Crypto Expert Reveals 5 Best Cryptos to Buy Now For August 2025

As the calendar turns to August, smart investors are once again scanning the market for high-upside plays in both large-cap and low-cap altcoins. Some of the best cryptos to buy now include a mix of utility-driven tokens and high-risk meme coins that have recently corrected but still hold strong upside potential.

Rather than chasing hype, traders are eyeing assets with compelling fundamentals, strong community backing, or signs of a rebound after steep dips. The focus isn’t just on what’s pumping today, but on tokens positioned to recover value or surge as momentum returns.

Crypto Expert Reveals 5 Must-Buy Coins for August 2025

According to Galaxy Research, a new wave of public companies is adopting crypto as part of their capital strategy, signaling a global rise in digital asset treasury adoption. This shift reflects growing investor confidence and could mark the beginning of a broader market rebound.

Source – Galaxy Research via X

Whether you’re taking advantage of deep discounts or backing projects with long-term potential, August is shaping up to be a strategic month for crypto accumulation.

Below are five of the best cryptos to buy now, as highlighted by crypto expert Jacob Crypto Bury, which you can explore further below or on his YouTube channel.

Toncoin (TON)

Toncoin is emerging as a strong contender this August thanks to its deep integration with Telegram and expanding ecosystem utility. Once valued at $25 billion, Toncoin now trades around $8 billion, marking a sharp 66% correction.

Some traders see this drop not as a red flag but as a chance to accumulate. With solid fundamentals and lower hype compared to its December peak, $TON looks reasonably priced.

If bullish momentum returns, a 2–3x upside could be possible. Many view it as a stable long-term hold in a highly volatile market.

Pump.fun (PUMP)

Pump.fun is drawing attention this August as a controversial yet potentially opportunistic altcoin. With a market cap around $900 million, down from its $2 billion launch, the token has dropped 70%, sparking concern among some traders.

However, this sharp decline also presents a speculative setup: the team behind Pump.fun has a brand reputation to protect and may take action to restore confidence and push the price closer to its initial listing value.

While some investors remain cautious, others view this dip as a chance to accumulate before a possible upside move. The platform itself remains strong, and its token mechanics still hold appeal for high-risk traders.

Pump.fun is being monitored closely for any developments that might indicate a recovery or coordinated effort to support its valuation.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is gaining attention as one of the fastest Bitcoin Layer 2 chains currently in development. Positioned as a highly scalable and efficient layer built on top of the Bitcoin network, Bitcoin Hyper aims to enhance transaction speeds while offering a robust infrastructure for smart contracts and decentralized applications.

The project has already raised $6.2 million in funding and is currently available for early-stage investment at a price of $0.012475 per token, making it an attractive option for investors looking to enter before its exchange listings.

One of the standout features of Bitcoin Hyper is its well-developed ecosystem, which includes a seamless bridge operation, Layer 2 settlement capabilities, and integrated security mechanisms.

These elements position it as more than just a scaling solution – it aims to be a full-fledged platform supporting a wide range of blockchain utilities. Additionally, the project has been gaining visibility through influencer support and community-driven marketing, helping to boost awareness.

Bitcoin Hyper also touts favorable tokenomics and investor accessibility, with an easy-to-use interface for purchasing via crypto wallets like MetaMask or Best Wallet. While it’s still early-stage, the technical vision and utility-driven focus make it an intriguing option for those bullish on Bitcoin’s long-term future and scalability.

As Layer 2 solutions continue to gain momentum in the broader crypto market, Bitcoin Hyper is positioning itself as one of the best cryptos to buy now. To take part in the $HYPER token presale, visit bitcoinhyper.com.

Solana (SOL)

Solana stands out as a top blockchain project, backed by 3.4 million followers and a strong ecosystem driving long-term bullish sentiment. Known for speed and scalability, it previously reached a $120 billion market cap.

Despite current market conditions, Solana is considered undervalued compared to its historic highs, making it an attractive option for accumulation ahead of the next bullish cycle.

Its strong community, consistent development, and increasing adoption across DeFi, NFTs, and Web3 projects make it a strategic pick for those seeking solid long-term growth.

Analysts like Christian believe $SOL could not only break past the $200 mark again but also potentially finish the next cycle in the $250 to $300 range. For investors looking beyond hype and toward utility-backed assets, Solana continues to stand out as a top-tier choice.

Ethereum (ETH)

As the second-largest crypto by market cap, Ethereum continues to benefit from growing institutional interest and expanding adoption across decentralized applications (dApps) and Web3 projects.

The network’s shift toward deflationary tokenomics, especially after EIP-1559, strengthens its long-term value by reducing supply over time. As more developers build within the Ethereum ecosystem and new projects launch on its blockchain, demand for $ETH is expected to increase.

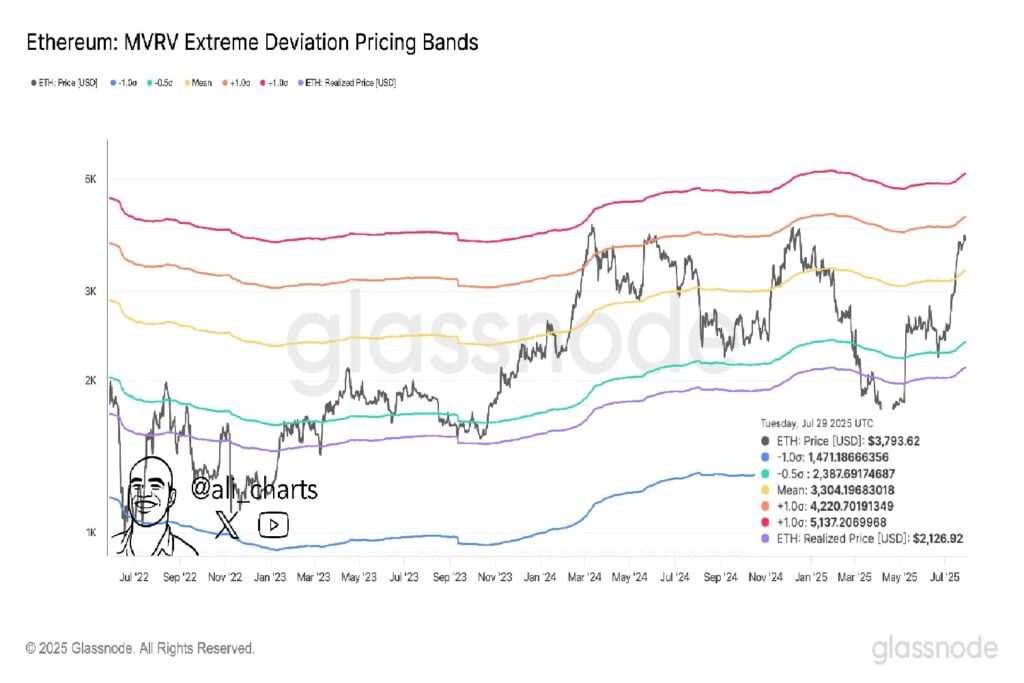

Ethereum is currently trading around $3,600, with many analysts projecting a potential rise to between $5,200 and $5,600 in the coming months. According to Ali Martinez, as long as the $3,300 support holds, $ETH could be on track to reach $4,220 and possibly $5,140, based on the MVRV pricing bands.

For long-term investors seeking a large-cap option with deep infrastructure support and ongoing innovation, Ethereum remains a strong contender heading into the rest of 2025.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.