Ethereum ETFs Beat Bitcoin In Daily Flows

For the first time in the 18-month history of US spot-crypto exchange-traded funds, the day’s heaviest torrent of institutional cash swept into Ethereum, not Bitcoin. Flow tallies for Thursday put net subscriptions across the nine US spot Ether ETFs at $602 million, edging out the $522.6 million that landed in the 11-strong cohort of U spot Bitcoin ETFs. The figures, compiled by on-chain analytics site SoSoValue, mark a symbolic hand-off between the two flagship assets in a market where Bitcoin has dominated inflows since July 2024.

Thursday’s surge came less than twenty-four hours after Ethereum funds smashed their own single-day record with an eye-watering $726 million haul, a feat that pushed cumulative holdings to just under five million ETH and lifted the spot price of the underlying token above $3,400 for the first time since January.

Ethereum Beats Bitcoin

The spearhead was BlackRock’s iShares Ethereum Trust (ticker ETHA) yesterday, which absorbed roughly $550 million—its second consecutive personal best—leap-frogging the firm’s flagship Bitcoin product IBIT on the day’s league table. According to flow data collated by Arkham Intelligence and Farside Investors, ETHA has raked in $1.25 billion over the past five sessions and now holds close to $7 billion worth of ETH, almost one-fifth of all assets parked in US Ethereum ETFs.

Bloomberg Intelligence analyst James Seyffart, posting on X, put the milestone in context: “As a group the US spot Ether ETFs have taken in over $5.5 billion since launch, including more than $3.3 billion since mid-April.” He noted that part of the magnetism stems from the return of a double-digit cash-and-carry basis on CME Ether futures, though futures positioning alone does not explain the depth of demand. Seyffart’s chart of CME open interest shows not only a sharp climb in nominal ETH terms but also a dollar-value trajectory that is beginning to rival early-2025 Bitcoin futures activity.

Structural tailwinds extend beyond arbitrage. Nasdaq has just filed to add native staking to BlackRock’s ETHA—a move that, if approved, would let the fund earn network rewards and potentially lift its headline yield above 5 percent, making Ether ETFs a rare blend of growth asset and income instrument.

Bitcoin, meanwhile, remains the undisputed heavyweight by sheer scale. Spot BTC ETFs have amassed $53 billion in net inflows since their January 2024 debut and command more than $150 billion in assets: ETF Store president Nate Geraci reminded followers that Bitcoin demand has hardly cooled, tweeting that spot BTC products logged inflows in 26 of the past 27 sessions, adding “over $10 billion” in fresh capital that is “pure & simple… institutional $$$.”

Yet Thursday’s flip in the daily standings underscores palpable momentum for Ethereum. Analysts attribute part of the shift to Ethereum-specific catalysts: a six-month high in staking yields, anticipation of SEC approval for staking-enabled ETFs by year-end, and bipartisan momentum behind the GENIUS and CLARITY bills that would hard-wire commodity status for most large-cap crypto assets.

Whether Thursday proves an inflection point or a statistical blip will depend on the sustainability of that rotation. For now, a once-unthinkable headline—Ethereum ETFs beat Bitcoin ETFs—captures the market.

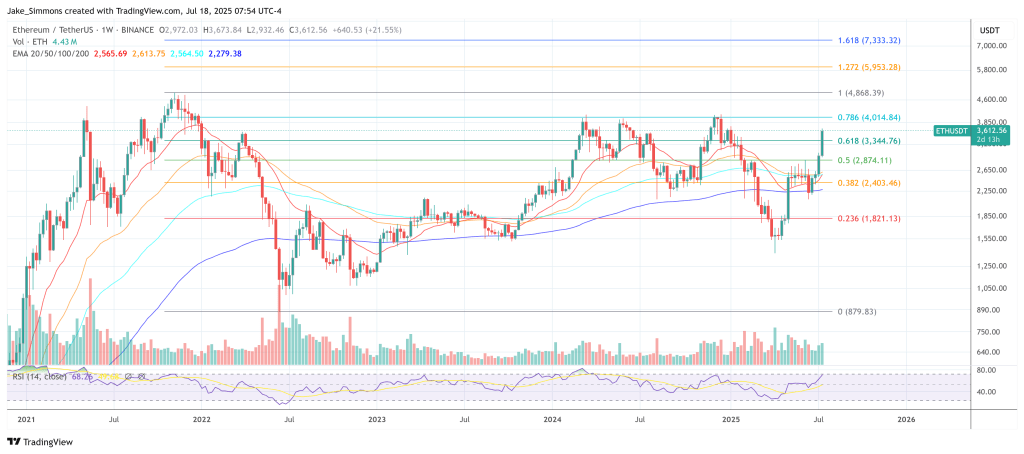

At press time, ETH traded at $3,612.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.