Ethereum Price Set To Double As SWIFT Rival Leads Bull Run With 25,000% Rally Predictions

For years, the Ethereum price has been the heartbeat of decentralized finance, the benchmark for smart contracts and token economies. But a shift is forming. As global payment systems edge toward blockchain rails, analysts say the next bull run might not be led solely by Ethereum. The spotlight is now turning toward a SWIFT rival quietly building the foundation for a new financial era.

The Ethereum price may double, but the real story could be Paydax Protocol (PDP), a hybrid liquidity protocol that some are calling the blockchain banking revolution.

ETH Price Eyes $9,000: Ambitious Or Possible?

The Ethereum price is poised for a significant bull run. Network upgrades are set to reduce fees, expedite transactions, and enhance staking rewards, making the ecosystem more efficient than ever. Meanwhile, DeFi and NFT activity continue to pour liquidity into the Ethereum price, fueling momentum across the board.

Source: TradingView

Technical charts display strong bullish signals, and with growing institutional adoption alongside the expansion of Layer-2 solutions, the Ethereum price isn’t just standing firm; it is evolving into a blockchain powerhouse poised to lead the next bull run. But a SWIFT rival is slowly forming as this new reality prepares to hit the markets.

The SWIFT Rival Story: Why Payments Are the New Frontier

Every day, SWIFT processes over $5 trillion in transfers — yet remains painfully slow, costly, and dependent on aging intermediaries. Blockchain promised to fix this years ago, but until now, no project has managed to merge Ethereum’s liquidity with real-world transactional flow.

Among them, Paydax Protocol is emerging as a SWIFT rival. It blends Ethereum’s programmability with institutional-grade liquidity infrastructure, not just creating programmable money but programmable payments. Its PDP token powers near-instant settlements without banks or intermediaries, positioning Paydax (PDP) to drive a separate bull run.

Inside The Project Analysts Say Could Multiply 25,000%

Analysts predict the Ethereum price could reach $9,000 by 2026, a doubling fueled by ETF inflows, staking growth, and enterprise adoption. But the real opportunity lies beneath the surface: when large-scale liquidity flows into Layer-1 networks, DeFi protocols built for capital efficiency can multiply returns exponentially in the bull run.

| Asset | Current Price | Target Price | ROI Potential |

| Ethereum (ETH) | $4,500 | $9,000 | 100% |

| Paydax (PDP) | $0.015 | $3.75 | 25,000% |

Paydax captures this energy at the micro-cap stage. Acting as a liquidity bridge, PDP channels institutional flows into cross-chain settlements, amplifying its bull run potential. Early metrics indicate that over 64 million tokens have been sold and $965,000 raised, with projections suggesting a potential gain of $3.75 per token, which amounts to a 25,000% increase in the next bull run.

The Paydax Protocol: A SWIFT Rival With Purpose

The Paydax Protocol was designed to address one of DeFi’s most significant inefficiencies: trapping liquidity. Traditional SWIFT transfers require intermediaries to clear payments; DeFi lending often locks capital for months. Paydax, the SWIFT rival, eliminates both constraints with its liquidity-unlocking engine powered by the PDP token, fueling a bull run.

Here’s what makes Paydax a true SWIFT rival:

- Real-Time Settlements: Instant transactions across multiple chains, bypassing the multi-day delays of SWIFT.

- Tokenized Collateral Lending: Borrow, lend, and earn yields without selling your underlying assets.

- Deflationary PDP Model: Each transaction burns a fraction of PDP, tightening supply as usage scales.

This architecture gives Paydax both utility and scalability — two traits that analysts say most “DeFi 2.0” projects lack.

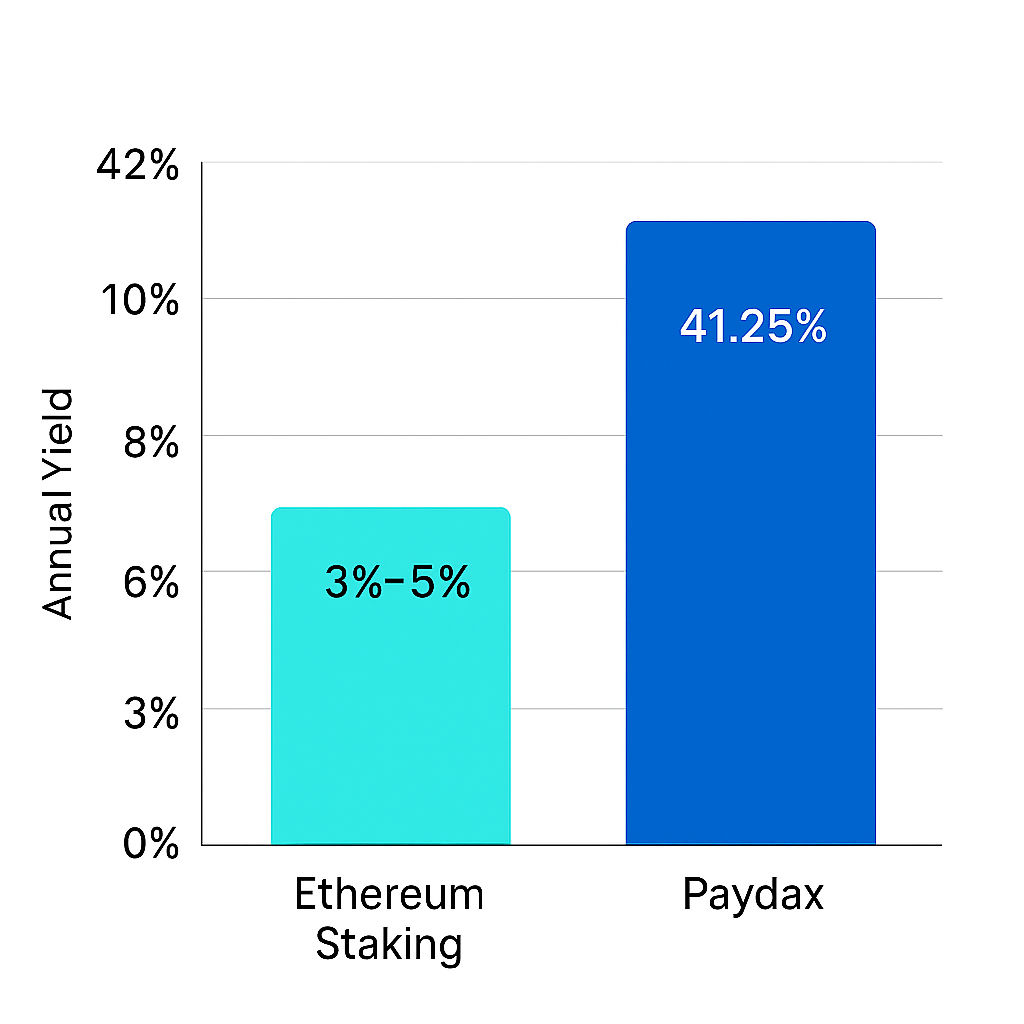

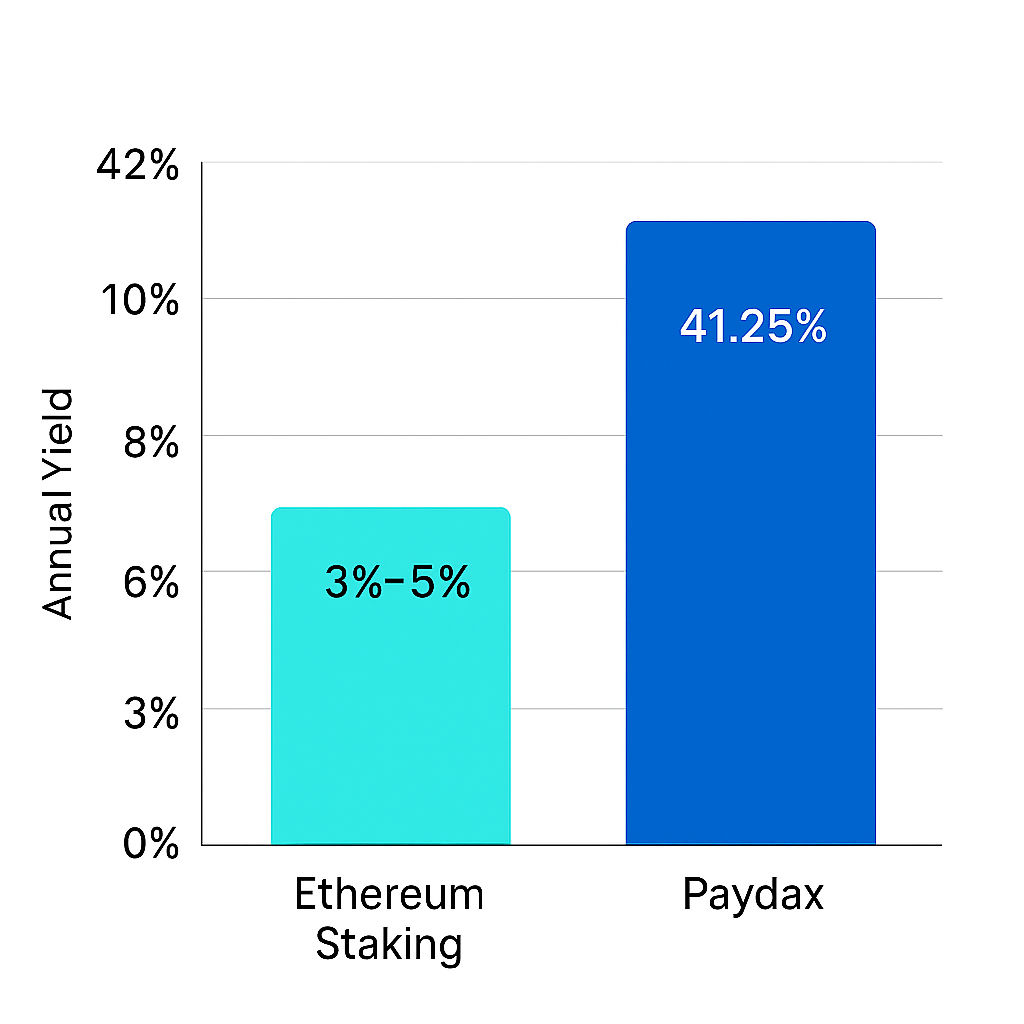

Enhanced Yields for Ethereum Users

Ethereum staking typically offers annual yields ranging from 3% to 5%, but what if your capital could work harder? Paydax, the SWIFT Rival, transforms idle crypto into high-performance liquidity. Users lending ETH, BTC, or LP tokens can earn an APR of 5%–7% and up to 41.25%, while liquidity providers receive even higher variable yields based on network activity.

Source: Paydax Protocol

In effect, Ethereum holders aren’t just staking the Ethereum price; they’re participating in a dynamic system where capital flows across chains, generating compounded returns. Paydax turns dormant crypto into an opportunity, giving users a tangible reason to bridge their assets and capture more value from every digital dollar.

The Presale Opportunity and Dual Momentum

As the Ethereum price consolidates, capital rotation favors emerging projects like Paydax. Early participants are quietly accumulating PDP while it trades near its presale floor. The presale remains open, offering a 25% bonus with code PD25BONUS, providing low-cost exposure backed by audit-assured security.

Source: Paydax Protocol

Ethereum price may dominate headlines as it nears new highs, but Paydax is where liquidity translates into actionable payments, bridging digital capital with real-world execution. Together, they signal the next phase of finance: one where blockchain potential meets tangible impact. Ethereum highlights the opportunity; Paydax may well become the engine powering the next bull run with a 25,000% surge.

Join The Paydax Protocol (PDP) presale and community:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.