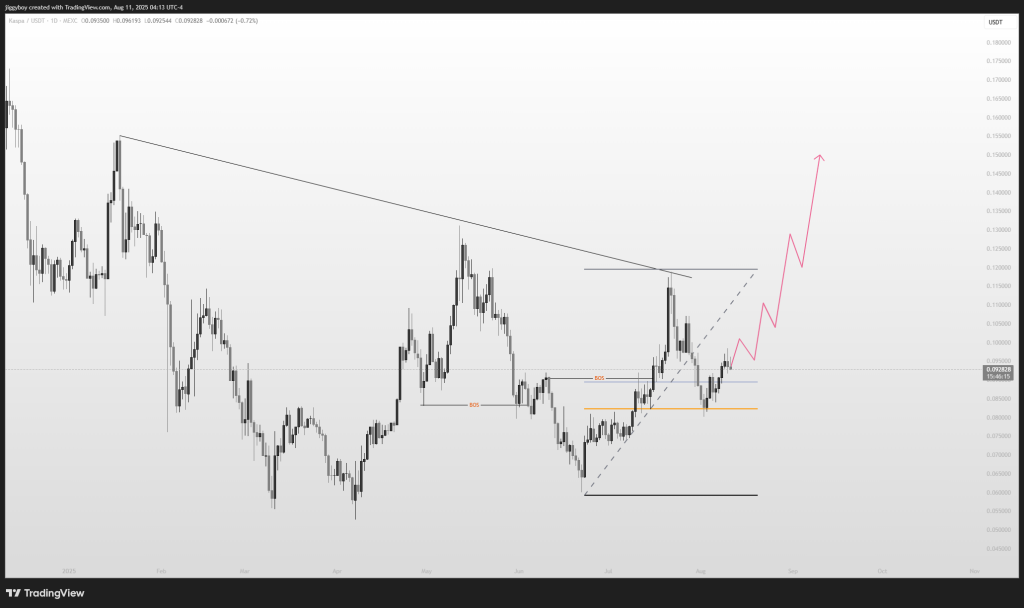

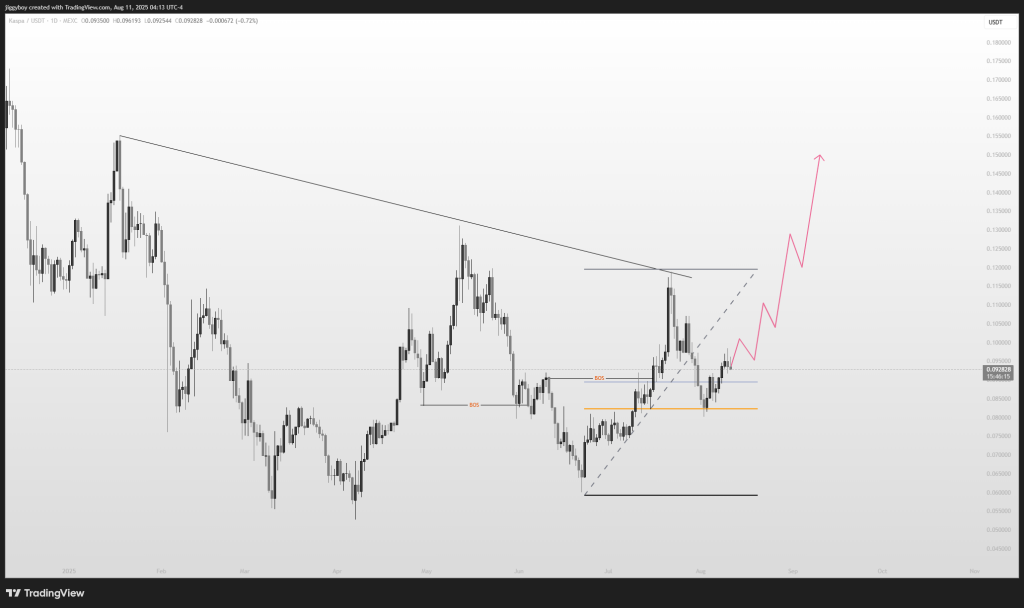

Kaspa Price Enters a Decision Zone as Exchange Supply Shrinks – Here’s What the KAS Chart Reveals

KAS price sits near a make-or-break level as traders weigh supply and leverage data. Kaspa Daily reported on X that funding rates stay positive and known exchange holdings fell to a six-month low of 2.19 billion KAS. Price compresses near $0.10, where the next move often begins.

KAS price has trended higher since late June. It topped in the mid-$0.12s in late July, then formed a base around $0.095–$0.10.

Kaspa Daily also noted that KAS ranks third for bullish sentiment today. The token has appeared in the top ten for months, showing steady optimism within the community.

Kaspa ranks 3rd in bullish sentiment today, continuing its streak of being in the top 10 almost non-stop for months.

— Kaspa Daily (@DailyKaspa) August 11, 2025

This consistent presence highlights the strong and sustained optimism within the community. pic.twitter.com/nMAvCHCnGB

Kaspa Derivatives Positioning: Funding Stays Green

Funding rates have held above zero since late June, according to Kaspa Daily. Longs pay shorts, which shows a persistent buyer tilt.

Funding spiked during July’s run and cooled as price ranged. Funding now leans positive again while KAS price coils at $0.10, a setup that often precedes a break.

Kaspa Funding Rates Stay Positive

Kaspa’s funding rates have remained positive since late June, showing a consistent long bias in the derivatives market.

Price is consolidating near $0.10, with leverage tilted toward buyers, a setup that could fuel a sharp move once the range… pic.twitter.com/JLCmSwp3fT

— Kaspa Daily (@DailyKaspa) August 11, 2025

Moreover, known exchange holdings have trended down from about 3.3B six months ago to 2.19B now. Fewer coins on exchanges usually mean lighter near-term sell pressure.

Tighter supply can accelerate moves when demand returns. It can also exaggerate pullbacks if bids thin out during volatility.

Kaspa known exchange holdings have dropped to a new 6-month low, with just 2.19 billion KAS sitting on exchanges.

This continued decline in available supply suggests reduced sell-side pressure pic.twitter.com/35olTjwuzT

— Kaspa Daily (@DailyKaspa) August 11, 2025

Read Also: XRP Price Prediction for Today (August 11)

Key Levels on the KAS Chart

Near-term resistance is at $0.098–$0.10. A clean 4H close above $0.10 puts $0.105–$0.11 in view and sets up a test of $0.12 if volume increases.

Support comes in at $0.094–$0.095, and then $0.090. Slightly steeper support is at $0.083–$0.086, the shelf of the late-July breakout.

The higher-timeframe ceiling remains the descending trendline near $0.112–$0.12. A daily close above this zone would confirm a larger change and make extension targets of $0.13–$0.15.

Moreover, breakout case needs rising spot volume, steady funding, and open interest that grows with price. That mix often sustains momentum.

A failure case appears if KAS price loses $0.094 while funding stays hot. That setup can trigger a squeeze toward $0.090, and even $0.085 if momentum accelerates.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.