Bitcoin, Ethereum, and XRP Hold Gains After CPI-Driven Surge

Crypto Market Holds Firm as Traders Assess Post-CPI Volatility

Bitcoin, Ethereum, and XRP maintain their gains after a highly volatile session driven by the latest U.S. CPI report. The inflation data showed a slight decline, fueling expectations that the Federal Reserve may pivot sooner than expected.

After yesterday’s post-CPI surge, Bitcoin is trading near $81,672, Ethereum is holding around $1,879, and XRP has climbed back to $2.31. However, with the market digesting macroeconomic signals and key resistance levels approaching, will the crypto rally continue, or is a correction on the horizon?

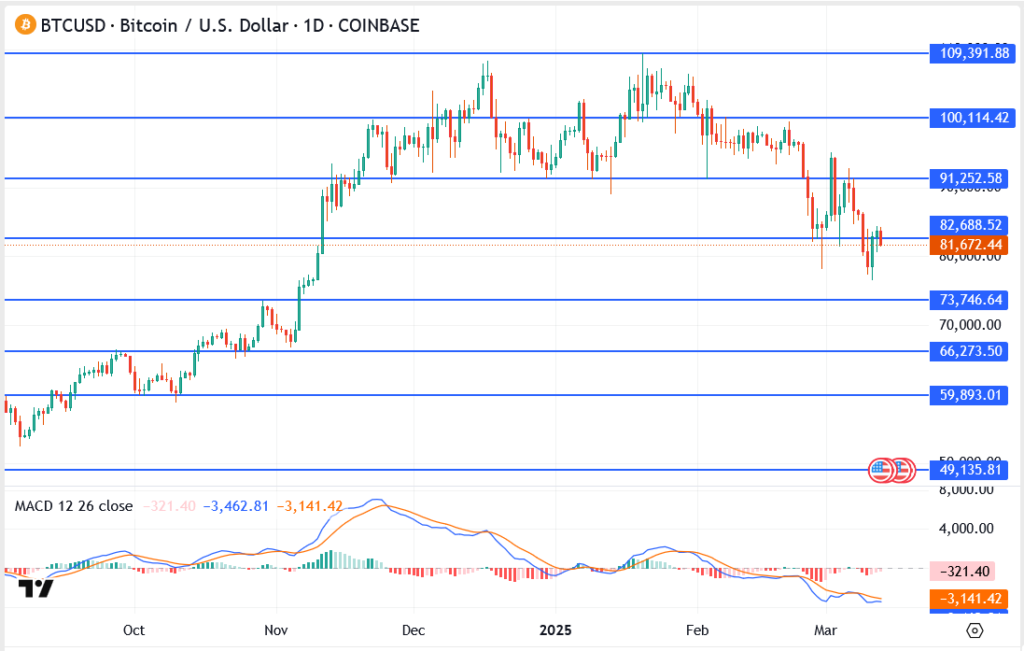

Bitcoin Price Analysis – Can BTC Hold Above $82K?

BTC Key Support and Resistance Levels

Bitcoin Price now: $81,672

24H Change: +0.5%

- Immediate Resistance: $82,688 – A break above this level could send BTC toward $85,000.

- Major Resistance: $91,252 – $100,000 – Bulls need to reclaim this range for a new uptrend.

- Immediate Support: $80,000 – If BTC fails to hold, a retest of $76,500 is likely.

- Major Support: $73,746 – $66,273 – Losing this zone could trigger a larger correction.

BTC Technical Indicators

- MACD: Still bearish but showing signs of a crossover, hinting at potential upside.

- RSI: Neutral, giving BTC room for further price expansion.

- Volume: Post-CPI buying pressure remains steady, supporting a potential push higher.

Outlook

If Bitcoin breaks above $82,688, it could target $85,000-$88,000. However, failure to hold $80,000 could trigger a pullback toward $76,500.

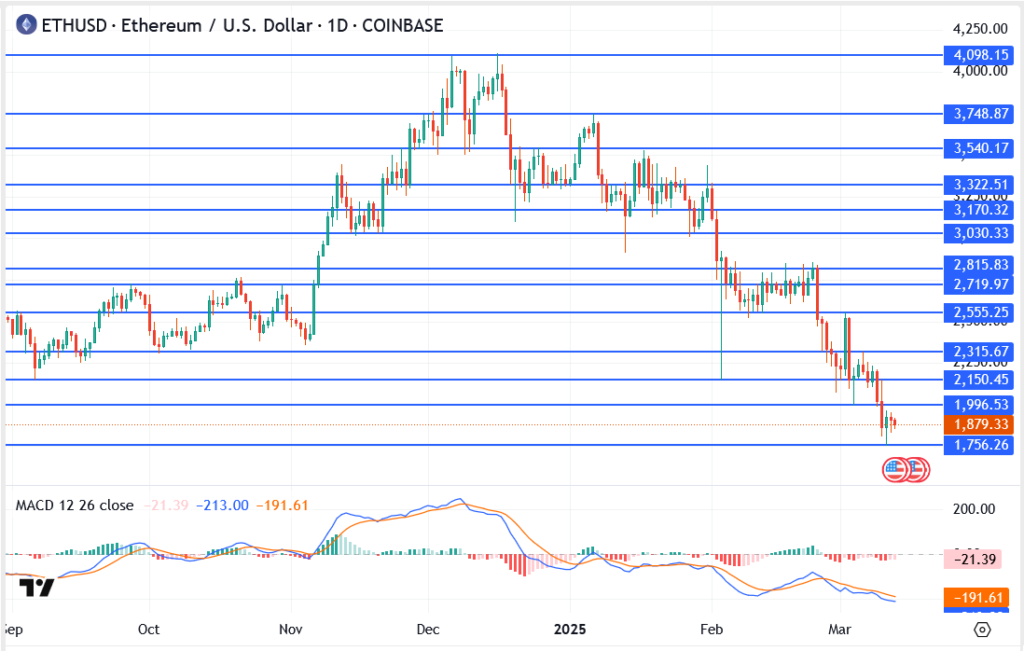

Ethereum Price Analysis – Bulls Struggle to Reclaim $2,000

ETH Key Support and Resistance Levels

Ethereum Price now: $1,879

24H Change: +1.2%

- Immediate Resistance: $1,996 – Ethereum must break this level for a run toward $2,150.

- Major Resistance: $2,315 – $2,555 – A move above this range would confirm bullish momentum.

- Immediate Support: $1,756 – Holding this level is crucial for stability.

- Major Support: $1,500 – $1,320 – A loss of these levels could trigger heavy selling pressure.

ETH Technical Indicators

- MACD: Bearish but flattening, suggesting weakening downward pressure.

- RSI: Slightly oversold, indicating a possible relief rally.

- Volume: Demand is picking up, but resistance at $2,000 remains a challenge.

Outlook

Ethereum needs a clean break above $1,996 to push toward $2,150. If it fails, $1,756 will be the next key support level to watch.

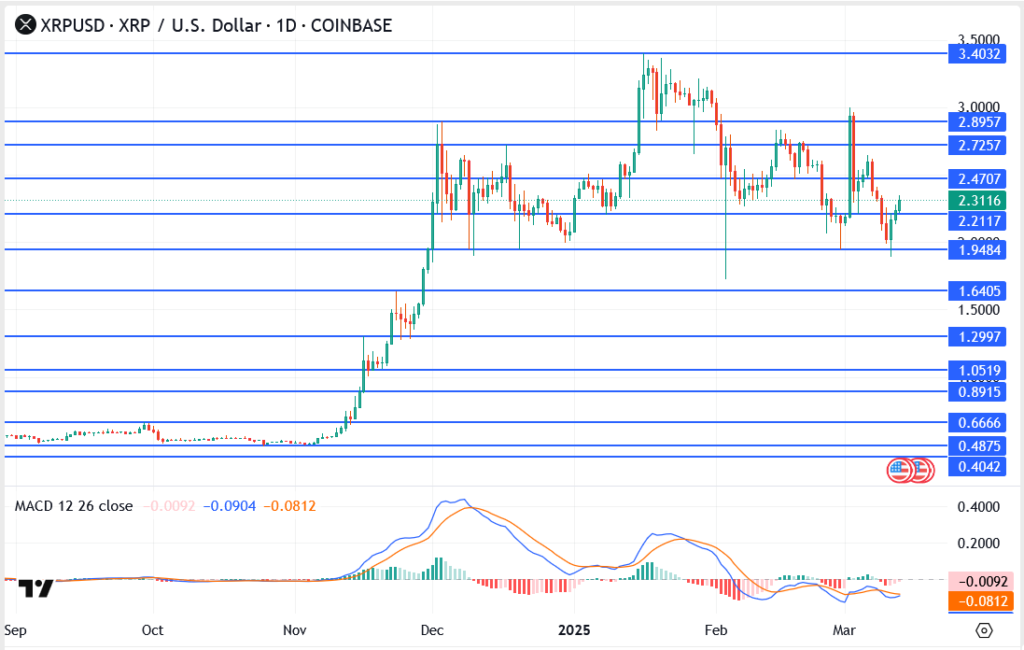

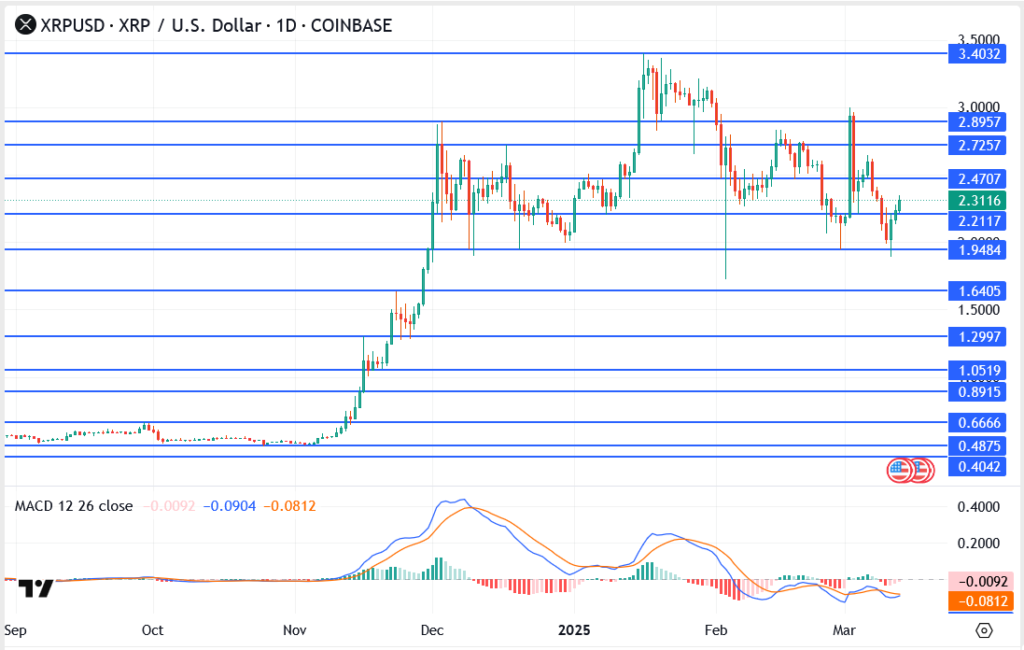

XRP Price Analysis – Rebounding Toward Key Resistance

XRP Key Support and Resistance Levels

XRP Price now: $2.31

24H Change: +2.1%

- Immediate Resistance: $2.47 – Bulls need to break this level for a test of $2.72.

- Major Resistance: $2.89 – $3.40 – A breakout above could trigger a strong rally.

- Immediate Support: $2.21 – Needs to hold for sustained upside.

- Major Support: $1.94 – $1.64 – If broken, XRP could enter a deeper correction.

XRP Technical Indicators

- MACD: Bearish but stabilizing, indicating a potential shift in trend.

- RSI: Neutral, providing room for additional gains.

- Volume: Moderate buying pressure, but XRP still needs stronger demand to confirm an uptrend.

Outlook

Ripple must clear $2.47 for a bullish continuation. If it fails to hold $2.21, expect a retest of $1.94.

Can Crypto Market Maintain Post-CPI Momentum?

- Bitcoin must stay above $80,000 to confirm strength—$82,688 is the key level to break.

- Ethereum faces strong resistance at $1,996, making a breakout critical.

- XRP needs to push above $2.47 for a continuation toward $2.72-$3.00.

The CPI-driven rally has stabilized, but traders should remain cautious as markets digest Federal Reserve policy signals. Will crypto push higher, or is this just a short-lived bounce before another wave of volatility?

Stay tuned for real-time updates as Bitcoin, Ethereum, and XRP approach key technical levels!