How To Use A Crypto AI Agent To Maximize DeFi Yield: A Step-by-Step Guide

- Summary:

- Crypto AI agents open the doors to a world where trading and investing are no longer limited by the capacity of the human mind.

Hundreds of articles discuss the rise of AI agents in crypto and how automation is about to take over the realm of decentralized finance.

These agents open the doors to a world where trading and investing are no longer limited by the capacity of the human mind, and where financial knowledge is no longer a barrier to entry. Within this world, AI agents don’t just execute trades on our behalf, but take on the much larger burden of managing and optimizing our investment strategies to try and increase the rewards we can earn.

Crypto AI agents are smart. They can continuously adapt and learn to optimize the strategies they devise, making better decisions over time to help human investors achieve their financial goals.

This world is not some distant future. It already exists, with hundreds of AI agents already managing millions of dollars worth of investments on behalf of humans. So let’s explore how anyone can get started using a crypto AI agent.

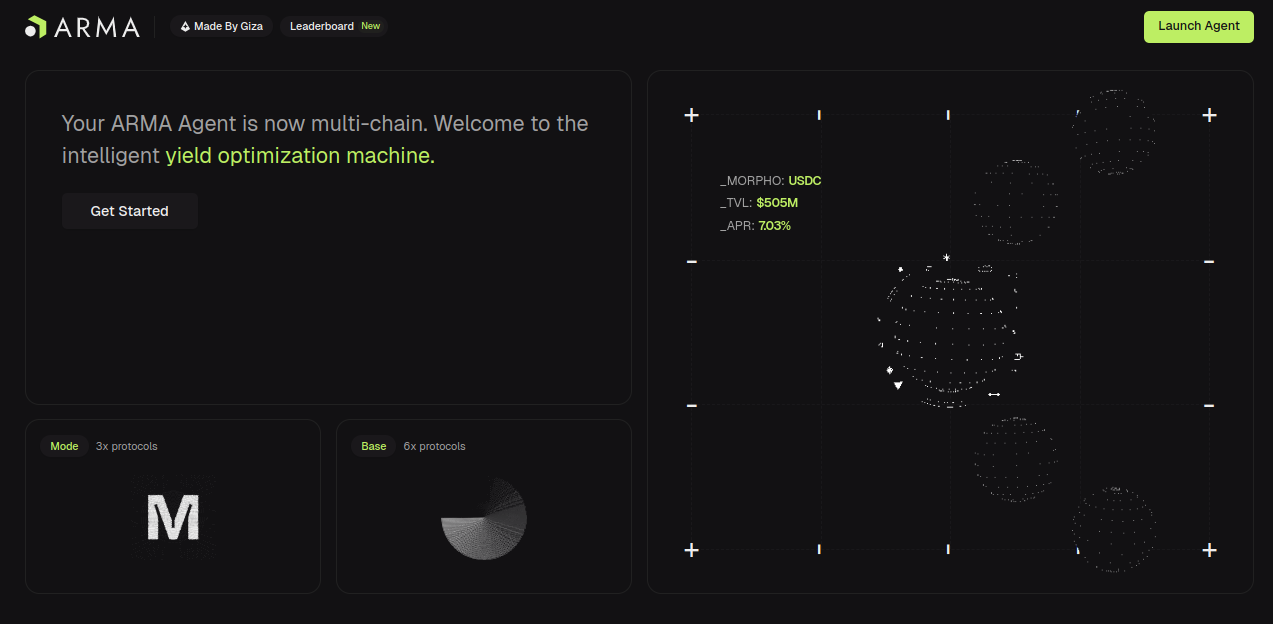

Introducing ARMA

A quick look at Cookie.Fun reveals that it’s tracking more than 1,400 different crypto AI agents that are already managing millions of dollars on behalf of human investors.

For the purposes of this guide, we’re going to be using Giza’s ARMA, which is described as an autonomous yield-optimization agent that’s focused on maximizing profits across stablecoin deposits across the Base and Mode Network blockchain’s most widely used protocols.

ARMA constantly monitors protocols such as Aave, Compound, Moonwell, Morpho, and others, evaluating the profit opportunities they provide. When it spots an opportunity for an investor to increase his or her profits, it will automatically reallocate their funds to that higher-yield pool, but only if the trade makes sense. It doesn’t just look at the available APR, but also the protocol and ecosystem rewards on offer and the gas fees for any swap, while using its predictive capabilities to assess how long the new pool is likely to remain the most profitable option.

After taking all of these aspects into consideration, it will make a decision on whether or not to make the swap, before executing it automatically to rebalance the user’s portfolio.

How To Use A Crypto AI Agent

Although the inner workings of AI models are notoriously complex, using them is pretty simple, so long as you know your way around a crypto wallet.

For our example, we’re going to activate and deploy the ARMA bot on our behalf, feed it some funds, and then unleash it onto the DeFI markets to put our capital to use. We’ve chosen ARMA for its overall simplicity, its popularity (over $1.05 million in assets under management), its claimed profitability, and its compatibility with legions of crypto wallets.

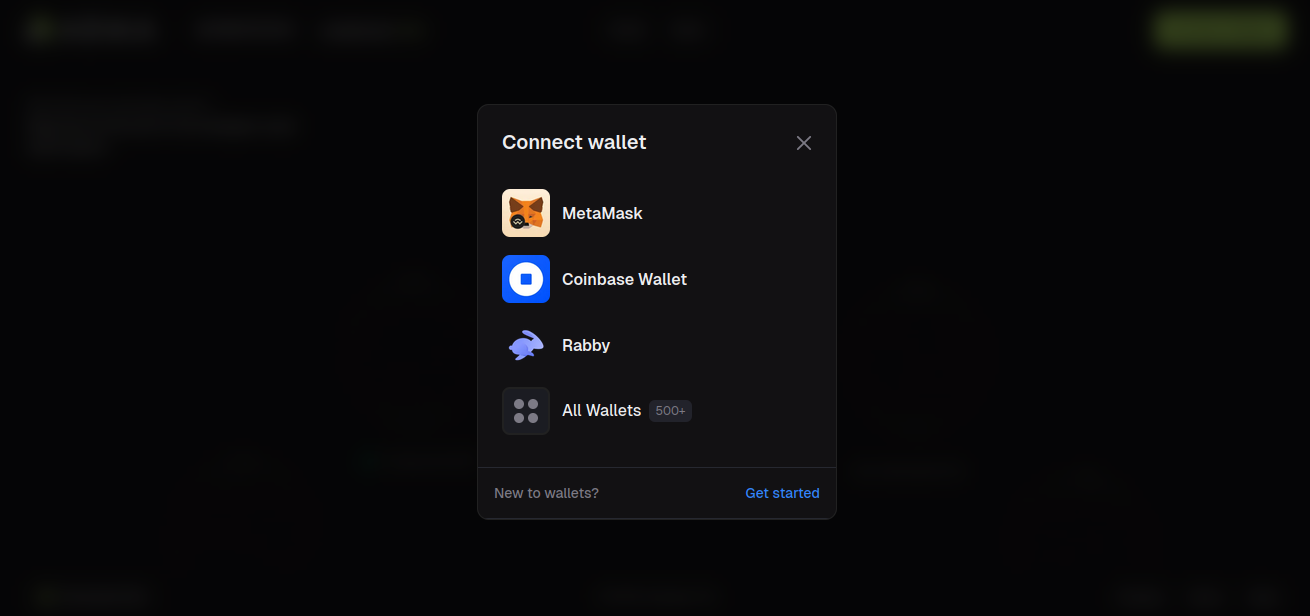

1. Connect Your Wallet

To get started you’ll need to head over to www.arma.xyz. Once there, the first thing to do is to click on the top right hand corner and connect your wallet to the ARMA app. Fortunately, it’s compatible with pretty much every wallet going, including MetaMask, Coinbase Wallet, Rainbow, Rabby, Trust Wallet, Exodus and more than 500 others.

Simply click the “Connect Wallet” button, choose your wallet from the numerous supported options, and then open your wallet to approve the connection request. Doing this establishes a secure connection for all future interactions with ARMA.

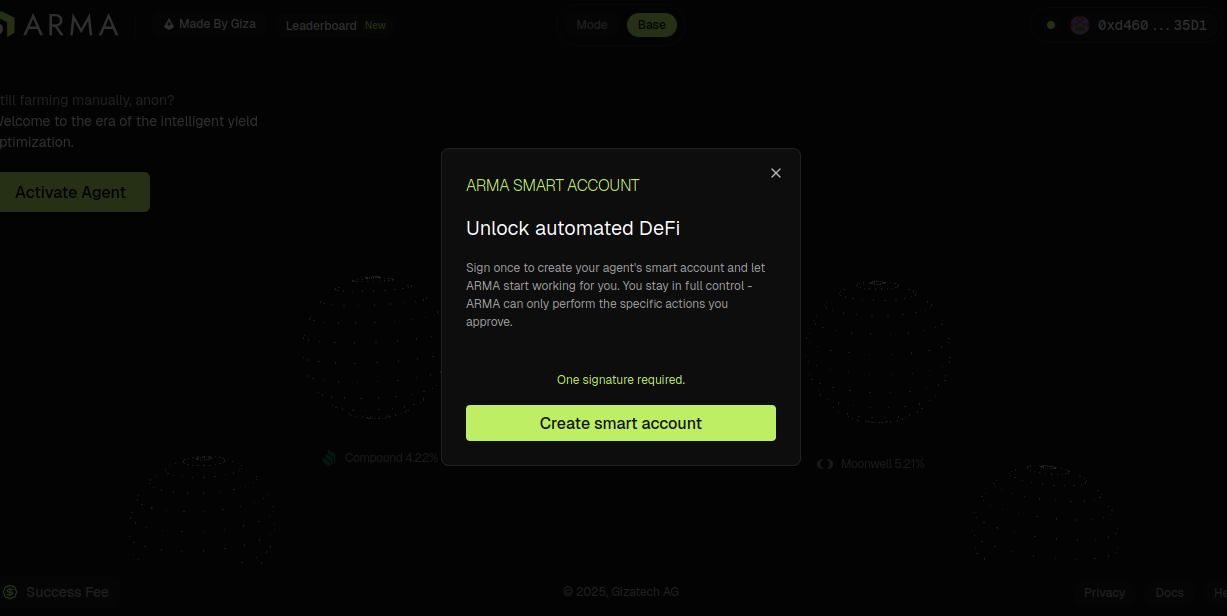

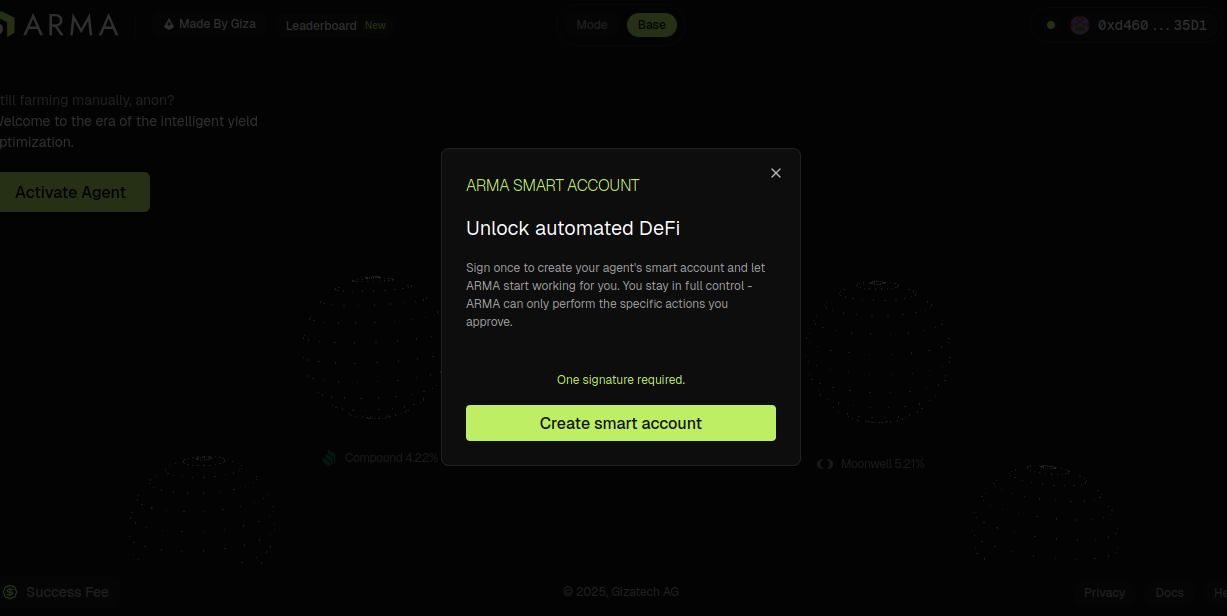

2. Create a smart account:

Your smart account will be automatically set up and configured to delegate protocol interactions to the ARMA agent. It will utilize your existing wallet to securely sign transactions. All that’s required is a single click to confirm, and ARMA will have all of the required approvals to start automating yield farming on your behalf. Doing so will authorize the transfer of your funds to your secure smart account. It will also create a one-time session key for ARMA to get started in its yield optimization operations. Your ARMA agent is now active.

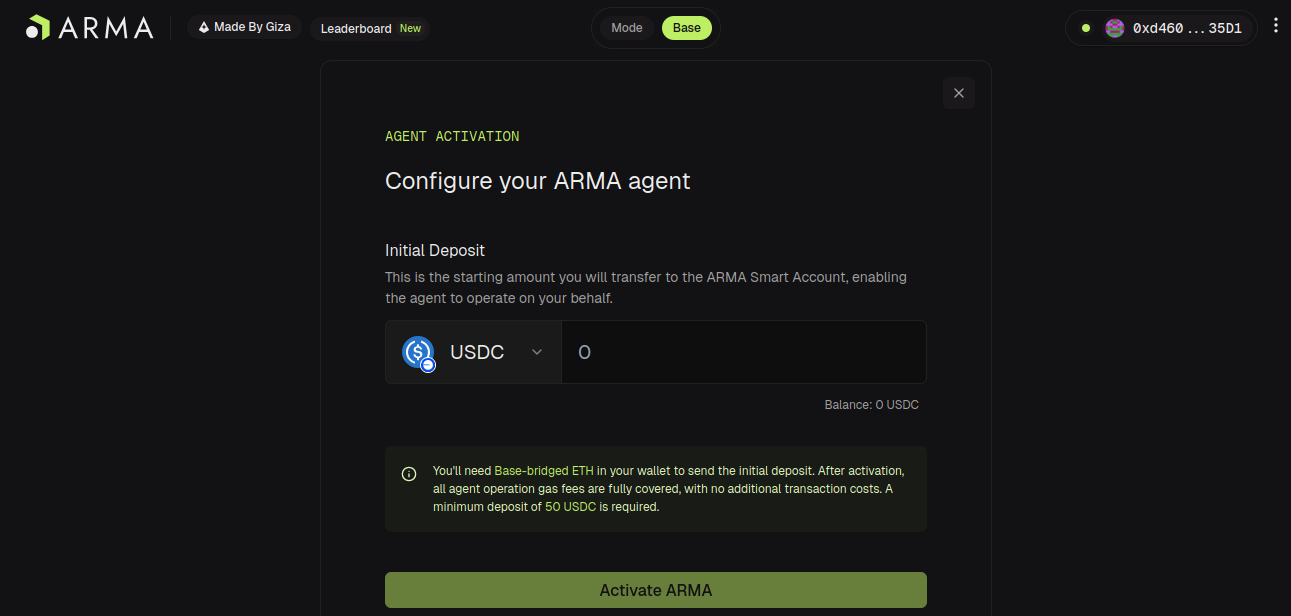

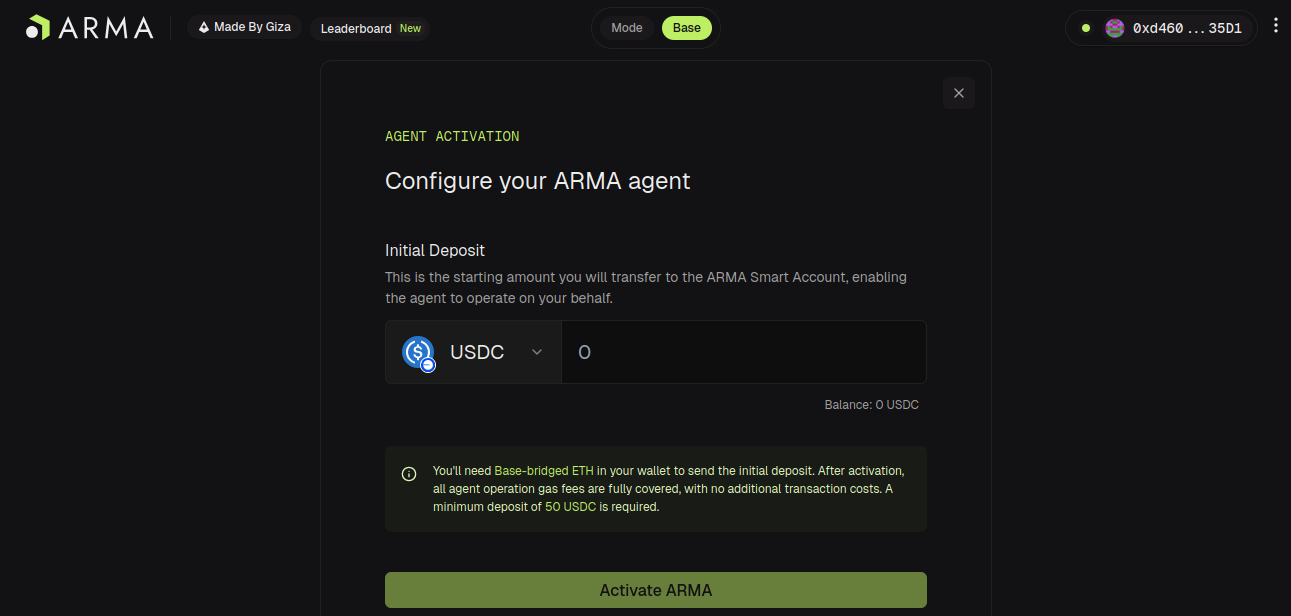

3. Make a Deposit

To make life much easier, ARMA accepts deposits in USDC or USDT from any blockchain network, so it’s a relatively simple step to fund your position. Simply select the token you wish to deposit, specify the amount, and hit the approve button.

Note that you’ll need some ETH on the Base network to pay the small gas fee for your initial deposit.

4: Setup the agent parameters

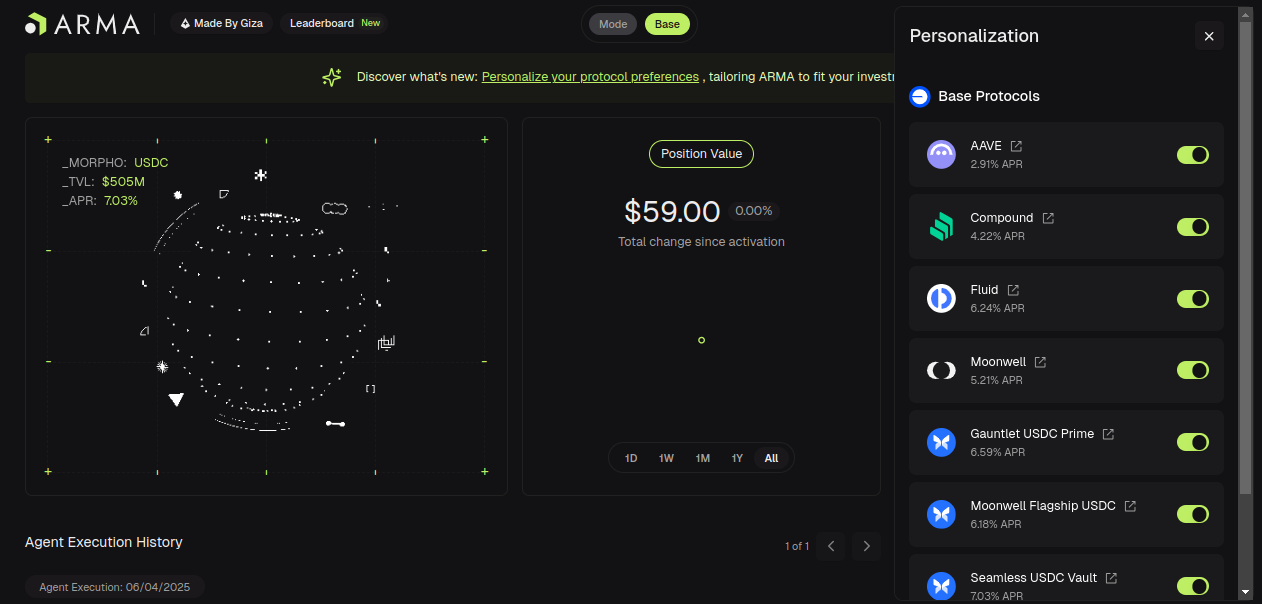

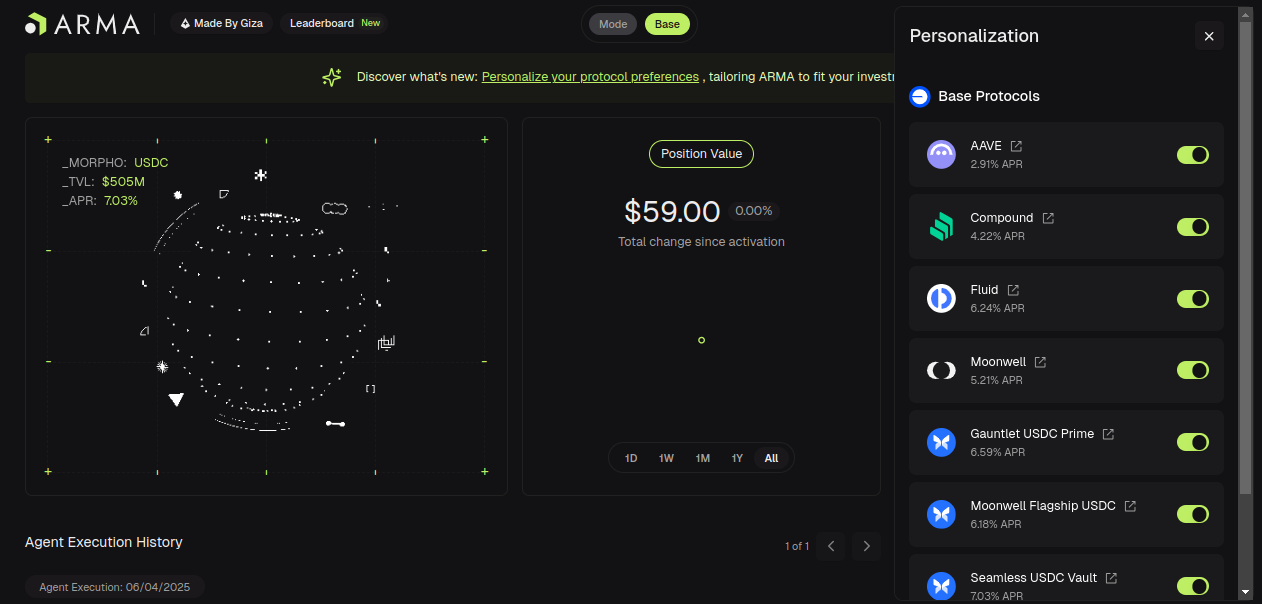

Once you’ve made your deposit, you’ll be redirected to the main ARMA overview page, which provides some easy-to-understand graphics and basic tools for monitoring your position. From here, you’ll be prompted to “personalize your protocol preferences”.

Click on that and it opens a side panel menu with a list of all of the currently supported protocols on Base and Mode Network. They’re all active by default, as this gives ARMA more room to maneuver and find the most profitable APRs available to maximize your profits, but if for any reason you don’t want to deposit your funds into a specific protocol, you can deselect it from this list.

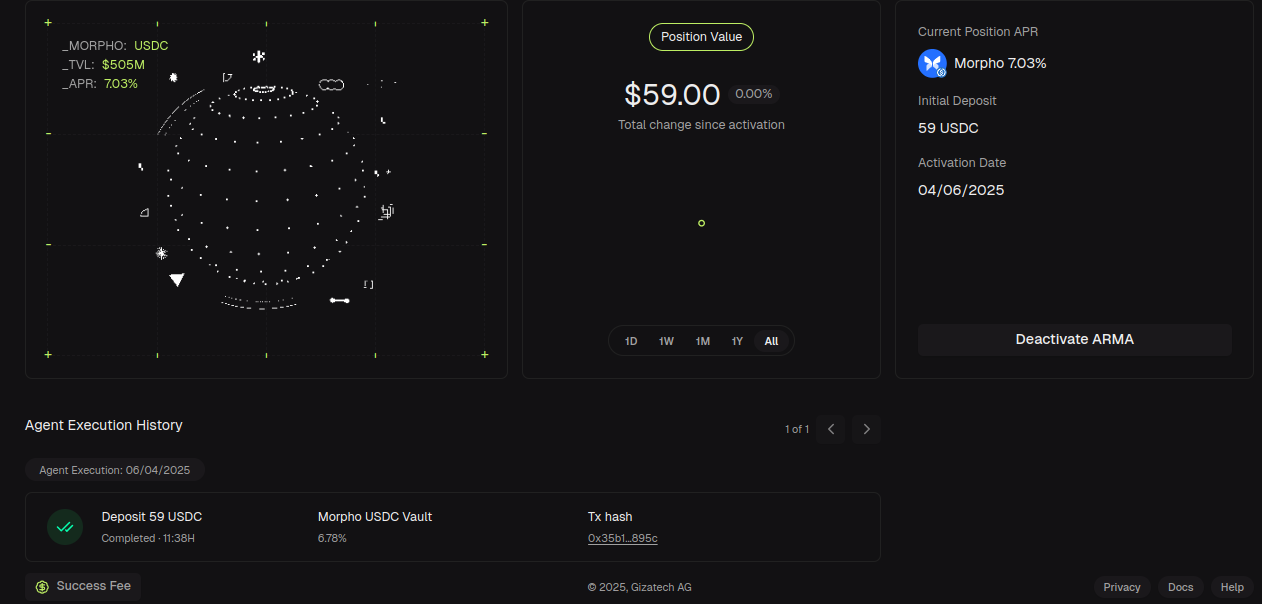

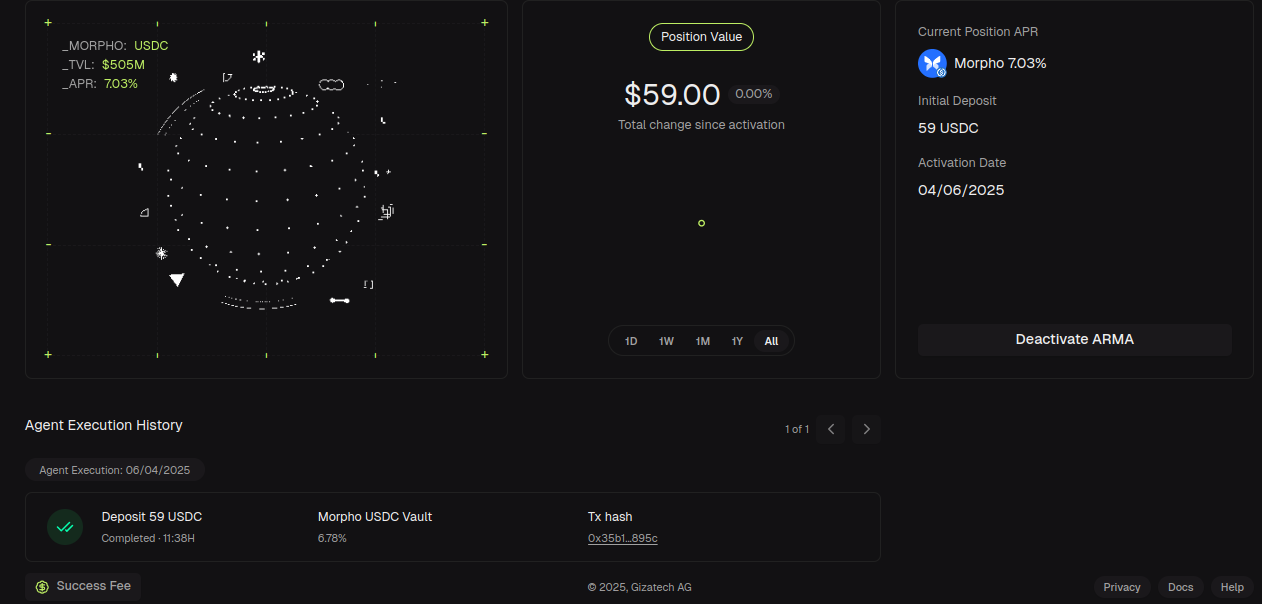

5: Keep track of your profits

Life really couldn’t be easier. Having set everything up, the only thing you need to do now is check back occasionally and monitor ARMA’s progress. It provides a range of tools for tracking your portfolio performance, with the main dashboard displaying your total balance and also your total earnings. This includes a breakdown of the percentage gain since ARMA was activated. You can dig deeper too, with different timeframe options to see its progress in the last day, week, month, or year.

The on-screen graphics also show your current protocol allocation and APR, and there’s a complete transaction history, with a chronological record of all previous transactions, including deposits and withdrawals.

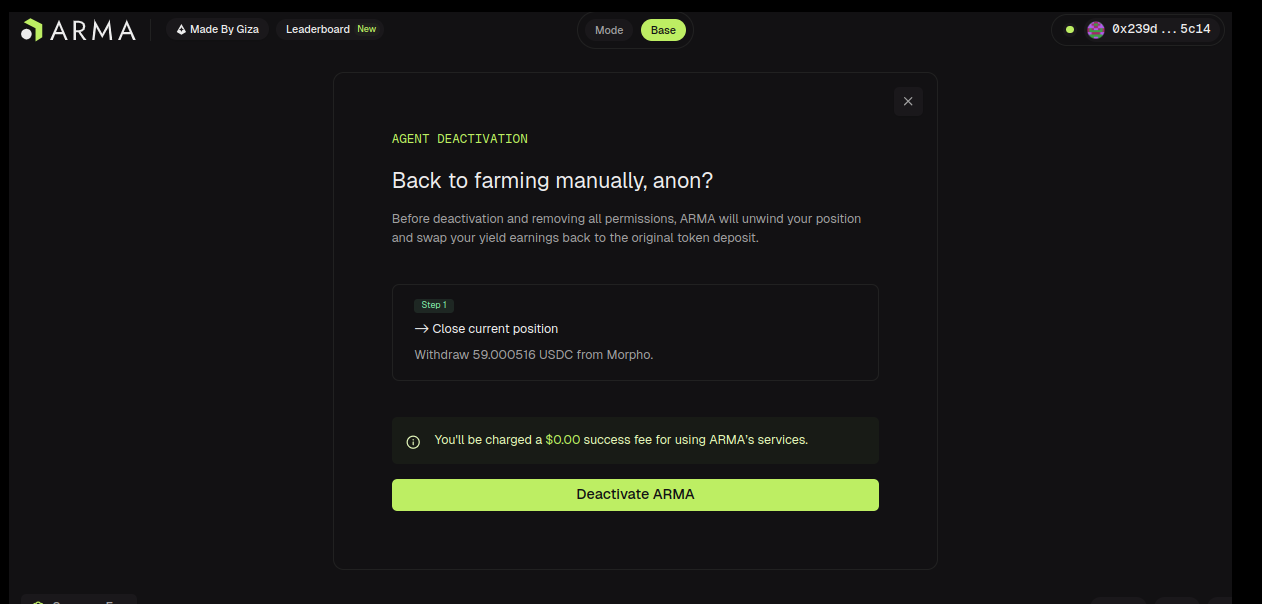

6: Get out of Doge

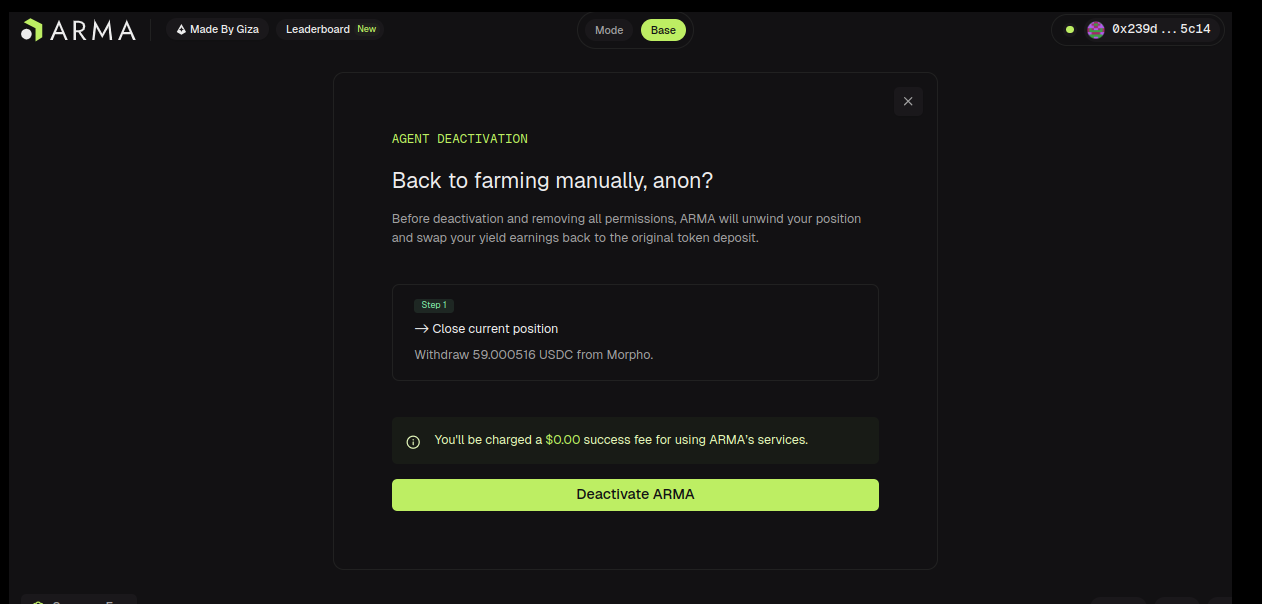

One of the best things about ARMA is that it makes it simple to exit your entire position with just a couple of clicks to take your profits and run at any moment. Simply hit the “Deactivate” button and you’ll be redirected to a confirmation page, which summarizes your current portfolio balance and the “success” fees charged to your account. Click “Deactivate” again to proceed, and all of the funds will be returned to your wallet.

Keeping Track

While this example pertains to a specific crypto AI agent, most of the ones we’ve discovered on platforms like Cookie.Fun follows a similarly straightforward process. In most cases, it involves connecting a wallet and creating an account in a few clicks, followed by making a deposit and finally, activation.

Using crypto AI agents is so simple that anyone with a basic level of crypto knowledge should be able to navigate the process without too much trouble. Once you’ve performed the necessary steps to link your wallet, created a smart account, and made your initial deposit, there isn’t that much else to do.

Just be sure to check back regularly to see if the AI agent you’re using is performing as expected. While admittedly, the jury is still out on the long-term effectiveness of AI agents in terms of profitability, there is some evidence to suggest that automated AI investing drives significantly higher profits than manually doing so.

In the case of ARMA, one case study that took place over an extended weekend showed that it was able to deliver an impressive 83% increase in DeFi lending yield, compared to maintaining a static position.

Over three days, ARMA, with more than $500,000 in user funds under management, pulled off 2,400 flawless transactions as it constantly shifted that capital around to the best-performing protocol, driving significant profit increases for all concerned.

Besides just monitoring your overall earnings, you may want to keep tabs on how often the AI agent rebalances your portfolio, checking to ensure it’s not making unnecessary transactions that could accumulate significant gas fees.

AI Agents Couldn’t Be Easier

So there you have it. Getting started with AI agents in DeFi couldn’t be easier, and that’s not surprising since they’re often said to be all about making crypto more accessible.

AI agents can be an appealing option to anyone who’s long been thinking about doing something besides “hodling” their crypto but never got around to doing it. If that sounds like you – and there are a lot of you – then you might want to consider taking a few minutes to set up an AI crypto agent to act on your behalf. Do it once, get back to doing nothing, and check back now and again to see what a difference it makes.