Multiple Metrics Suggest Sonic (S) Price Is About to Explode—Here’s the Outlook

Sonic price has increased by close to 30% in the last four days. However, this could be the beginning of bigger moves for the project.

Crypto analyst Axel Bitblaze highlighted that Sonic Labs (S) has outperformed 90% of major L1s in both price action and fundamentals over the last three months. What makes the current situation particularly notable is what he describes as a perfect synchronization between price and fundamentals.

The price action of S/USDT on the 4-hour timeframe reveals several important developments. In early February, Sonic experienced what the analyst call the “BTC nuke effect” – a significant price drop triggered by Bitcoin’s downward movement.

However, this was followed by an impressive bullish phase where both Total Value Locked (TVL) and price doubled, indicating robust fundamental growth. This upward movement peaked near 1.00 USDT before entering a downtrend.

A descending trendline formed after reaching this high, characterized by lower highs and lower lows. Currently, the price is testing this trendline with a potential breakout that could signal a trend reversal. If successful, this breakout might lead to bullish continuation.

The chart identifies $0.3743 as a key support level where the price found a bottom and rebounded strongly. This recovery has been notably described as the “fastest among alts,” suggesting exceptional relative strength compared to other alternative cryptocurrencies.

Supply Dynamics Create Bullish Pressure

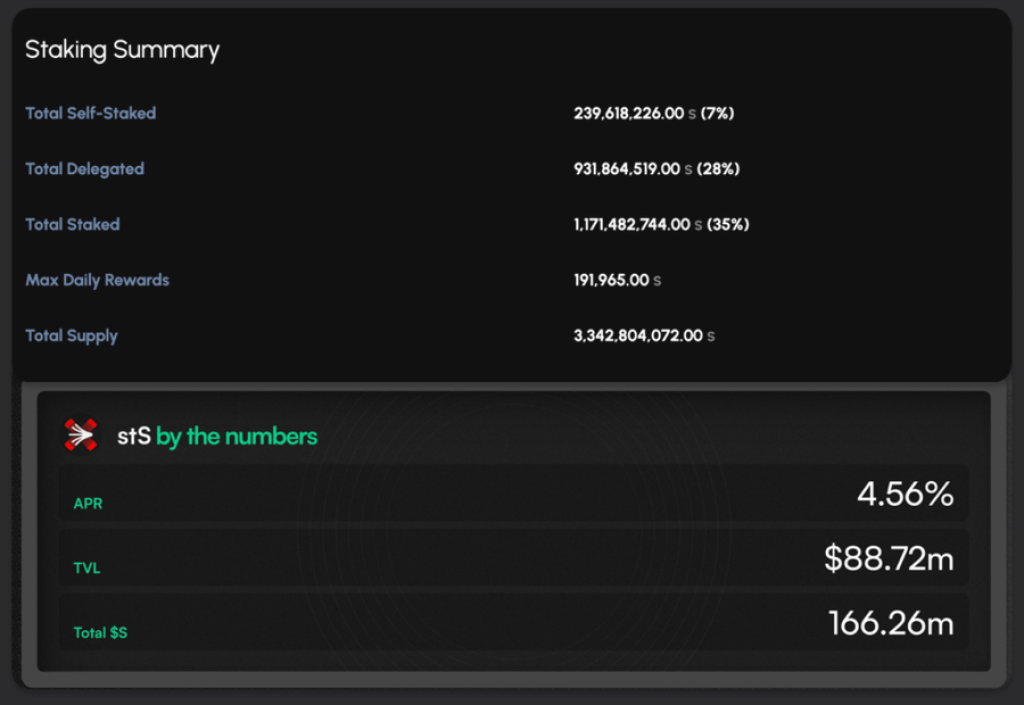

According to Axel Bitblaze, almost the entire Sonic supply is now circulating and held by the community. Approximately 35% of this supply is staked, with another 5-6% being liquid staked. This means nearly half of the total supply is positioned off exchanges and sitting on-chain, reducing potential sell pressure.

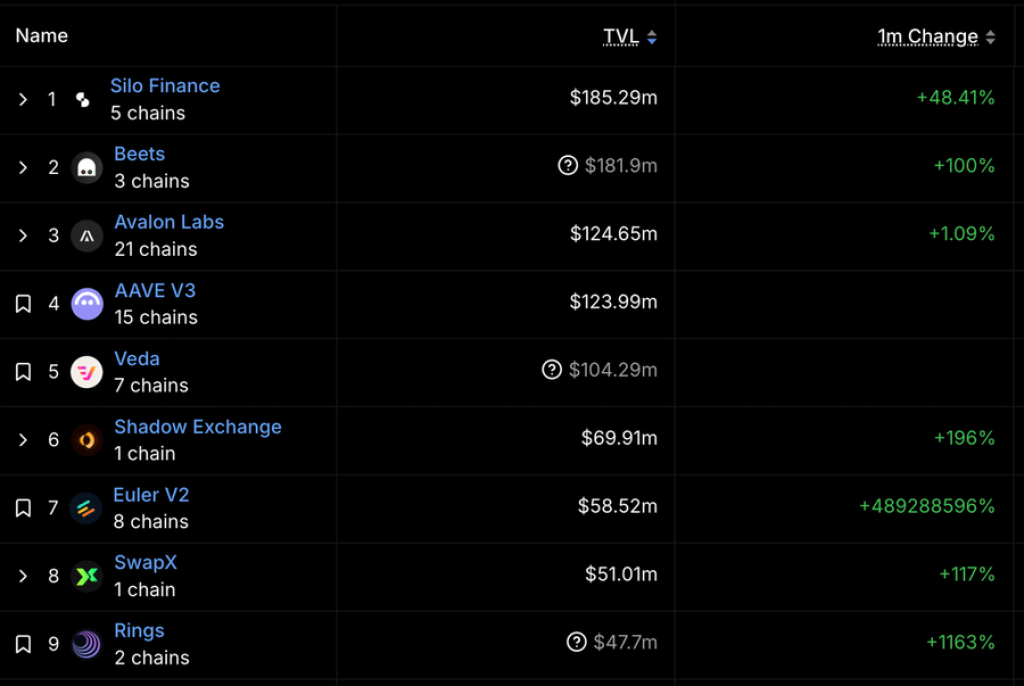

Simultaneously, DeFi activity on Sonic has experienced dramatic growth. Major players like Aave and Pendle Finance have launched on the platform. Sonic’s inflows even surpassed Base on deBridge Finance.

Top decentralized applications including Shadow On Sonic and Beets Finance doubled their TVL in just one month. The platform now ranks in the top 6 for app revenue, outperforming established networks like SUI and Avalanche.

Read Also: This Trader Makes a Shocking Hedera (HBAR) Price Prediction – Top Crypto to Buy?

Strong Fundamentals Create Resilience

The community is actively putting their Sonic tokens to work through various DeFi activities from liquidity providing to yield farming, with yields described as exceptionally rewarding at present. With staked supply already high and DeFi inflows accelerating, sell pressure on order books continues to decrease.

This dynamic explains why when Bitcoin and alternative cryptocurrencies experienced significant downward pressure, Sonic held strong and outperformed most alternatives. While panic selling affected other markets, Sonic holders remained steady, focusing on farming yields instead. Bitblaze suggests this effective economic flywheel is worth studying for its resilience and growth potential.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.