Bitcoin Halving News; XRP Price Prediction & Why DeSoc Could Top The Charts In 2025

The tides are turning! Bitwise CIO Matt Hougan noted that Bitcoin’s post-halving playbook is breaking. Although XRP price predictions all point to an incoming parabolic rally that mirrors the usual post-halving bullish run, all eyes are on innovation, utility and early-stage upside in this cycle. That’s where DeSoc enters the frame.

DeSoc is the disruptive force aiming to overhaul how people interact, create and earn online. It’s the intersection between Web3 and social media and its ongoing presale has been gaining traction really fast. What do analysts say about Bitcoin and XRP and why could DeSoc top charts this year? Let’s find out.

Bitcoin’s New Era: Why The Old Halving Cycle May No Longer Matter

For over a decade, Bitcoin’s playbook has been predictably cyclical: every four years, the block reward halving would trigger a bullish frenzy, followed by a euphoric top, then a crushing bear market. However, Bitwise CIO Matt Hougan recently noted that the cycle may now be broken.

Since the launch of spot Bitcoin ETFs in early 2024, capital from pensions, wealth managers, and endowments has flooded into Bitcoin markets. ETFs alone now hold over 1.2 million BTC, worth approximately $147 billion, according to Dune Analytics. But rather than racing higher, Bitcoin has entered a consolidation zone, suggesting that big money is accumulating not speculating.

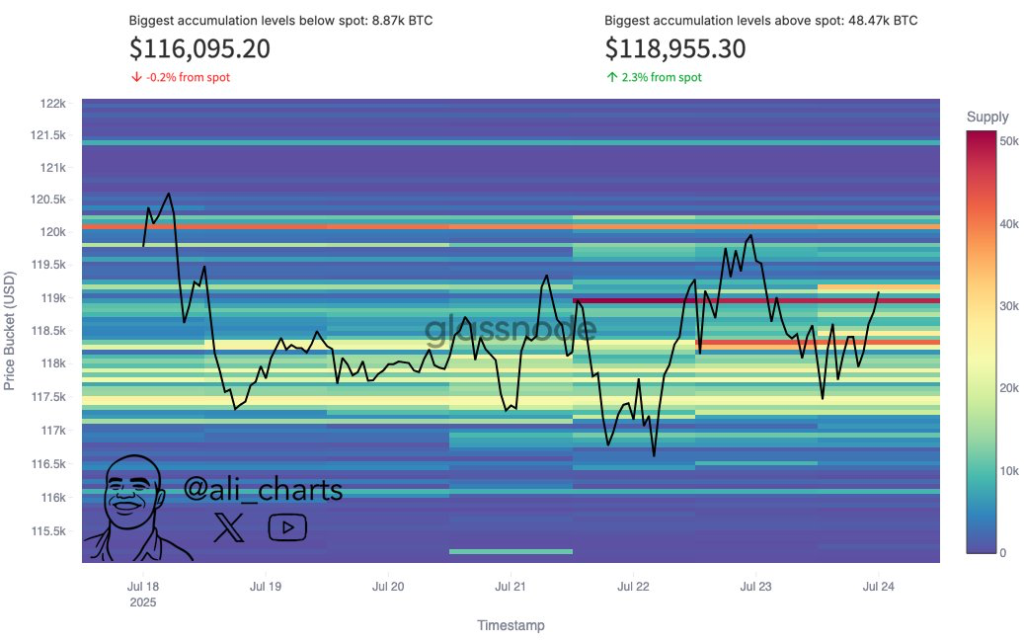

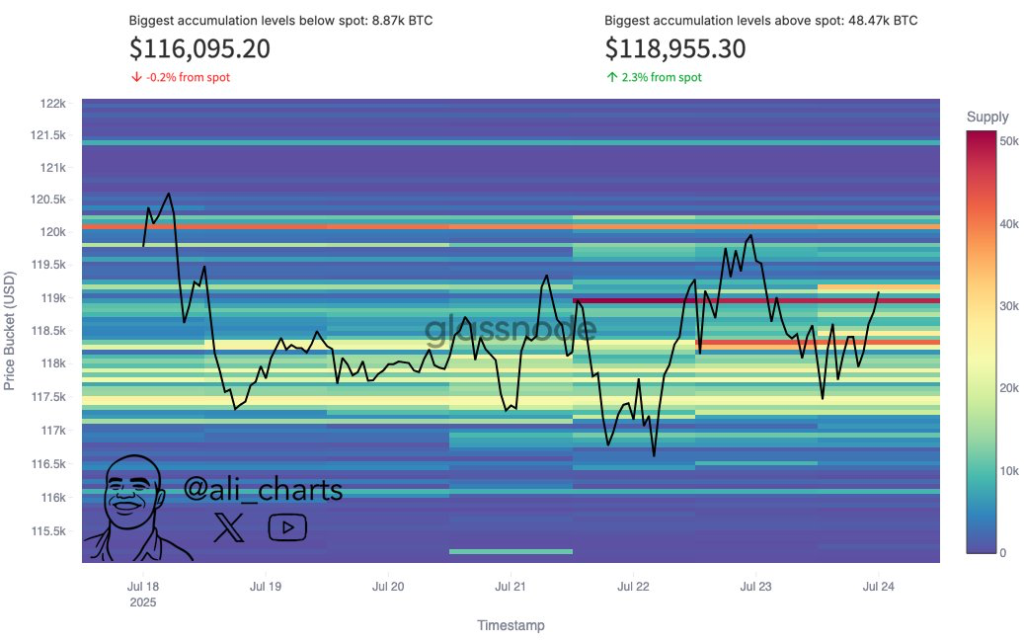

And while some analysts, like Bitwise CIO Matt Hougan, argue that halvings now have half the impact they used to, others disagree. Nick Hansen of Luxor Mining believes market participants aren’t emotionally detached. Analyst Ali Martinez noted key zones at $116,095 (support) and $118,955 (resistance). A breakout above these levels could ignite the next leg toward $131,000.

XRP Price Prediction: All Eyes on $3.00 as Bulls and Bears Lock Horns

Ripple’s XRP is currently fighting for its footing after a turbulent week. The coin slipped 7% to trade near $3.26 after a regulatory whiplash that followed the SEC’s approval and pause of Bitwise’s spot XRP ETF. The sudden halt has raised concerns about SEC manoeuvres with altcoin-backed ETFs and casts doubt on XRP’s near-term institutional adoption.

The delay immediately affected market sentiment. XRP’s derivatives market softened. Futures Open Interest fell to $9 billion, down from a recent peak of $10.94 billion. Technically, XRP is teetering at the $3.00 psychological level. The MACD is flashing a clear sell signal, the RSI is pointing downward at 55, and red histogram bars continue to grow all indicating weakening buying pressure that may push the price below $3.

Yet not all signs are bearish. On-chain analyst Ali Martinez noted that whales accumulated over 280 million XRP in the past 10 days. He predicts a breakout to $6 in the medium term and $15 longer term, citing bullish flag breakouts and strong volume support.

DeSoc: The Sleeping Giant of 2025 That Centralized Social Media Should Fear

Modern social media platforms are digital monarchies. A few centralized gatekeepers control algorithms, ban users and monetize our attention without sharing the profits. The result? A bloated system plagued by censorship, shadow-banning, intrusive ads and zero user ownership.

But DeSoc‘s decentralized social media solution is about to turn that model inside out. Analysts are already calling it the “next 100x play”, not because of hype, but because of structural advantage. Where Twitter, Meta and TikTok thrive on user exploitation, DeSoc is built on self-sovereignty, data portability and profit-sharing. Users own their identity, creators earn without intermediaries and governance is handled by the community, not a boardroom.

The technology powering DeSoc represents a quantum leap from failed Web3 experiments, such as BitClout and Friend.tech. DeSoc integrates high-throughput Layer 2 protocols, modular identity standards and zero-knowledge authentication for privacy-preserving verification.

Every post, like, share or follow is recorded on the blockchain’s immutable, transparent and censorship-resistant DLT. Monetization is native and creator-centric, utilizing smart contracts to automatically distribute ad or subscription revenue. No third-party platform taxes your growth.

Moreover, DeSoc is not a single platform. It is a base-layer protocol. In other words, it provides an infrastructure that any developer can build on. This creates a network of interoperable apps, each governed by its community, but connected by a shared social graph.

Conclusion: The Battle for 2025 Dominance Is Just Beginning

While there are concerns that the post-halving parabolic moves may be broken, Bitcoin is experiencing exponential growth. XRP is polarizing. And DeSoc is rising. However, DeSoc still offers something else entirely: a structural shift. In the same way Ethereum redefined finance, DeSoc could redefine digital communication.

That’s why its ongoing presale saw a whopping $10 million in funding in just days. The best part? The price is just $0.01. If the DeSoc thesis proves true, early investors could win over a 100X gain on their foresight. Don’t be left out!

Discover the future of decentralized social infrastructure with DeSoc. Explore the project and join the SOCS token presale here:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.