‘Rust’ film armorer freed from prison as Alec Baldwin case was dismissed

NEWYou can now listen to Fox News articles!

Hannah Gutierrez-Reed, the armorer convicted in the tragic on-set shooting death of a cinematographer during the filming of Alec Baldwin’s film “Rust,” has been released from a New Mexico prison.

Gutierrez-Reed was found guilty of involuntary manslaughter in March 2024 for her role in the incident, where a live round discharged from a prop gun that Baldwin was handling in 2021. The shooting also injured director Joel Souza.

The “Rust” armorer has an appeal of the conviction pending in a higher court. Jurors acquitted her of allegations she tampered with evidence in the “Rust” investigation.

CONVICTED ‘RUST’ ARMORER ASKS FOR NEW TRIAL AFTER ALEC BALDWIN’S INVOLUNTARY MANSLAUGHTER CASE DISMISSED

Hannah Gutierrez-Reed, the former armorer for the Western film “Rust,” listens to closing arguments in her trial at district court in March 2024. (Luis Sánchez Saturno/Santa Fe New Mexican via AP)

She was released from the Western New Mexico Correctional Facility after serving her full 18-month sentence.

Gutierrez-Reed signed out of prison in Grants to return home to Bullhead City, Arizona, on parole related to her involuntary manslaughter conviction in the death of cinematographer Halyna Hutchins.

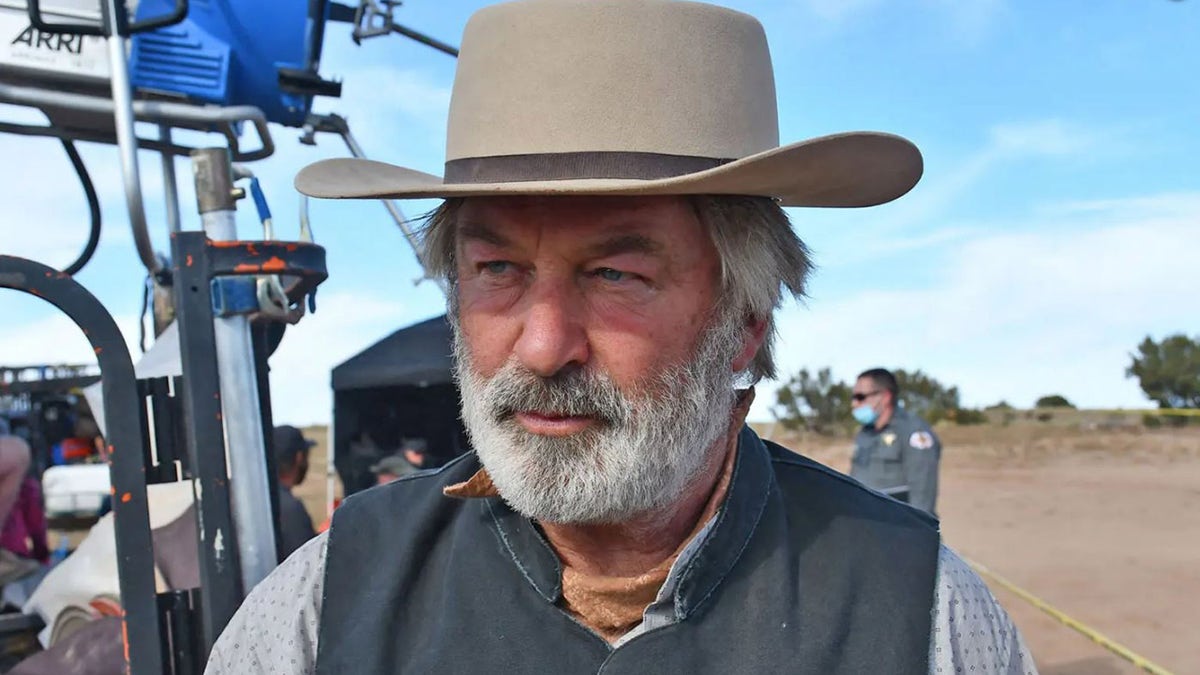

Alec Baldwin’s case was dismissed with prejudice. (Santa Fe County Sheriff’s Department)

The terms of parole include mental health assessments and a prohibition on firearms ownership and possession.

Prosecutors argued that Gutierrez-Reed had unwittingly brought live ammunition onto the set of “Rust” and failed to follow basic gun safety protocols.

ALEC BALDWIN SUES NEW MEXICO OFFICIALS FOR MALICIOUS PROSECUTION, DEFAMATION FOLLOWING ‘RUST’ TRIAL

Hannah Gutierrez Reed addressed the courts during her sentencing for involuntary manslaughter. (Courtesy: New Mexico courts)

She is also being supervised under terms of probation after pleading guilty to a separate charge of unlawfully carrying a gun into a licensed liquor establishment.

Gutierrez-Reed carried a gun into a downtown Santa Fe bar, where firearms are prohibited, weeks before “Rust” began filming.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

Halyna Hutchins died on the set of “Rust” in October 2021 from a gun Alec Baldwin was holding. (Panish Shea Boyle Ravipudi LLP)

Meanwhile, Baldwin was charged with involuntary manslaughter after a gun he was holding fired on the set of “Rust” in New Mexico, killing cinematographer Hutchins. Hutchins died Oct. 21, 2021.

In July 2024, Judge Mary Marlowe Sommer dismissed the case with prejudice, meaning the charge cannot be brought against the actor again.

His case was dismissed mid-trial after the judge found that the prosecution had withheld exculpatory evidence from the defense.

CLICK HERE TO GET THE FOX NEWS APP

The Associated Press contributed to this report.