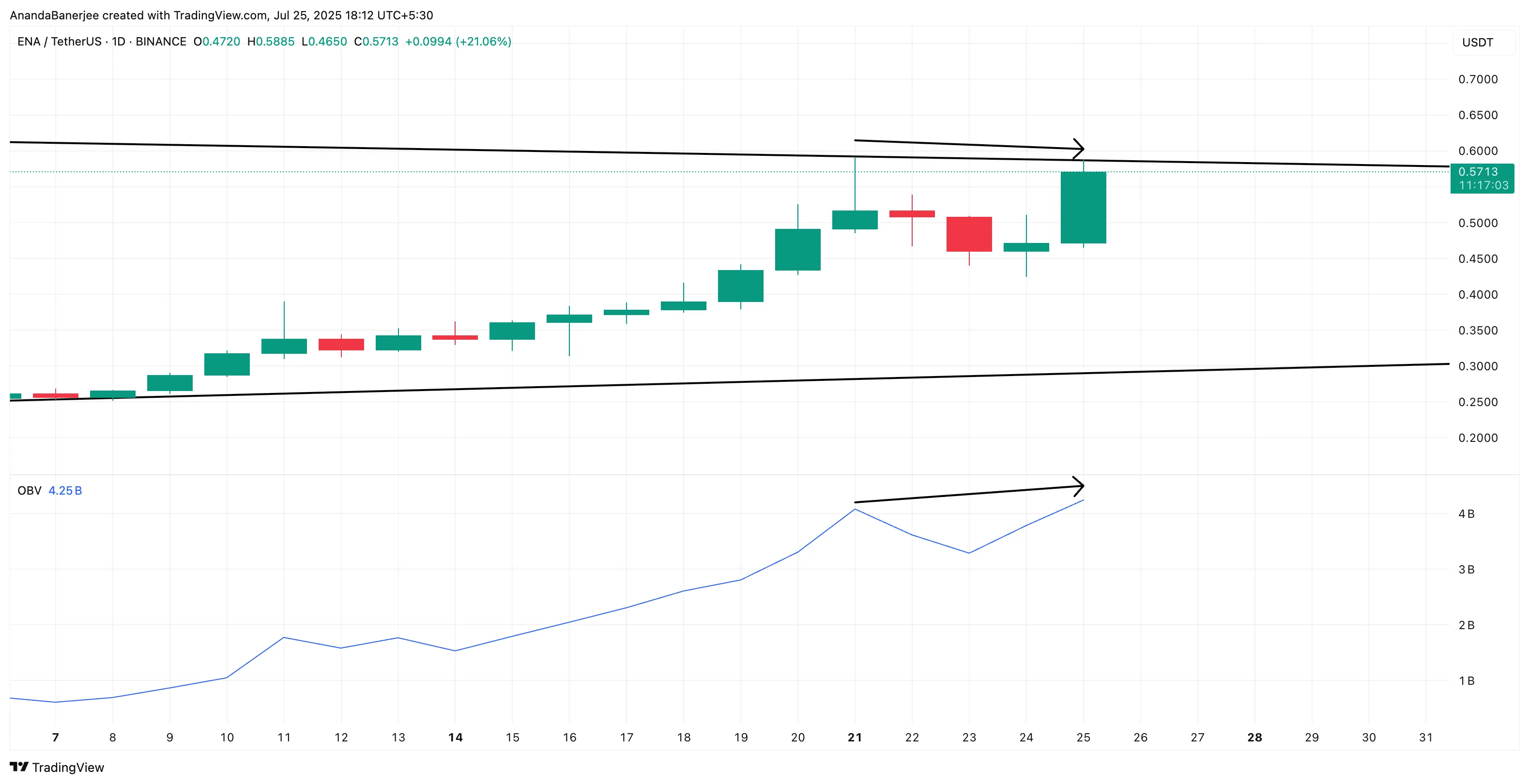

The chart shows something even more interesting. While ENA’s price made a lower high, the On-Balance Volume (OBV) made a higher high at the time of writing. This is called a bullish divergence; it happens when volume flows suggest buyers are stronger than the price action shows.

At the time of writing, ENA is still inside a converging wedge pattern and trading near $0.57. The OBV trend is breaking higher, which hints that buying pressure is building under the surface. Buyers are quietly stepping in even as the price consolidates.

This kind of divergence often appears before a breakout. Combined with the whale activity, it shows that accumulation may already be underway.

On-Balance Volume (OBV) tracks whether volume is flowing into or out of a token, helping spot hidden trends.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Wedge Breakout Could Ignite the Next Leg for ENA’s Price, But $0.60 Is Key

Technically, ENA has been trading inside a wedge since late June. However, just to add another layer of validation, the chart uses the trend-based Fibonacci extension tool. This tool or indicator is used to chart price targets during an uptrend.

The first point of the Fibonacci extension plotting began near $0.22 and extends to a recent swing high around $0.59. Yesterday, ENA retraced to $0.42, but today it’s bouncing back hard and hovering just under the breakout zone.

The big number to watch now is $0.60. That’s the 0.5 Fibonacci extension level from the recent trend. A clean breakout above the wedge at $0.58, followed by the $0.60 mark, could unlock a rally toward $0.65, $0.71, or even beyond. More so with the current whale and volume backing.

However, here’s the catch. If ENA fails to break out and drops back below $0.51, the bullish case weakens. That would invalidate the wedge breakout thesis and could trigger a pullback.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.