Morning Crypto Report: XRP to $4.20 Not a Dream, New Ethereum Hard Fork Game-Changer, Bitcoin Faces Worrying $111 Million Sale

The crypto market begins Wednesday under clear pressure from macro catalysts as traders position around today’s FOMC decision and Jerome Powell’s press conference. Total capitalization is near $3.82 trillion, with Bitcoin at $112,900 and Ethereum testing nerves around $4,000.

Liquidity remains thin as U.S. yields stabilize into the Fed event, while a $15 trillion earnings cluster from Microsoft, Alphabet, Meta, Boeing and Caterpillar later today will dictate risk appetite, extending into Nasdaq futures and crypto correlations.

TL;DR

- XRP could repeat HBAR’s 25.7% ETF rally and shoot past $4.

- Ethereum finalizes Fusaka testnet ahead of Dec. 3 hard fork.

- Sequans moves $111 million in Bitcoiin to Coinbase before FOMC decision.

- Big Tech earnings and Powell press conference to dictate evening volatility.

XRP: ETF math points to $4.20

XRP trades near $2.65, up a bit overnight, but the real conversation comes from Hedera’s (HBAR) shock ETF approval rally as HBAR coin surged 25.7% in 24 hours, after Canary Capital’s spot ETF launch on the NYSE, moving from $0.1775 to $0.2052 on 182% volume growth.

Should XRP mirror the same 25.7% ETF lift, its price would jump from $2.62 toward $3.29, clearing the psychological $3 barrier and setting targets in the $3.50-$4.20 corridor. With filings from Grayscale, Bitwise and 21Shares awaiting SEC review, traders see HBAR’s approval as a dry run for how institutional flows could distort XRP’s chart.

The $2.60 support band is intact, and indicators hint at potential retests of $2.80-$3, so the technical outlook aligns with XRP ETF speculations fueling fundamentals.

Still, a break under $2.58 would neutralize the bullish setup, but the asymmetric risk remains tilted upward given HBAR’s precedent.

Ethereum: Fusaka hard fork nears

Ethereum holds just below $4,000 after two brutal intraday reversals, waiting for a catalyst beyond Fed rhetoric, and there is one, as the key driver now is the Fusaka hard fork, scheduled for mainnet activation around Dec. 3.

The Hoodi testnet has just completed its final trial run, following earlier deployments on Holesky and Sepolia. Fusaka introduces several upgrades central to Ethereum’s scaling roadmap:

- EIP-7594 (PeerDAS): Partial data validation, cutting validator load by allowing blob-shard processing.

- EIP-7825 / EIP-7935: Gas-limit increases and core efficiency boosts.

- Blob-package expansion, node security upgrades and infrastructure prep for L2 throughput.

This hard fork cements Ethereum’s positioning as the foundational L2 settlement layer. With DeFi TVL grinding higher and daily gas usage back to mid-2024 levels, developers see Fusaka as the necessary update to handle the next scaling cycle without bottlenecks.

Short term, ETH needs to hold $3,950 or risk unwinding toward $3,850, but the fork narrative limits downside into year’s end.

Bitcoin: $111 million treasury sale raises red flag

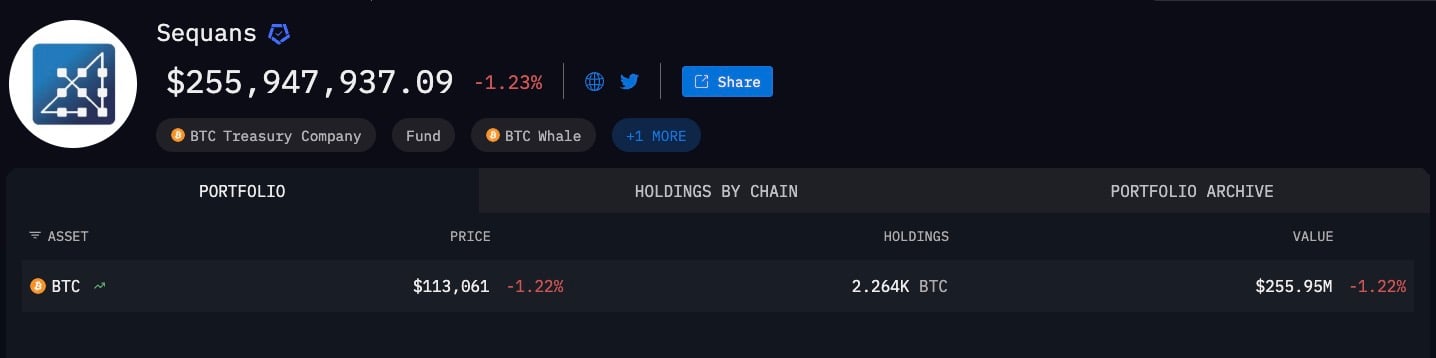

After dipping under $112,000 in Asian trading, Bitcoin sits near $112,900, with the spotlight on Sequans Communications that just moved 970 BTC, worth about $111 million, to Coinbase.

This is its first major outbound transaction since the company started building its 3,234 BTC treasury, currently valued at $255 million.

Sequans ranks 29th on the global list of public Bitcoin treasury holders, far behind giants like Strategy (640,808 BTC) and Tesla (11,509 BTC), but its timing is worrying. In light of upcoming FOMC, some interpret the sale as pre-emptive risk management, others as balance-sheet optimization.

Either way, corporate flows of this magnitude add pressure to an already fragile BTC spot book.

Immediate resistance for the Bitcoin price stands at $113,500, with stronger supply stacked near $115,000. The critical downside trigger is $112,000, and losing that zone reopens $110,800 as the next crucial support.

Evening outlook

The evening is a collision of macro and micro. An FOMC statement, Powell’s press conference and results from Meta, Alphabet, Microsoft, Boeing and Caterpillar will hit risk assets within hours of each other.

- Bitcoin: Hold $112,000 or risk deeper slide, reclaim $113,500 for relief.

- Ethereum: Defend $3,950, breakout of $4,050 leads to $4,200 setup.

- XRP: ETF narrative keeps $2.80-$3.00 open, HBAR precedent lights path to $4.

By the time Wall Street closes, traders will know if Powell crushed risk appetite or if ETF hopes and corporate earnings gave crypto the green light. This is the most binary day of the week, and the market is sitting right at the fault line.