Can $2.8 Billion Bitcoin Buy Prevent Further Price Crash?

Bitcoin has faced notable volatility in recent days, with strong market growth on Sunday, followed by a complete wipeout on Monday.

Despite these fluctuations, the hope for a recovery remains, fueled by FOMO (fear of missing out) and greed-driven investors. These sentiments could play a crucial role in Bitcoin’s price movement.

Bitcoin Investors Are Bullish

The continued decline in exchange balances signals a pattern of accumulation. Over the past week, more than 27,976 BTC, worth over $2.88 billion, was purchased by investors. This has reduced the available supply to approximately 3 million BTC.

The idea that Bitcoin has not yet reached its all-time high (ATH) encourages further investment, as many believe the current price levels represent an opportunity that won’t last long. FOMO remains a significant driver, as retail and institutional investors alike bet on Bitcoin’s future potential.

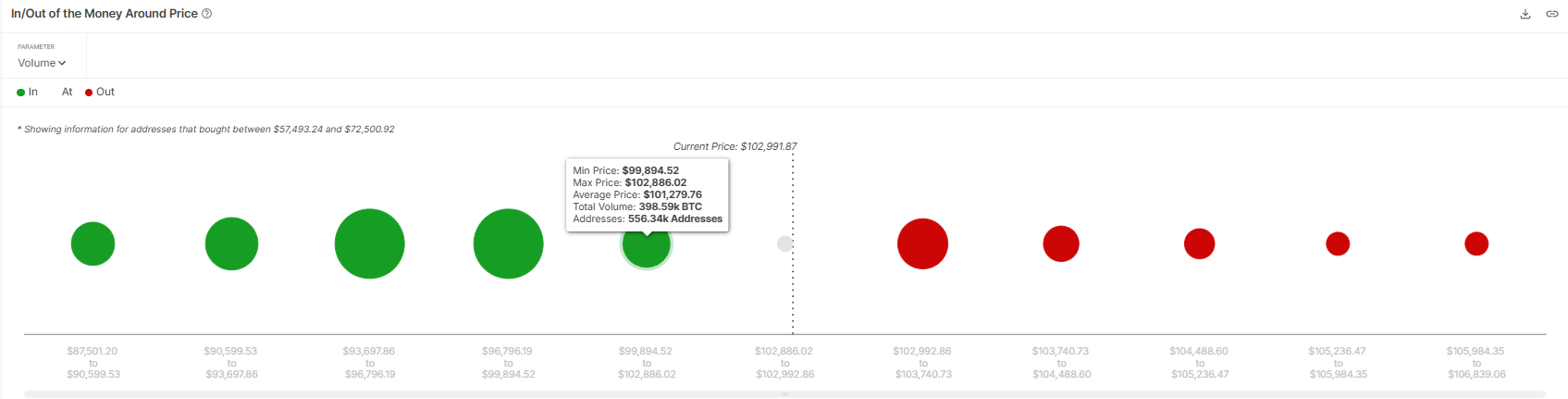

The IOMAP (In/Out of the Money Around Price) indicator suggests that Bitcoin has strong support around the $102,886 to $99,894 range, where investors have accumulated over 398,590 BTC worth more than $41 billion. This makes the region a strong buying zone, with many investors holding onto their positions in anticipation of Bitcoin’s next upward movement.

A decline below this support is unlikely because investors are waiting for a price increase rather than selling. In addition to the strong accumulation zone, the general market sentiment is bullish. The ongoing support at these levels reinforces the view that Bitcoin is positioned to continue its rise.

BTC Price Can Bounce Back

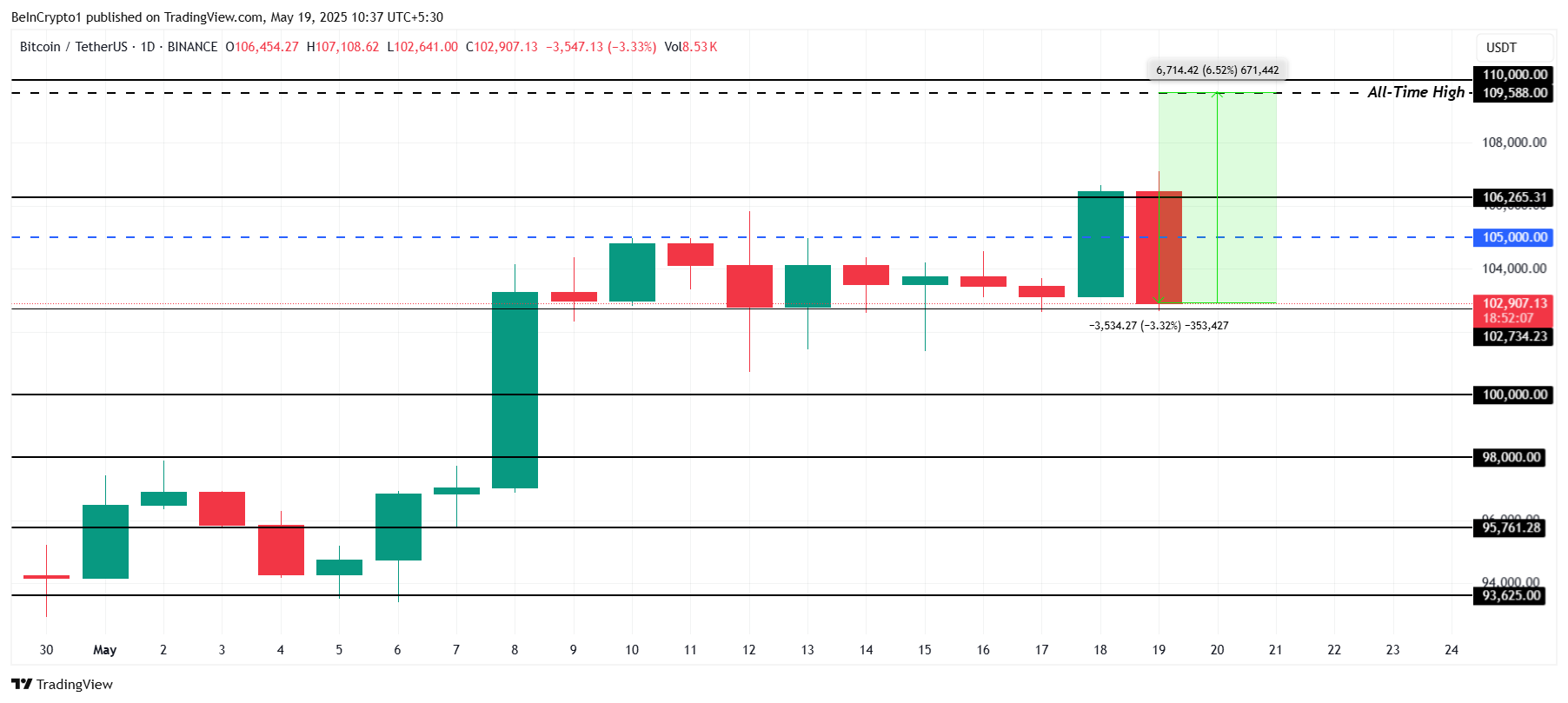

Bitcoin is currently trading at $102,907, just above the critical $102,734 support level. Despite today’s 3.3% drop, further price declines seem unlikely due to the strong demand zone just below this level. Buyers appear willing to step in at these price points, suggesting stability in the short term.

With Bitcoin having briefly risen to $107,108 earlier in the day, it seems likely the cryptocurrency will recover its losses. Investor accumulation is expected to push Bitcoin higher, and it could breach the $105,000 level again, forming consolidation above the $102,734 support. This would set Bitcoin on course for continued growth, bringing it closer to its ATH of $109,588, which it stands 6.5% away from.

However, the bullish outlook could be invalidated if long-term holders (LTHs) decide to sell off their positions to secure profits. If this happens, Bitcoin’s price could slip below the critical $102,734 support, potentially bringing it down to the $100,000 range.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.