Bitcoin Historical Pattern Repeats: 30-Day Funding Rate Signals Uptrend Continuation

Bitcoin has been flirting with a breakout above its all-time high since last week, briefly pushing above the $110,000 level but failing to secure a firm close above it. Despite the pullbacks, bulls remain in control, with price action consistently defended above the $105,000 mark—a key support level now acting as a foundation for further upside. This resilient structure suggests that a bullish continuation could soon follow, especially if buying momentum returns in the days ahead.

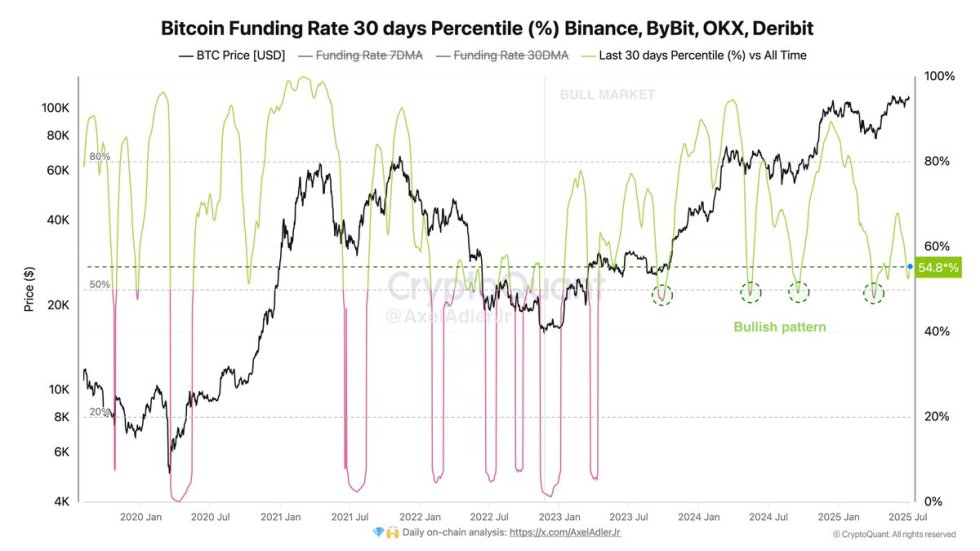

Top analyst Axel Adler shared a compelling signal from the 30-day percentile funding rate across major exchanges. According to his analysis, every time this metric dropped to the 50% level, it marked a local bottom. Each occurrence was followed by a significant trend reversal and resumption of the broader uptrend.

As long as funding remains neutral and the price stays above $105K, Bitcoin appears primed for another leg higher. The breakout above all-time highs may just be a matter of time.

Bitcoin Funding Rate Patterns Signal Strength

Bitcoin is preparing for a major move as it continues to test the area just below its $112,000 all-time high. While bulls remain in control, the lack of follow-through above this critical level has fueled speculation about a possible pullback. Some analysts warn that if BTC fails to break into price discovery soon, it could trigger a sharp correction, potentially sending the price below the $100,000 mark. This growing uncertainty coincides with the broader market cooling off after months of volatility.

Interestingly, US stocks are trading at all-time highs, and macroeconomic pressures have begun to ease following six months of instability. Inflation appears to be stabilizing, and investors are regaining confidence across risk-on assets. This shift supports Bitcoin’s bullish long-term thesis, but short-term risks remain in focus.

Axel Adler offers a key insight that adds perspective to the current setup. He highlights a consistent pattern in the 30-day percentile funding rate across major exchanges. Each time the metric dropped near the 50% level—seen in September 2023, May 2024, September 2024, and April 2025—it marked a local bottom followed by a strong rally. The last instance in April 2025 preceded a surge to $112K. Currently, the percentile stands at 54%, indicating sustained bullish momentum.

However, caution is warranted. If the metric rises toward the 80% level, it could indicate excessive leverage and foreshadow a correction. Until then, Bitcoin appears well-positioned, but its fate depends on whether bulls can finally push it into price discovery, or whether the hesitation opens the door to a larger retrace.

BTC Consolidates Near Resistance: Breakout Looks Imminent

Bitcoin continues to show resilience near its all-time highs, with the price currently trading around $108,790 on the 12-hour chart. The $109,300 level remains a stubborn resistance zone, having been tested multiple times since May but not yet convincingly broken. However, bulls have repeatedly defended the $103,600 support zone, which aligns with previous consolidation areas and psychological significance. This tight range, between $103,600 and $109,300, has formed a multi-week consolidation pattern, hinting at an imminent breakout.

The 50 and 100 simple moving averages (SMAs), currently at $106,318 and $106,596, respectively, are trending upward and providing near-term support. The 200 SMA, located at $98,837, sits far below the current price and highlights the strength of the ongoing macro uptrend. Volume remains relatively neutral, with no signs yet of a major breakout or breakdown, though volatility has compressed slightly, often a precursor to larger moves.

If Bitcoin breaks and holds above $109,300, it could quickly accelerate toward new highs and enter price discovery. On the other hand, failure to sustain this level might trigger another retest of $106,000 or even the $103,600 base support. With macro conditions stabilizing and bullish sentiment returning, the next few sessions may decide Bitcoin’s near-term direction.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.