Best Cryptocurrencies to Invest In Now Ahead of April 2025 Surge

April 2025 is just around the corner, and the crypto market is setting the stage for a dynamic month ahead. With major altcoins showing promising setups, opportunities continue to emerge for traders and investors.

Despite some corrections, the market remains full of potential plays—whether through strategic long-term holdings or capturing short-term volatility. In this discussion, we’ll break down some of the top altcoins to watch, analyze key market trends, and assess whether now is the right time to accumulate.

Bitcoin (BTC)

Bitcoin remains a dominant force in the cryptocurrency market, with a market capitalization of $1.67 trillion, accounting for over 50% of blockchain’s total valuation. While it may not offer the 10X or 100X potential that some altcoins do, Bitcoin continues to be a key asset for institutional investors and long-term holders.

Figures like Michael Saylor and major investment firms consistently accumulate Bitcoin as a hedge against inflation, often referring to it as “liquid gold.” Currently valued at $84.2K, Bitcoin’s stability and historical performance make it a cornerstone in crypto portfolios.

Rather than attempting to time the market, long-term success often comes from staying invested over time, as $BTC has repeatedly demonstrated its ability to withstand volatility and reach new highs.

Ethereum (ETH)

Ethereum is showing strong performance, outpacing Bitcoin and most of the market in both price action and trading volume. It has reclaimed key levels between $1,950 and $2,000, with $2,000 acting as a significant psychological barrier.

The recent price surge, supported by increased volume, indicates bullish momentum. Last week’s technical movements saw $ETH fill an imbalance zone and successfully test critical support levels, reinforcing buyer confidence.

Source – Jacob Crypto Bury on YouTube

Despite the bullish structure, caution is warranted. Historically, Ethereum outperforming Bitcoin has often led to a market pullback. Additionally, a surge in leverage suggests that short liquidations are driving the price up rather than organic demand.

While $ETH could still push toward $2,100, sustaining this breakout requires stronger fundamentals or Bitcoin maintaining its strength. Without these factors, a correction could follow, with $1,950 likely serving as a stable support level.

Several Ethereum-based altcoins are also benefiting from this momentum. While Ethereum’s current trend presents potential opportunities, long-term sustainability remains uncertain without further confirmation of a broader market uptrend.

Sui (SUI)

Sui is positioned as a highly capable token with significant potential for recovery. It brings the benefits of Web3 with the ease of Web2, making it an appealing option for investors looking for innovative blockchain solutions. Since its inception in 2024, $SUI’s market capitalization has grown from $2.4 billion to $15 billion.

However, it has also experienced a 50% correction in market cap, with its price reaching a peak of $5.29 before dropping to $2.25. Despite this pullback, Sui remains a strong contender in the space, showcasing resilience and potential for future growth.

Solana (SOL)

Solana has shown some bullish momentum after a bearish end to last week, but concerns remain regarding its sustainability. While the overall crypto market has seen some positive movement, $SOL’s rally appears to be driven largely by leverage rather than strong organic demand.

Unlike Ethereum, which is experiencing an influx of normal trading volume, Solana’s volume remains relatively low, making its recent price increases less convincing.

Fundamentally, Solana’s metrics are still weak. Total value locked (TVL) has bottomed out alongside the price, and although decentralized exchange (DEX) trading volumes remain above $1 billion, the overall network performance has been declining.

Some reports suggest a significant downtrend in DEX activity and TVL, highlighting concerns about Solana’s long-term stability. However, the possibility of a Solana ETF and the resilience shown by its ecosystem offer some reasons for optimism.

To confirm a bullish breakout, $SOL needs to break above $136 with strong volume. If successful, it could rally toward $145 and $150. While a bullish breakout is still expected in the long term, the timing remains uncertain, requiring patience from investors.

Avalanche (AVAX)

Avalanche has demonstrated impressive growth in past market cycles, reaching a market capitalization of $22 billion in 2021. Despite its strong fundamentals, Avalanche has yet to achieve a new all-time high in the current cycle, making it a potential candidate for further growth.

$AVAX is currently priced at $19.55, with a market capitalization of $8 billion and a 24-hour trading volume of $157 million. Over the past week, $AVAX has risen by 6%. The blockchain is known for its speed, scalability, and interoperability, providing a secure and efficient environment for decentralized applications (dApps).

With a fully doxxed team behind the project, Avalanche remains a promising option for investors seeking a high-performance blockchain network with room for expansion.

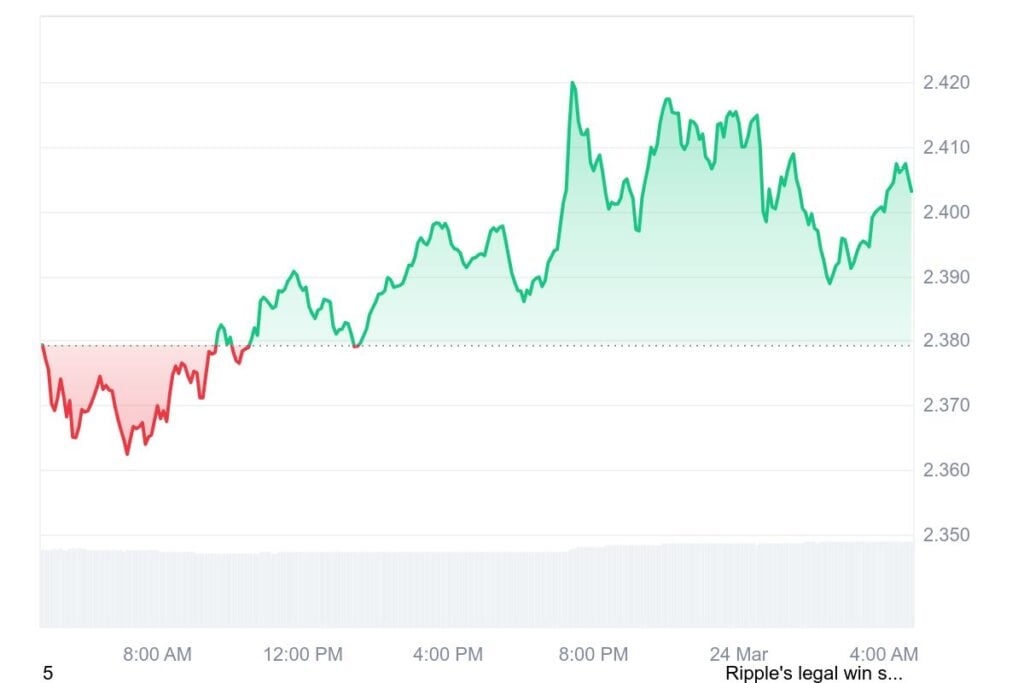

XRP (XRP)

XRP remains a significant player in the crypto market, despite not generating as much excitement as some other tokens. From a fundamental perspective, $XRP holds strong potential, especially after the resolution of its legal battle with the SEC.

While the lawsuit’s outcome did not classify XRP as a security, its clearance from regulatory uncertainty provides a more stable path forward.

Historically, XRP has not yet reached the $4 mark, but there is speculation that it could revisit its previous high of $3 and potentially push beyond that level. With a sizable market share and solid dominance, $XRP continues to be a relevant asset in the broader crypto landscape.

Cardano (ADA)

Cardano currently holds a market capitalization of $24.7 billion but has yet to make any significant moves in this cycle. However, there is growing speculation that Coinbase is becoming increasingly favorable toward Cardano, which could lead to a major launch on the exchange.

Such a development has the potential to drive a substantial price surge for the asset. While $ADA has remained relatively quiet in terms of major advancements, a strategic listing or increased support from major platforms like Coinbase could be the catalyst for a strong upward movement in its valuation.