Bitcoin Primed for Further Upside Based on Current Market Structure, Says Crypto Analytics Firm – Here’s the Outlook

Bitcoin (BTC) metrics are signaling that the flagship crypto asset may soon print fresh all-time highs, according to new insights from market intelligence firm Swissblock.

In a new post on the social media platform X, Swissblock says Bitcoin has more upside potential as key metrics have yet to suggest a top is in.

“Has BTC topped? Current market structure suggests otherwise. Here are three concise, data-driven charts that point to further upside – grounded in:

- Liquidity timing.

- Behavioral signals.

- Capital rotation.”

Swissblock says its “Optimal Signal” metric, which tracks the duration of prior explosive Bitcoin moves, suggests that the flagship crypto asset has the potential to remain in an uptrend for more than 10 additional days.

“Based on Bitcoin Vector’s Optimal Signal, each of the last major BTC expansions has lasted 15-30 days. We are currently on day 12 – with capital also beginning to rotate into ETH. This cycle appears incomplete.”

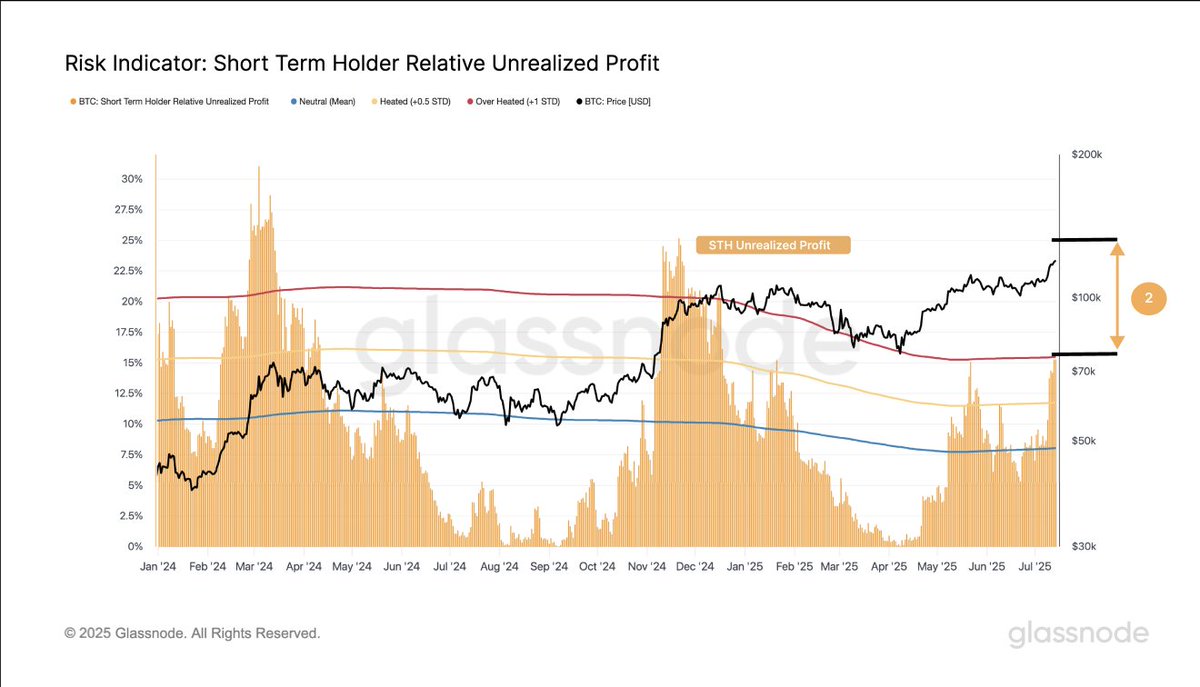

Next up, the firm looks at crypto analytics firm Glassnode’s Short Term Holder (STH) Relative Unrealized Profit metric, which is a measure of the total profit of all coins in existence whose price at realization time was lower than the current price, normalized by the market cap.

“Glassnode’s Short-Term Holder Relative Unrealized Profit remains well below the threshold reached during prior cycle tops (January and April 2024). Market participants are not exhibiting signs of excessive profit-taking or euphoria – yet.”

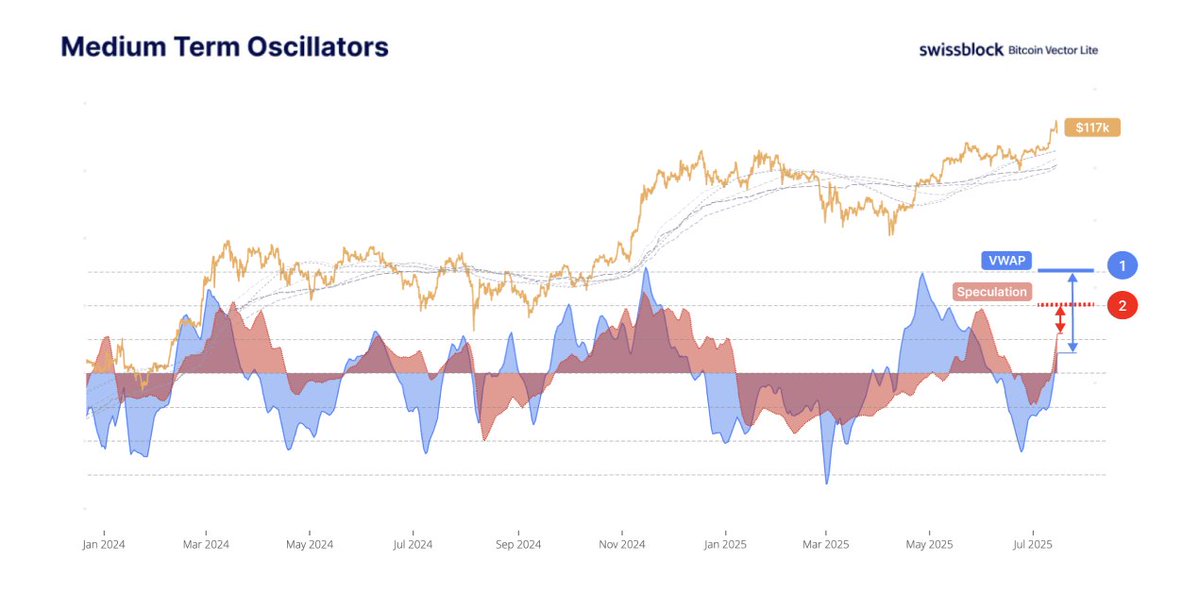

Lastly, the firm says that veteran on-chain analyst Willy Woo’s volume-weighted average price (VWAP) indicator, as well as his proprietary “Speculation Index,” suggests Bitcoin has yet to reach a cycle peak.

VWAP is the average price of an asset over a period of time, but weighted for trading volume.

“Both [Willy Woo’s] Speculation Index and VWAP Liquidity confirm that the market is not yet overheated. Neither indicator has reached prior cycle extremes, suggesting ongoing support for higher prices.”

Bitcoin is trading for $119,042 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3