Granger Causality and the Negative Wealth Effect in BAYC-Linked Virtual Assets

Table of Links

Abstract and 1. Introduction

2. Data and Methodology

2.1 Bubble Timestamping

2.2 Cryptocurrency-LAND Wealth Effect

3. Results

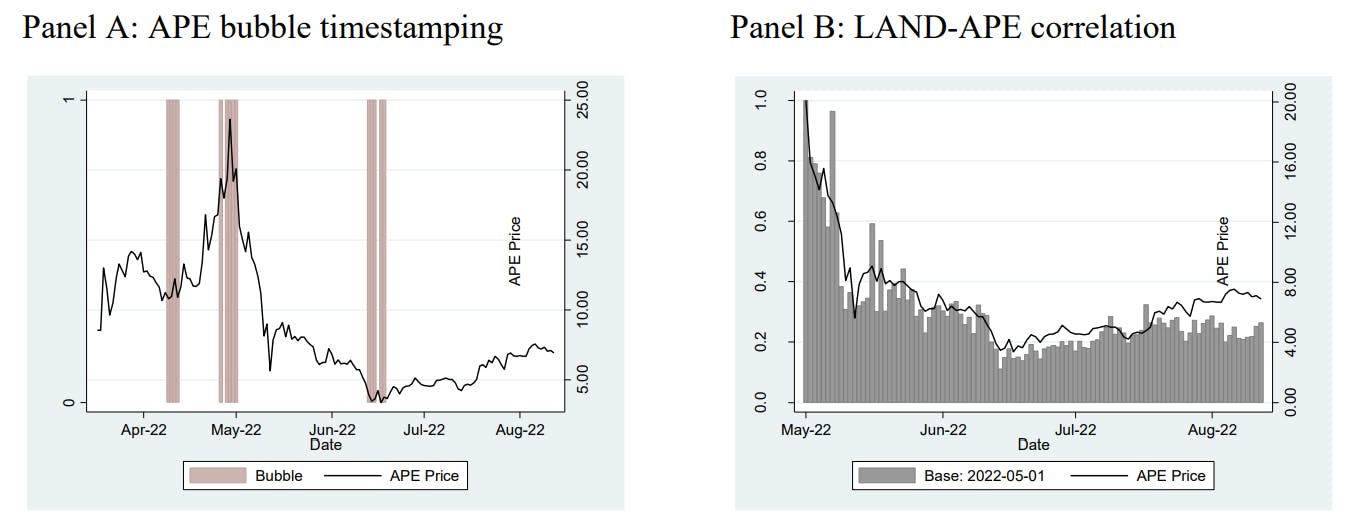

3.1 Bubble Timestamping

3.2 Cryptocurrency-LAND Wealth Effect

3.3 Granger Causality Test

4. Conclusion and References

Appendix: Bored Ape Yacht Club’s Otherside

Appendix: Bored Ape Yacht Club’s Otherside

Bored Ape Yacht Club (BAYC) is arguably the most well-known digital art NFT with the highest price ever attained for a single sale is $2.85 million, albeit paid in ETH.[10] There are 10,000 unique BAYC NFTs, each with its own artistic attributes. The NFT contract was created on April 22, 2021. The ApeCoin (APE) cryptocurrency contract was created on February 14, 2022 and began trading in April, while the corresponding LAND NFT smart contract was launched slightly prior to the crypto market crash of May 2022 and LAND on May 1, covering only the downward part of the cycle.

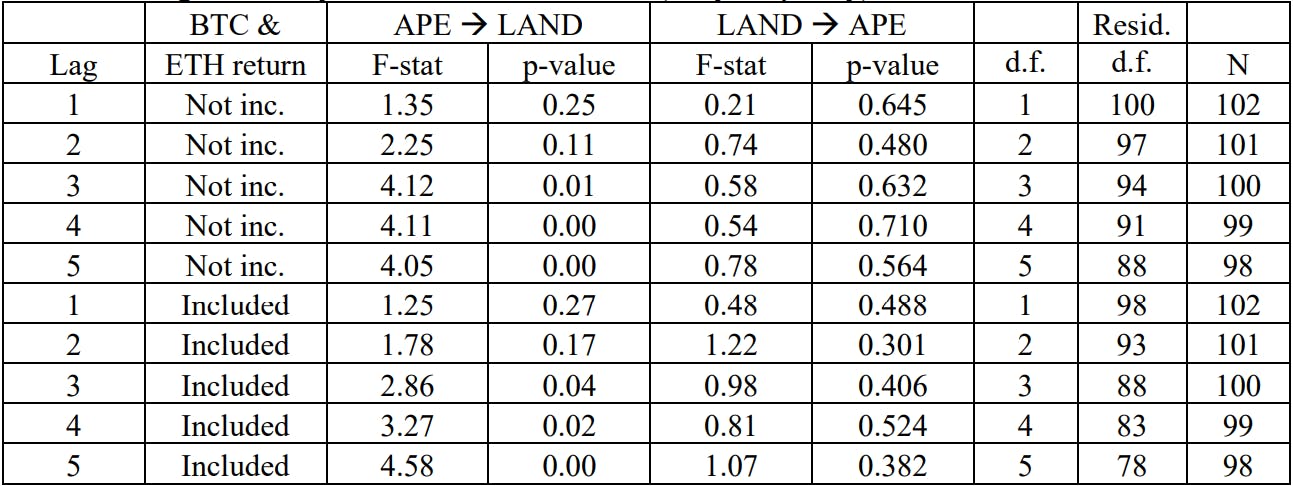

We repeat the same analyses for Otherside, but since there are more transactions, the HPI can be estimated at daily frequency. Thus, we conduct the analyses at daily frequency and find the same results. The correlation between Otherside’s HPI and APE is 0.9211, and the Granger causality test (with up to 5 lags because of more granular frequency) suggests that it takes at least 3 days before the spillover to occur, which provides comfort to the interpretation of wealth effect as consumers begin to feel the effect of the change in wealth and change their behavior. Overall, the BAYC’s result suggests that the (negative) wealth effect is also present in the downward cycle.

Table A2: Granger Causality Test and the Wealth Effect

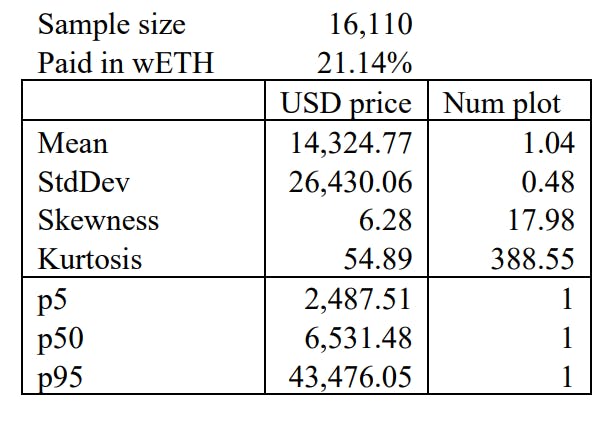

This table reports the various results leading to VAR Granger causality test. Panel A reports the summary statistics of the first-differenced, weekly time series along with the statistics of the augmented Dickey and Fuller (1979) test of unit root. Panel B reports the pairwise correlation of the first-differenced data. Panel C reports the F-test statistic of the test that lagged value of cryptocurrencies Granger causes LAND prices at up to 3 lags. In the extended version, the time series of Bitcoin and Ether prices are also included.

Author:

(1) Kanis Saengchote, Chulalongkorn Business School, Chulalongkorn University, Phayathai Road, Pathumwan, Bangkok 10330, Thailand. (email: [email protected]).

[10] https://cryptopotato.com/bored-ape-yacht-club-nft-sold-for-2-85-million-in-eth/, accessed on September 9, 2022.