Inside the Artificial Markets That Predict Real Financial Shifts

Table of Links

Abstract, Acknowledgements, and Statements and Declarations

-

Introduction

-

Background and Related Work

2.1 Agent-based Financial Market simulation

2.2 Flash Crash Episodes

-

Model Structure and 3.1 Model Set-up

3.2 Common Trader Behaviours

3.3 Fundamental Trader (FT)

3.4 Momentum Trader (MT)

3.5 Noise Trader (NT)

3.6 Market Maker (MM)

3.7 Simulation Dynamics

-

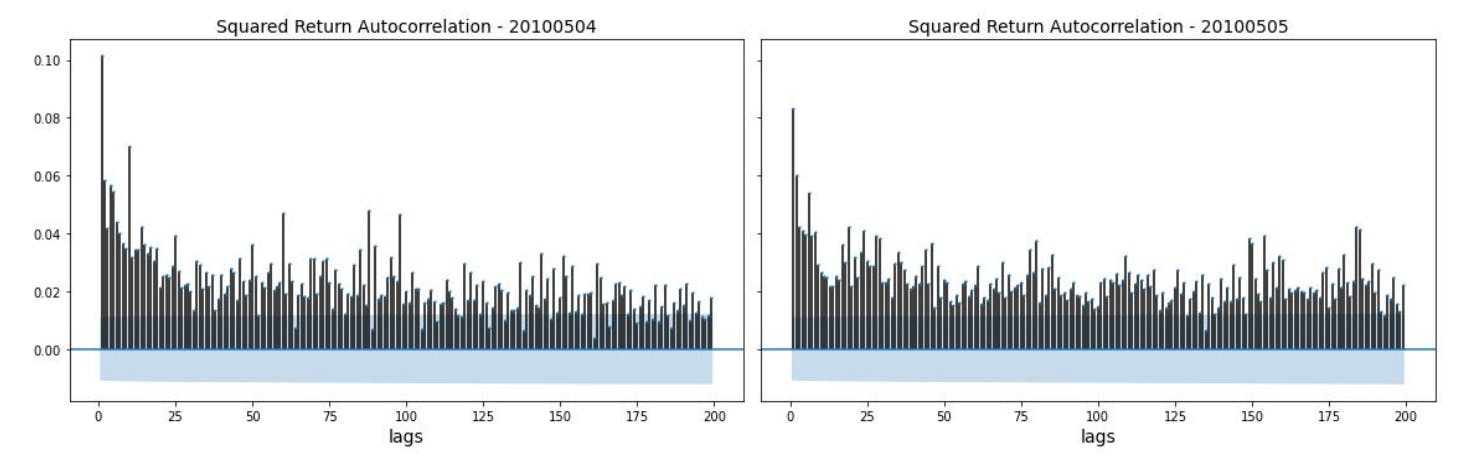

Model Calibration and Validation and 4.1 Calibration Target: Data and Stylised Facts for Realistic Simulation

4.2 Calibration Workflow and Results

4.3 Model Validation

-

2010 Flash Crash Scenarios and 5.1 Simulating Historical Flash Crash

5.2 Flash Crash Under Different Conditions

-

Mini Flash Crash Scenarios and 6.1 Introduction of Spiking Trader (ST)

6.2 Mini Flash Crash Analysis

6.3 Conditions for Mini Flash Crash Scenarios

-

Conclusion and Future Work

7.1 Summary of Achievements

7.2 Future Works

References and Appendices

2.1 Agent-based Financial Market simulation

An agent-based model (ABM) is a computational simulation driven by the individual decisions of programmed agents (Todd et al. 2016). ABMs are often used in simulating financial markets. In agent-based simulated financial markets, an agent’s objective is to “digest the large amounts of time series information generated during a market simulation, and convert this into trading decisions” (LeBaron 2001). With the advantage of capturing the heterogeneity of agents and diversity of the underlying economic system, ABMs provide a promising alternative to traditional equilibrium-based economic models.

Gode and Sunder (1993) build an agent-based model with only zero-intelligence traders to simulate financial markets. Those zero-intelligence traders are not able to think strategically, or do any advanced learning, or statistical modelling of the financial market. Surprisingly, results show that zero-intelligence traders can trade very effectively in the simulated market. The prices tend to converge to the standard equilibrium price and market efficiency tends to reach a very high level. According to their experimental results, they argue that some stylised facts in financial markets may rely more on institutional design rather than actual agent behaviour. Agent-based models are also proposed to model the “Trend” and “Value” effects in financial markets. Chiarella designed an agent-based model composed of two types of traders: fundamentalists and chartists (Chiarella 1992). With only two types of traders, lots of dynamic regimes that are compatible with empirical evidence can be generated in the simulated artificial financial market. An extension of the Chiarella model is proposed in Majewski et al. (2020). The extended model adds a new type of trader called noise trader and allows the fundamental asset value to have a long term drift. The extended Chiarella model is capable of reproducing more realistic price dynamics. This extended Chiarella model in Majewski et al. (2020) forms the basis of the proposed agent-based financial market simulation in this paper. A more complex agent-based model for financial market simulation is proposed in McGroarty et al. (2019). Five different types of traders are present in the simulated market: market makers, liquidity consumers, momentum traders, mean reversion traders, and noise traders. Their model is capable of replicating most of the existing stylised facts of limit order books, such as autocorrelation of returns, volatility clustering, concave price impact, long memory in order flow, and the presence of extreme price events. Those stylised facts have been observed across different asset classes and exchanges in real financial markets. The successful replication of these stylised facts indicates the validity of their agent-based simulation model. It is shown that agent-based financial market simulation is capable of generating artificial financial markets with realistic macro behaviours.

The prevalence of electronic order books and automated trading permanently change the way the market works. It is virtually impossible to infer meaningful relationships between market participants using traditional mathematical methods because of the complexity of electronic financial markets. Instead, agent-based financial market simulation has been gradually getting popularity in the market microstructure literature. An agent-based simulated financial market offers an experimental environment for examining market features and characteristics. It also provides plenty of artificial financial market data for analysis. Hayes et al. (2014) develop an agent-based model for use by researchers, which offers the capability of capturing the organization of exchanges, the heterogeneity of market participants, and the intricacies of the trading process. Agent-based models can also provide regulators with an experimental environment that helps to comprehend complex system outcomes. In other words, it allows for a clearer examination of the relationship between micro-level behaviour and macro-outcomes. For example, Darley and Outkin (2007) test the regulatory changes that came with decimalization in the NASDAQ market using agent-based financial market simulation. The agent-based models of the NASDAQ market shed light on how these changes would impact market function.

To summarise, agent-based financial market simulation simplifies complex financial system simulation by including a set of individual agents, a topology and an environment. Different agent-based models in the literature focus on different practical problems in financial markets. In this paper, we focus on agent-based models applied to flash crash analysis. In the following section, we provide a literature review of flash crash episodes.

Authors:

(1) Kang Gao, Department of Computing, Imperial College London, London SW7 2AZ, UK and Simudyne Limited, London EC3V 9DS, UK ([email protected]);

(2) Perukrishnen Vytelingum, Simudyne Limited, London EC3V 9DS, UK;

(3) Stephen Weston, Department of Computing, Imperial College London, London SW7 2AZ, UK;

(4) Wayne Luk, Department of Computing, Imperial College London, London SW7 2AZ, UK;

(5) Ce Guo, Department of Computing, Imperial College London, London SW7 2AZ, UK.