ATH ever closer, the signals not to miss

The ATH (All Time High) of the prezzo di Ethereum dates back to November 2021, when it almost reached $4,900.

Since then, it has always struggled even to recover the $4,000, after the bear-market of 2022 that brought it even below $1,000.

However, the recent bullrun seems to have the strength to bring it back up.

The $4,000: target price level of Ethereum (ETH)

The price of Ethereum (ETH) exceeded $4,000 for the first time in its history in May 2021.

However, it was a very brief peak, almost immediately followed by a return below $3,000.

It then returned above this figure both in September and October of the same year, only to go on to record new all-time highs in November at almost $4,900.

After the bear-market of 2022, it managed to climb back above $4,000 only in March 2024, when it even came close to reaching $4,100.

Another similar rise was at the end of 2024, with the temporary return to $4,100 in December.

Since then, it has not been able to climb back above $4,000, although both in July and August of this year it managed at least to climb back above $3,900.

“`html

“`

When will the new ATH of Ethereum arrive?

To tell the truth, many were expecting a new ATH of Ethereum not only in December, but also as early as March 2024, because Bitcoin, for example, managed to record a new one.

Moreover, if in March 2024 the price of Bitcoin slightly updated the previous ATH, at the end of the year it updated it significantly, thanks to Trump’s electoral victory.

The fact is that, in theory, the victory of Trump should have paradoxically favored Ethereum more than Bitcoin, but instead, it ended up favoring Bitcoin more, probably thanks mainly to the traditional bull markets, where crypto ETFs are traded. In fact, the spot Bitcoin ETFs in 2024 were already doing great, while those on Ethereum were not.

Things, however, might have changed now.

In particular, the spot ETFs on ETH in the USA seem to have woken up.

To tell the truth, they had done great especially at the end of July, while at the beginning of August they had once again recorded overall daily net outflows.

However, in the last thirty days, the overall net inflows have been nearly 1.9 billion dollars, compared to total overall net inflows of almost 9.4 billion since they landed in the bull market just over a year ago.

Just consider that the ETFs on BTC spot in the same period recorded a total net outflow of 720 million dollars, however, against total inflows exceeding 54 billion since they landed on the stock exchange just over a year and a half ago.

The rise in the price of Ethereum (ETH): the comparison with Bitcoin (BTC)

All this is supported by the rise in the price of Ethereum in Bitcoin (ETH/BTC), which in recent months had reached record lows.

“`html

“`

In fact, in April ETH had even dropped below 0.018 BTC, which is the lowest level of the current cycle.

It must be said that the strong decline in the value of ETH in BTC began especially from November 2022, and since it only stopped in May 2025, it is a decline that lasted more than two and a half years.

Therefore, for Ethereum, the current situation seems to be very different from that of March or April 2024, when its price in dollars briefly returned above $4,000, and the current $3,900 is promising.

The boom of transactions on Ethereum

The most interesting data however is the boom in the number of daily transactions recorded on the Ethereum blockchain.

If until April it hovered around 1.2 million, now it has even risen above 1.8 million, a level of usage not seen since August 2021.

On the contrary, the current growth trend does not seem to have run out yet, and it is possible that August 2025 could close with the highest number of monthly transactions ever recorded on the Ethereum blockchain.

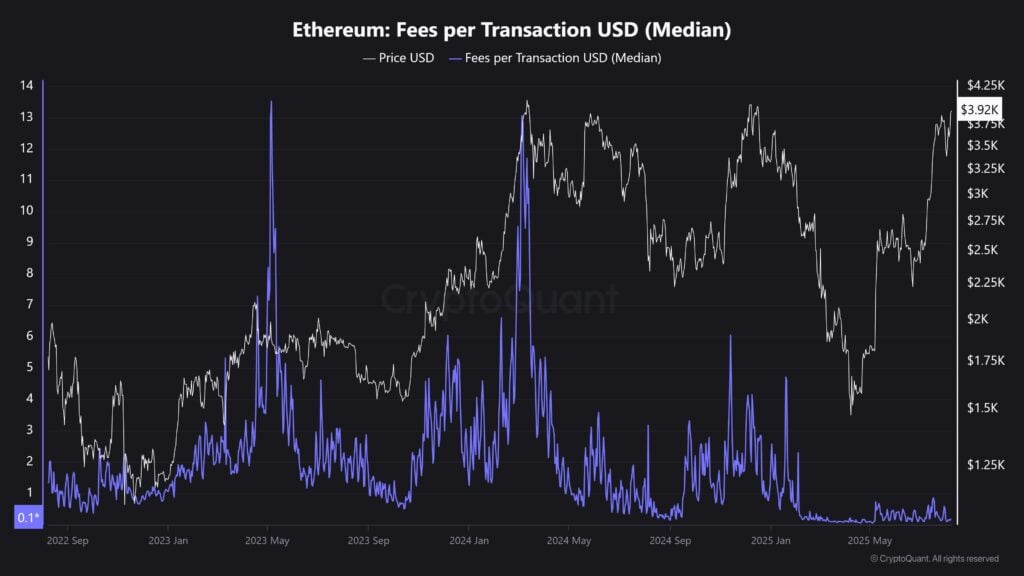

Moreover, the median value of fees per transaction is still very low, even lower than in May. There was a peak in July, but the median fees per transaction never exceeded 1$, whereas, for example, in 2021 it reached peaks above 30$ multiple times.

This scenario seems very bullish, even more so than the one concerning the analysis of price trends in the markets, also because it must be remembered that all the fees on the Ethereum blockchain must always and necessarily be paid in ETH.