How Much Could $2,000 in Ripple (XRP) Be Worth at the Peak of the Bull Run?

If you’re thinking about putting $2,000 into XRP right now, you’d be getting around 1,000 tokens at today’s price, which is hovering just over $2.

Now, here’s the exciting part—many believe that the next phase of the bull run could be right around the corner. After a strong start to the year, Bitcoin hit a high of $109,000 in January, but since then it’s mostly been going sideways or slightly down.

Lately, though, things have picked up again. Bitcoin is now trading at $88,000, up over 15% in just two weeks. And historically, when Bitcoin starts moving, the rest of the market—including XRP—usually follows.

What’s Going on With XRP Price Right Now?

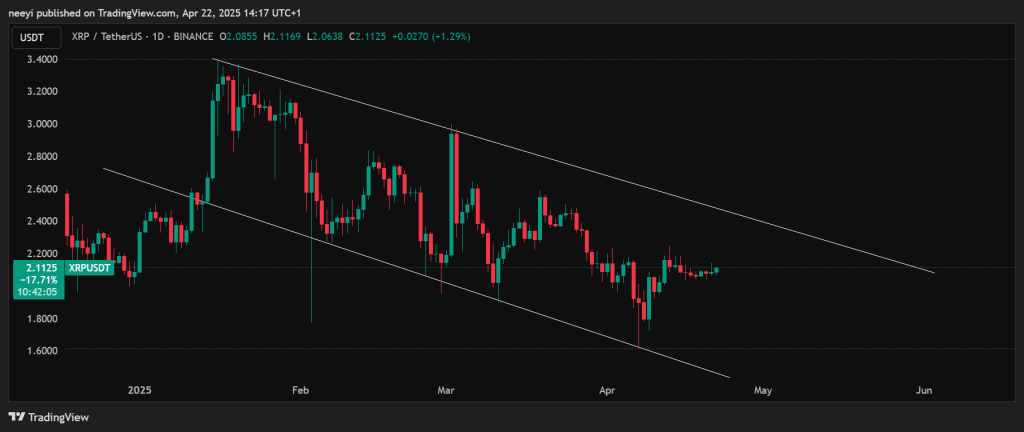

Let’s rewind a bit. XRP had a solid start to the year and climbed all the way up to about $3.40 in January—just shy of its all-time high around $3.80. But since then, the token has been sliding downward, caught in a descending channel that’s been pretty tough to break.

Right now, XRP is sitting near $2.10. That’s about a 40% drop from where it was just a few months ago. It’s had a few chances to push higher, but every time it gets close to breaking out of the channel, it gets pushed back down.

On the flip side, it has also bounced a few times from lower support levels—especially around $1.60 to $1.70. For any major bullish move to happen Ripple price has to break above the top of this channel.

Ripple’s Legal Drama, Institutions, and the Bigger Picture

Besides Bitcoin, there’s another massive factor affecting XRP’s price: the ongoing legal issues with the SEC.

Right now, the Ripple vs. SEC case is on a 60-day pause, which likely means both sides are talking behind the scenes. That’s a big deal. At the same time, another lawsuit—this one from the state of Oregon—is adding more regulatory pressure by labeling XRP as an unregistered security.

Despite all this legal noise, Ripple keeps building. They just dropped $1.25 billion to acquire Hidden Road, a move meant to expand the use of the XRP Ledger in financial markets. That’s a sign Ripple is serious about long-term growth, no matter what’s happening in court.

And beyond courtrooms and charts, there’s something else that could drive XRP higher: adoption.

If big banks and payment processors start using XRP for faster, cheaper international transfers—and especially if central banks start relying on XRP for their digital currencies—that could open the floodgates. The more useful XRP becomes in the real world, the more valuable it could get.

So, What Could Your $2,000 in XRP Be Worth?

We asked ChatGPT to give us some price XRP price prediction based on how the rest of this bull run might play out. Here’s what came out of that forecast:

In a worst-case, cautious scenario, XRP might climb to around $2.50 to $2.80. That would turn your $2,000 into somewhere between $2,500 and $2,800. Not bad, considering that’s the low-end outlook. But in this case, we’d probably still be dealing with legal uncertainty and only a modest crypto rally.

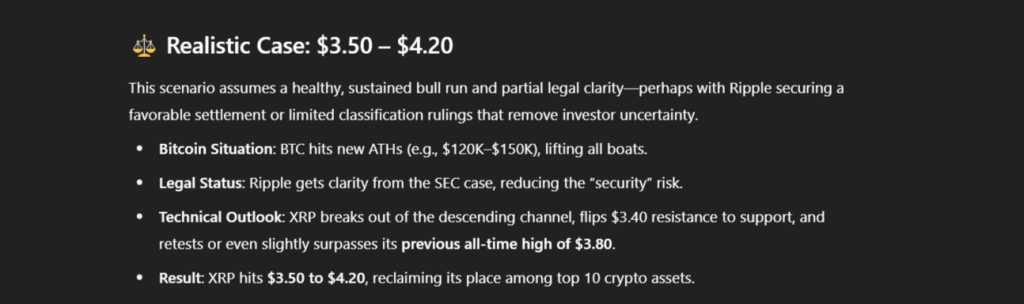

In a realistic, middle-of-the-road scenario, XRP could rally to somewhere between $3.50 and $4.20. That bumps your investment up to $3,500–$4,200. This would likely mean Ripple gets partial legal clarity and Bitcoin continues rising toward a new all-time high—somewhere in the $120K to $150K range.

Read Also: Should You Throw $1,000 Into Raydium Right Now? RAY Price Outlook

Now here’s where it gets fun. In an optimistic scenario, where Ripple wins big in court, institutions start using XRP like crazy, and Bitcoin triggers a full-blown altcoin season—XRP could explode to $6 or even $10+. That means your $2,000 in XRP could grow to $6,000–$10,000 or more. It would take a perfect storm, sure—but crypto’s pulled off bigger surprises before.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.