Why Morpho’s $9B Network Is Powering Lending on Pharos’ RWA Blockchain

Can DeFi lending systems support institutional-grade credit markets? Pharos, a Layer 1 blockchain focused on Real-World Asset Finance (RWAfi), are integrating Morpho’s lending infrastructure natively into its mainnet, marking a strategic step toward building credit rails for both institutional and decentralized participants in DeFi lending market.

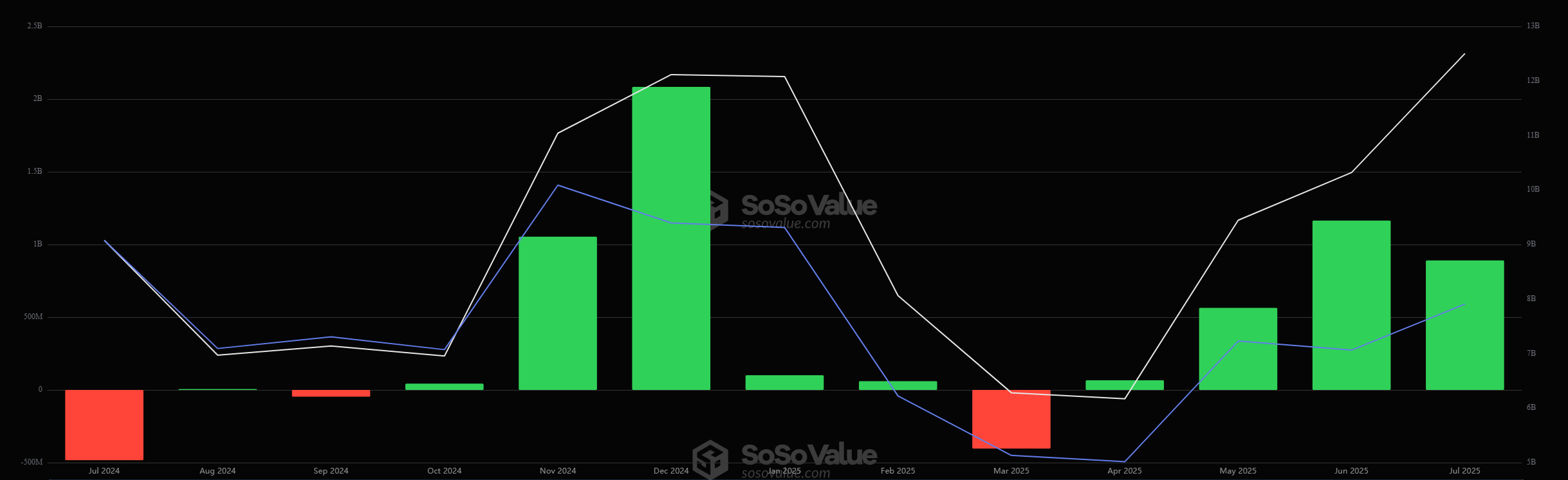

The collaboration is aimed at bringing modular, transparent lending systems to real-world assets on-chain. With Morpho’s lending protocol currently securing over $9 billion in deposits, the integration brings a familiar name in DeFi into the RWA conversation.

What This Integration Changes for Real-World Asset Lending

Pharos is not the first Layer 1 to focus on real-world assets, but the platform’s emphasis on building modular systems with institutional compatibility gives this collaboration a different weight. The integration brings isolated risk lending and credit modeling directly into the Pharos mainnet architecture.

Wish Wu, CTO and Co-Founder of Pharos, framed the collaboration as foundational.

“For us, working together with Morpho is about building trust and composability at the core of RWAfi,” Wu said. “By integrating Morpho’s lending infrastructure directly into our mainnet, we’re laying the foundation for a more transparent and capital-efficient on-chain credit ecosystem.”

The lending rails will support a wide range of use cases including tokenized treasuries, private credit, and yield strategies designed for both retail and institutional participants.

How Morpho Fits Into the RWAfi Ecosystem

Morpho is currently one of the most widely trusted DeFi lending protocols, known for building capital-efficient lending systems with isolated risks and modular design. Their infrastructure is already used for various crypto-backed loans and custom yield products.

Kirk Hutchison, who leads new chain growth at Morpho, sees the collaboration as a way to extend those lending frameworks into newer territories.

“Deploying natively on Pharos allows us to keep extending Morpho’s most trusted lending infrastructure to the real-world asset space following initial success like private credit and tokenized stocks,” Hutchison said.

Morpho’s involvement also strengthens Pharos’ broader RWAfi strategy, which includes partners such as Ant Digital and Gauntlet, and focuses on formal verification, custody solutions, and risk calibration.

Understanding RWAfi and Why Lending Needs to Evolve

RWAfi, short for Real-World Asset Finance, refers to financial systems that bring real-world assets, such as credit, invoices, real estate, or tokenized equity, onto public blockchains. These systems aim to improve transparency, automation, and capital efficiency while reducing dependence on opaque intermediaries.

However, integrating real-world assets into DeFi requires more than tokenization. It also requires robust infrastructure for pricing, credit modeling, liquidity routing, and risk segregation. That is where Morpho’s lending framework becomes relevant.

By deploying on Pharos, Morpho’s infrastructure can provide tools for asset originators to spin up lending markets with isolated risk exposure, composable underwriting models, and automated collateral management. It also allows institutional lenders to allocate capital using transparent, programmable logic rather than relying on opaque term sheets.

Why This Move Matters for Institutional and Retail Credit Markets

One of the challenges in scaling real-world asset markets on-chain is the lack of infrastructure that satisfies both institutional and DeFi-native requirements. This integration attempts to address both.

Pharos’ upcoming vault products, powered by Morpho, are expected to include structured lending strategies and capital deployment frameworks. The architecture is designed to be composable, which means it can integrate with other tools and systems across the Pharos ecosystem. That modularity is critical for experimenting with new forms of yield structures and underwriting logic.

Retail users will benefit from more accessible yield opportunities that are backed by real-world cash flows rather than purely crypto-native assets. On the other side, institutional participants get a sandbox for programmable credit with auditability and composability.

Infrastructure, Not Hype, Will Define the Future of RWA

The launch of yet another RWA protocol is not newsworthy in itself. What makes this collaboration worth watching is the infrastructure-first approach. Too many RWA projects have focused on tokenizing assets without rethinking the credit, compliance, or custody infrastructure that needs to support them.

Morpho’s decision to deploy natively on Pharos suggests that both teams are aligned on building from the bottom up. Credit markets need to be transparent, programmable, and modular—qualities that have often been missing from past RWA efforts. If the collaboration delivers, it could offer a test case for how on-chain lending should work when assets are tied to real-world value.

Don’t forget to like and share the story!

This author is an independent contributor publishing via our