How gTrade v10 Is Redefining On-Chain Derivatives for Professional Traders

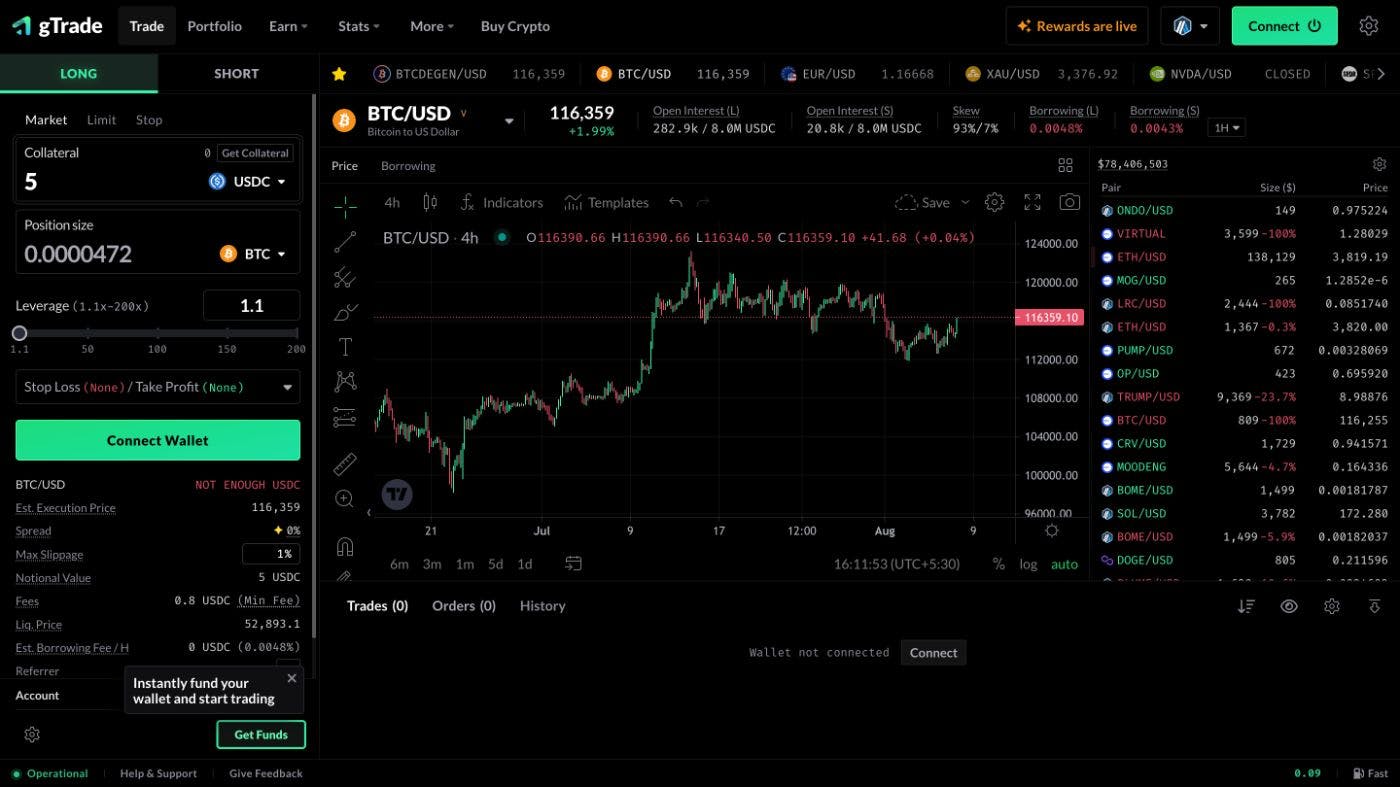

What happens when a decentralized trading platform removes its biggest bottlenecks? That is the question Gains Network is attempting to answer with the rollout of gTrade v10, a major infrastructure upgrade intended to scale the protocol to meet the growing needs of DeFi traders and integrators. The update brings notable changes to how fees, leverage, and execution are handled, without compromising on-chain transparency.

Funding Fees Replace Borrowing: A Shift in Incentive Design

In v10, gTrade replaces the traditional borrowing fee model with funding fees, a mechanism commonly used on centralized futures exchanges to balance long and short positions. In the old system, traders paid borrowing fees on leverage, often leading to unpredictable holding costs, especially during volatile markets.

Now, a market-driven velocity model adjusts funding rates gradually based on open interest imbalances (referred to as “skew”). For example, if too many users are long BTC using stablecoin collateral, the system progressively increases the funding fee for longs and decreases it for shorts. This encourages counter trades that rebalance the system.

“We’re taking the precision and transparency that scalpers loved and unlocking it for a broader class of traders.”

– said Seb, Founder of gTrade.

This change is currently applied to stablecoin-backed positions on major pairs like BTC, ETH, SOL, XRP, and BNB. Pairs using GNS, ETH, or APE as collateral will retain the old borrowing fee model for now.

Counter Trades and Market Incentives

Another key innovation in v10 is the introduction of Counter Trades, which are trades that reduce skew in the market. These trades, if executed under specific leverage limits, qualify for lower fees and reduced price impact. The protocol is also offering whitelist incentives to frequent arbitrageurs and market-neutral traders.

Counter trades are especially useful in volatile markets, where large imbalances can occur quickly. By rewarding trades that help restore equilibrium, gTrade is moving closer to a self-regulating system. From a system design perspective, this supports sustainability. From a user’s perspective, it creates an additional revenue path for market makers and delta-neutral traders.

gTrade v10 also moves toward native price discovery, shifting execution prices closer to real-time market demand rather than relying entirely on oracles for trade entries and exits. This enables a more dynamic and fair experience for high-frequency traders. Liquidations, however, still use oracle pricing to avoid manipulation—a feature that protects users from getting liquidated based on short-term volatility or anomalies.

This dual model helps balance between execution flexibility and liquidation safety, both critical for trust in perpetual futures protocols.

Mid-Trade Profit Withdrawals, A Capital Efficiency Move

In a first for many decentralized futures platforms, v10 allows PnL withdrawals during an open trade. A trader can lock in some profit without fully closing or resizing their position. This is useful for strategies that require reallocation of capital or risk management without breaking a running trade.

For example, a user who is long ETH with $1,000 profit can withdraw $400, leave the trade open, and use that $400 elsewhere. This improves capital efficiency and opens the door for more complex strategies like hedged positions or multi-leg exposure. Collateral withdrawals are also more flexible now, provided they do not violate the leverage bounds for the asset pair.

Position Management Becomes More Transparent

One of the less discussed but critical upgrades in v10 is the move from USD-based position sizing to token-based sizing. This means a position is now tracked and displayed directly in terms of token quantity (e.g., 0.75 BTC long), rather than the USD value collateralized.

This aligns with how most traders think about exposure and makes it easier to track performance. Fees and PnL are now displayed separately, improving clarity and user trust.

Adaptive Leverage and Real-Time Risk Management

Previously, leverage needed to remain above 1.1x, but now v10 reduces the minimum leverage for updates to open trades to just 0.1x. This applies to partial closes or collateral withdrawals and provides better risk and position management, especially during high volatility.

“This helps traders adjust their positions intelligently without the need to close out prematurely,” Seb added in the official announcement.

The UI has also been upgraded to reflect real-time leverage thresholds and risk limits, reducing errors and confusion for advanced users.

Integrator Benefits and Ecosystem Expansion

The long-term goal for v10 is to make gTrade attractive not just for retail traders but also for integrators, funding fee farmers, and market makers. Partners like Volmex Finance, Bifrost, and Symphony can now build on top of the protocol using its new high open interest caps, fairer execution model, and funding fee flexibility.

With gTrade now active on multiple chains like Arbitrum, Base, Solana, and Polygon, the protocol is attempting to bridge scalability with accessibility.

$200K Trading Competition and What It Signals

To coincide with the launch, Gains Network will host a $200,000 trading competition later this month. This is not just a marketing stunt, it is also a stress test of the new system under load.

By encouraging traders to experiment with v10’s features at scale, the team is gathering live feedback on slippage, funding rate stability, UI experience, and execution latency.

Final Outlook: A System Grown Up

gTrade v10 feels like a significant maturing moment for the protocol. It introduces scalable economic incentives, mechanisms for self-balancing, and clarity for traders that were previously lacking in many DEXs.

It also shows that the team is actively listening to power users, particularly those managing large trades, engaging in arbitrage, or integrating external strategies into the platform.

For DeFi to rival centralized exchanges, it needs not only deep liquidity but also features that mirror CEX sophistication. gTrade v10 gets closer to that line—without abandoning its on-chain principles.

Don’t forget to like and share the story!

This author is an independent contributor publishing via our