Injective (INJ) Price Crash Incoming? Expert Warns of a Major Market Cycle Shift!

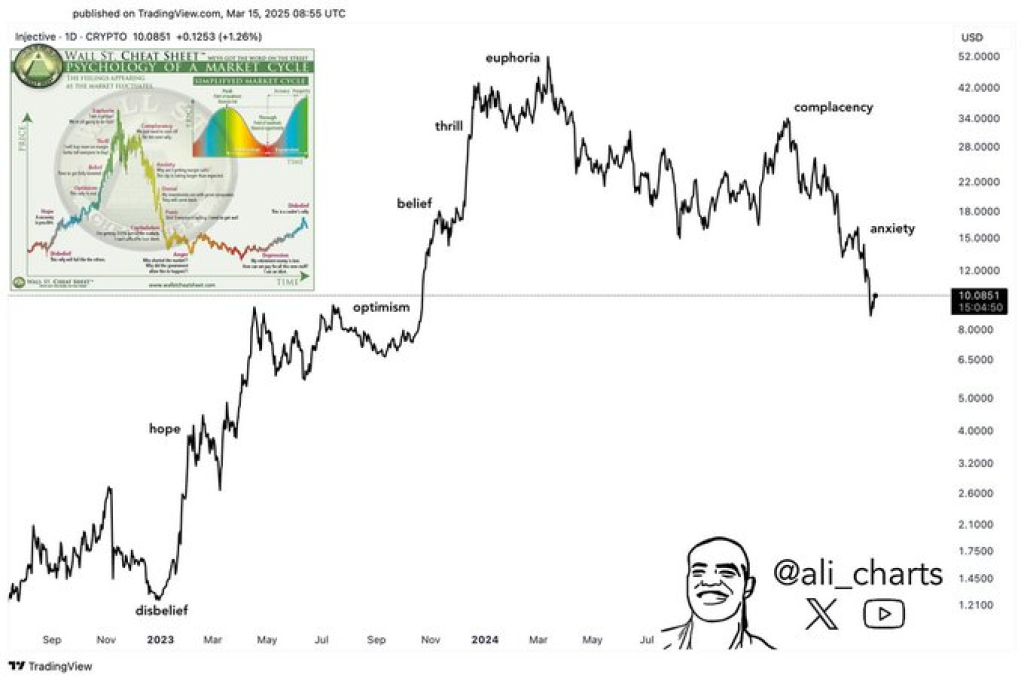

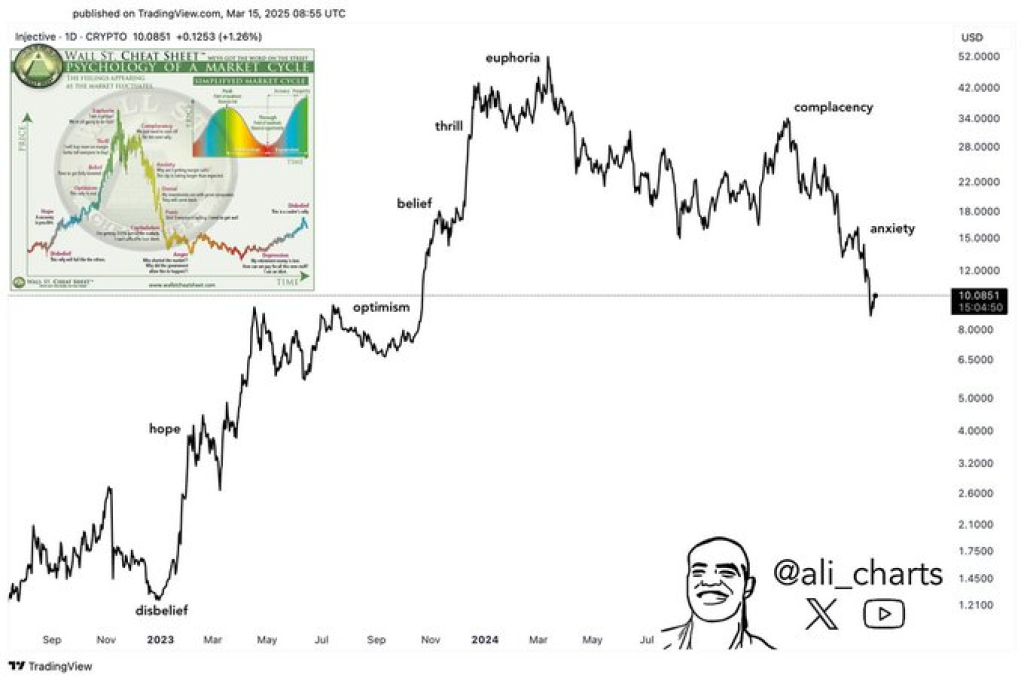

Injective (INJ) is going through a market cycle change that has traders worried. Crypto analyst Ali posted on X that Injective’s price has finished one market cycle and is moving from euphoria to anxiety. According to Ali, it might soon enter the denial phase – typically a time when more people sell and markets become uncertain.

Ali outlined the market cycle’s psychological phases and warned that INJ’s price could be on the verge of further downside movement. The tweet and accompanying chart analysis indicate that the token has already passed its peak and is now navigating the early stages of a bearish trend.

Injective Price Trends and Market Cycle Analysis

INJ’s price has followed the typical boom-and-bust pattern that matches the Wall Street Cheat Sheet psychology model. The upward trend started in late 2022, moving through the disbelief, hope, and optimism stages before reaching its highest point in early 2024 during the euphoria phase.

Following its high, the price entered a distribution phase, leading to a correction. The decline has now reached the anxiety phase, where traders start questioning the market’s stability. If this trend continues, the next stages could involve denial, panic, and capitulation, which may result in further downward movement.

INJ Key Support and Resistance Levels to Watch

Market analysis highlights critical price levels that could influence Injective’s next moves. The $10-$12 range serves as the current support zone, a level that has historically provided stability. A breakdown below this range could push the price toward the $7-$8 region, a previous accumulation zone before the rally. If selling pressure increases further, the $5-$6 range could be tested.

On the resistance side, the $30-$35 range, which marked the complacency stage, remains a key area. If the price attempts a recovery, $18-$20 could serve as a resistance level before any potential upward momentum can develop.

Read Also: Expert Predicts Cardano (ADA) Price Could Surge 15% – Here’s What Needs to Happen

Possible Scenarios for Injective Price Movement

If the current support level holds, Injective could see temporary relief, leading to a short-term price consolidation or bounce. However, if sentiment continues to weaken, the market may transition deeper into the denial and panic phases, driving prices lower.

For a full recovery, new demand and positive market catalysts would be needed to shift sentiment. Until then, traders and investors remain cautious as Injective’s price navigates this uncertain phase of the market cycle.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.