Intel Stock Price Resurgent But Trump Cloud Hangs Over It

- Intel stock price has been struggling for traction and President Trump’s onslaught against the CEO could make it harder.

Intel stock price has rebounded in the pre-market session on Friday as investors digested US President Donald Trump’s call for the company’s CEO, Lip-Bu Tan to resign. The stock was up by 0.86% at the time of writing, rising to $19.96. Trump, in a post on his Truth Social account, claimed that Tan is compromised due to his alleged links to China- a country seen as a threat to America’s AI tech leadership.

However, investors seem to have moved on from that development for now, choosing instead to pay greater attention to the strong earnings reported by the majority of S&P 500 Index companies. In addition, the new trade tariffs set to kick in from August 9 have largely been seen as more accommodative than the previous ones announced in May, with no instances of counter-tariffs in play.

Trade barriers between the US and China are a key limiter to the earnings of top AI tech companies and Trump’s take on Intel’s boss could complicate matters for its relatively weak balance sheet. Tan issued a statement on Thursday denying Trump’s claims that he’s “conflicted”, and instead offered his 40+ years of experience in the industry as a pointer to his rich global network.

Intel (NASDAQ: INTC) investors view Tan- appointed in March- as the right driver to lead the company out of its financial struggles. Notably, Intel stock price rose 15% on the day the company announced him as the replacement for former CEO, Pat Gelsinger. However, Intel is also a beneficiary of nearly $8 billion grant availed by CHIPS Act, and Trump’s collision with Tan could potentially compromise that financial pipeline.

Intel Stock Price Prediction

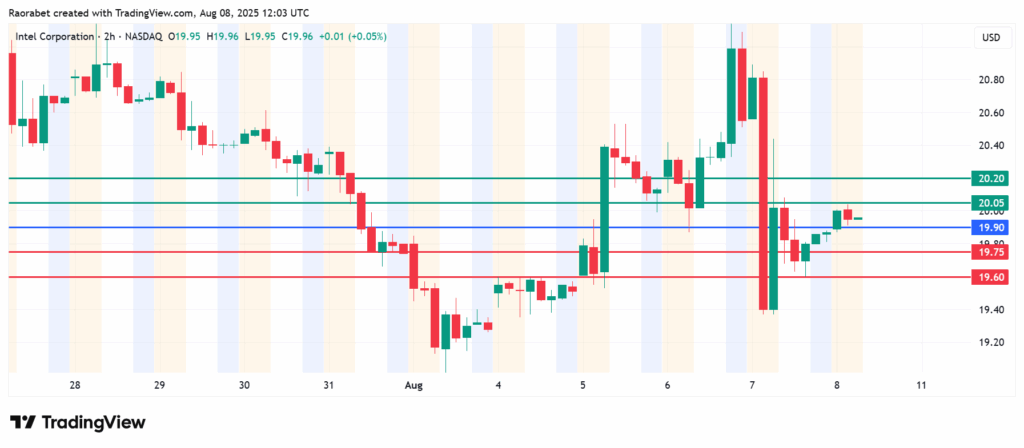

The pivot mark on Intel stock price is at $19.90 and the momentum points to a likely extension of the upside. INTC price will likely meet the first resistance at the $20.05 mark. However, the buyers could break that barrier if they extend their control. That could clear the path to test $20.20.

Alternatively, action below $19.90 will signal the onset of the downward momentum. With that, Intel stock price is likely to find the first support at $19.75. Breaking below that level will invalidate the upside narrative. Also, a stronger momentum could extend losses and test $19.60.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.