Analyst Predicts Solana Price Bullish Breakout To $200

Solana price has recently shown strong signs of recovery, leading analysts to predict a bullish breakout that could see the SOL price surpass $200.

Analysts anticipate that the current trend is a precursor of a significant bullish breakout as Trump tariffs fears end and the Bitcoin price recovers above the $94k resistance.

Is Solana Price Ready for a Bullish Breakout?

Solana price has been trading in a contained range-bound channel for several months, as depicted between October 2024 to April 2025. During this time, the cryptocurrency set the important support level at $147.48 and the price has been rebounding off this level of support.

According to Crypto General analyst, the price movement has formed an ascending triangle pattern. This pattern usually points to the bulls’ market continuation and can extend their move towards the upper resistance level, which is $288.51.

The ascending triangle implies that the price of Solana is steadily rising as the demand for the token also rises, with the formation of higher lows. This pattern is commonly regarded as an accumulation formation when buyers continuously drive the price up in anticipation of a breakout. A breakout above the $288.51 may open the door for more gains, taking SOL to $350 to $390 in the next few months.

Institutional Adoption Could Propel Prices Higher

Another reason that could further push Solana’s price up is the demand from institutional investors, such as SOL ETFs that have applied to the SEC and are waiting to be approved. Amid the swearing-in of a new SEC chair, the market anticipates an end to the uncertainties in regulations that may lead to the influx of institutional funds into Solana and other coins.

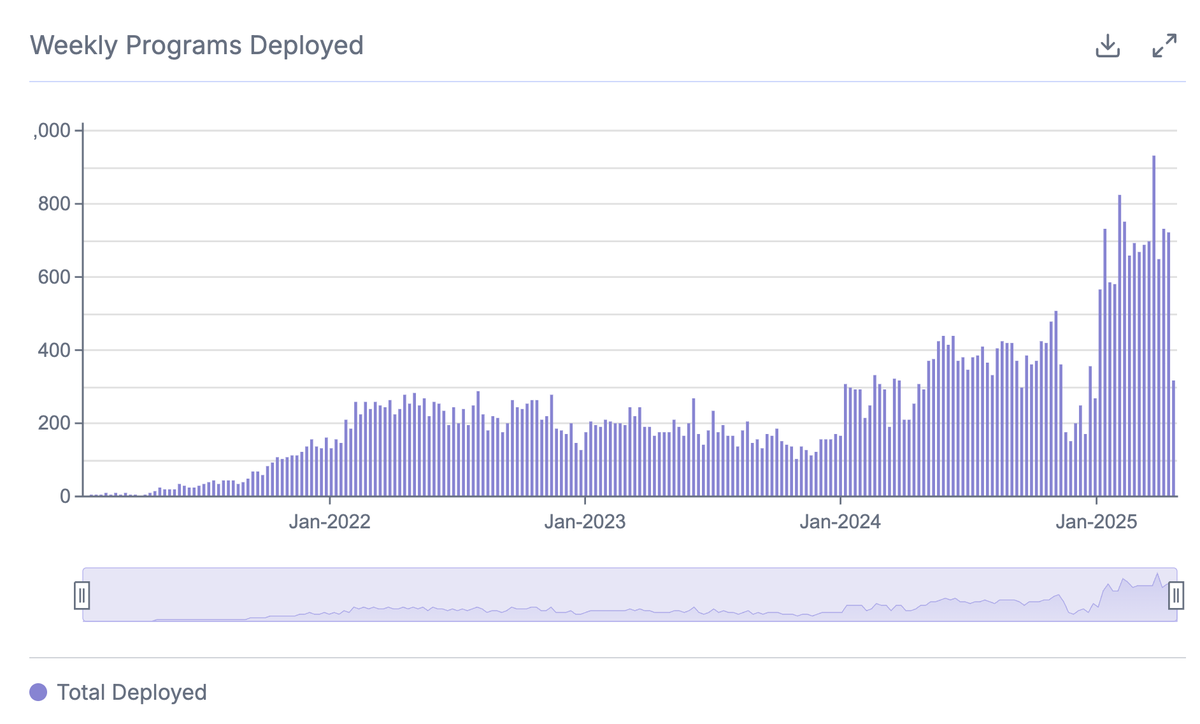

On a similar note, the high number of deployments on the Solana blockchain suggests that adoption and usage are also on the rise. As more developers build on the platform, the case for further growth in SOL’s value strengthens.

Several analysts, like Peter Brandt, have also stated that Solana could surpass Ethereum in the long term, which bolsters its long-term projections. Should institutional adoption increase, it could provide more upward pressure on Solana’s price and possibly even push it past $200.

Technical Indicators Suggest Bullish Outlook

To further support the bullish pressure, technical analysis of the SOLUSD price chart points to a significant bull run. From the 1-day price chart, the Bollinger Bands are expanding, which suggests the growing fluctuations in the SOL price. A

mid this trend, the price of SOL has crossed the upper Bollinger Band which is a sign of high volatility and uptrend action. If the price is above the middle band (blue line), it signals that this pattern may remain in control, which is a bullish signal.

In addition, Solana’s chart shows a falling wedge formation. This pattern, a bullish reversal formed by converging trend lines with lower highs and higher lows, hints at a major move incoming.

Solana’s recent breakout above the upper trendline of this wedge could be the beginning of a significant upward move. After this breakout, analysts target $275 as a potential price zone, reflecting a substantial upside from the current price.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: