Firefly Aerospace Share Price Sinks Nearly 5% in Second Day of Trading After IPO Pop

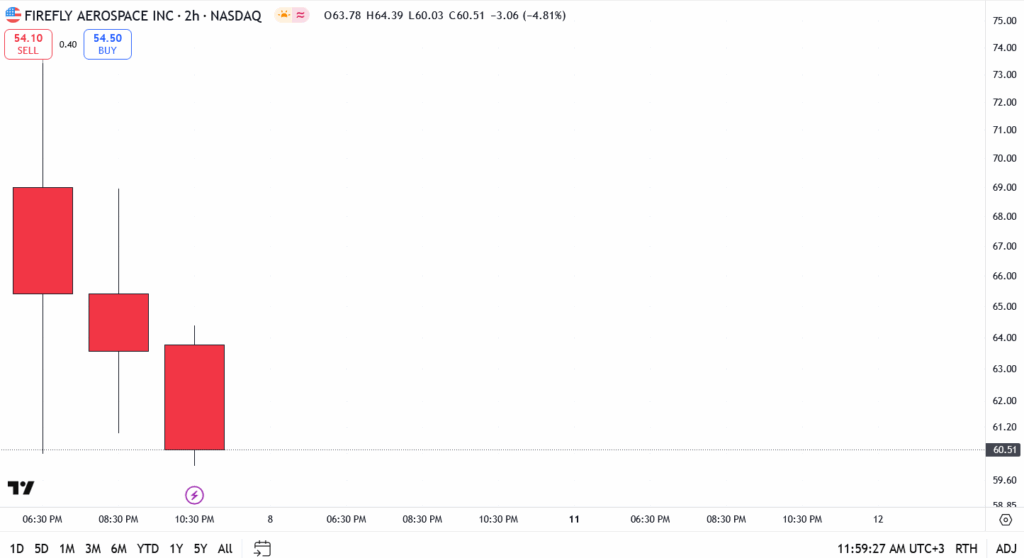

Firefly Aerospace’s (NASDAQ: FLY) shares came under pressure on Friday morning, extending the pullback that began late on its debut session. The stock fell 4.81% to $60.51 as of writing, sliding further from Thursday’s intraday highs near $70 as early IPO euphoria gave way to profit-taking and technical selling.

Thursday’s blockbuster open saw the rocket maker briefly soar before reversing sharply into the close, with the selling momentum spilling into today’s session. Traders pointed to weak follow-through buying and a cluster of stop-loss orders being triggered as the stock broke below $63, deepening the decline.

From IPO Buzz to Reality Check

The company, known for its rapid-growth ambitions in the private spaceflight sector, priced its IPO at $54 per share, and initially attracted strong demand from retail and institutional players. But with the stock still up around 12% from its offer price despite the drop, some market watchers argue the pullback is a natural cooling-off after a volatile debut.

Early trading after an IPO often comes with big price moves as investors weigh the initial hype against the company’s real fundamentals. For Firefly, attention now turns to how well it can deliver on its ambitious launch plans, win fresh contracts, and show a clear route to profitability.

FLY Technical Levels to Watch

- Current price: $60.51

- Resistance: $63.00, then $67.20

- Support: $59.80, followed by $56.00

The two-hour chart shows FLY failing to hold its opening day consolidation zone, with momentum skewed lower in early Friday trade. A bounce above $63 could re-ignite momentum toward the mid-$60s, but a close below $59.80 risks inviting deeper profit-taking toward the $56 support area.

Outlook: Testing the Market’s Conviction

The next few sessions will be critical in determining whether Firefly Aerospace can stabilise after its volatile start. Stronger volume on up days would suggest institutional support is stepping in, while continued heavy selling could keep the stock under pressure into next week. For now, the IPO glow has dimmed, and the burden is on management to sustain investor confidence beyond the opening fireworks.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.