HBAR Price Shows Worrying Pattern – More Pain Ahead?

Hedera Hashgraph’s native token HBAR has plummeted by 15% over the past week, dragged down by a broader market pullback.

As the crypto market continues to show signs of weakening momentum, technical indicators suggest HBAR’s downturn may be far from over.

HBAR Drops Under 20-Day EMA as Bears Take Over

Readings from the one-day chart show that HBAR’s double-digit decline has pushed its price below the 20-day Exponential Moving Average (EMA).

As of this writing, this key moving average forms dynamic resistance above the token’s price at $0.2446. For context, HBAR currently trades at $0.2391.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When price trades above the 20-day EMA, it signals short-term bullish momentum and suggests buyers are in control.

On the other hand, when an asset’s price breaks below this level, it signals increased sell-side pressure and weakening short-term support. This puts HBAR at risk of logging more losses over the next few trading sessions.

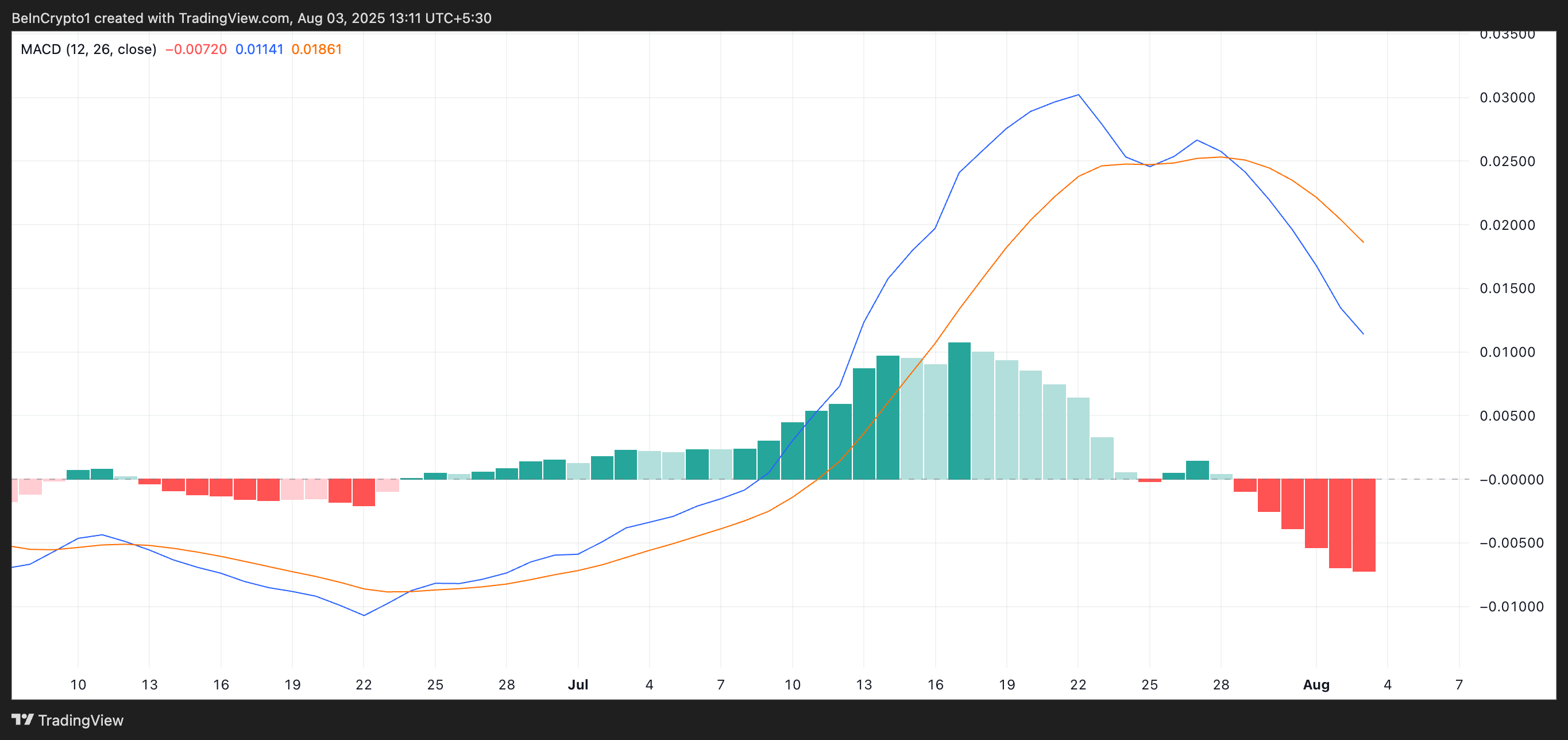

Furthermore, the setup of the altcoin’s Moving Average Convergence Divergence (MACD) indicator supports this bearish outlook.

As of this writing, HBAR’s MACD line (blue) rests below the signal line (orange), while the red histogram bars have grown in size — a sign that bearish momentum is accelerating.

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As with HBAR, when the MACD line rests below the signal line, it signals declining buying pressure and growing sell-side strength. This further supports the case for continued downside in the short term.

Can a Sentiment Shift Save the Token?

HBAR may be on course for deeper losses in the coming days as selloffs strengthen. In this scenario, its price could fall below $0.2283.

However, if sentiment shifts and a strong support base forms, it could drive the token’s price past the 20-day EMA and toward $0.2609.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.