Old Bitcoin Wallets Reactivate: Untouched BTC Movements Close In On 2024 Peak

Bitcoin’s remarkable upward performance in the 2025 bull market phase appears to have stirred up the movement of coins that have been dormant for several years. On-chain data is showing that a significant portion of these coins being moved in the first half of the year is drawing close to last year’s peak.

Long-Lost Bitcoins Stir As 2024 Levels Near

An unanticipated change is occurring in the Bitcoin ecosystem, as BTCs that were previously thought to be lost or untouchable have displayed an unexpected movement in 2025. CryptoQuant, a leading on-chain data and analytics firm, outlined the notable performance in a post on the X platform.

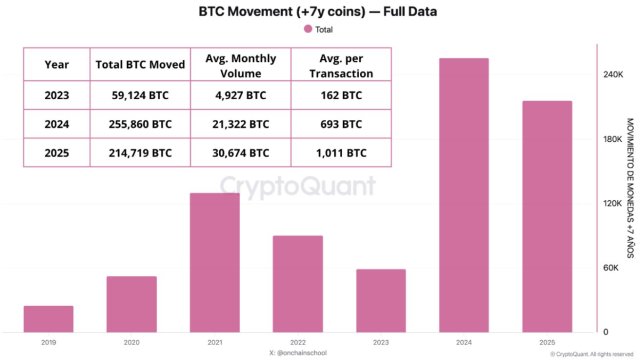

With several months left until 2025 comes to an end, the number of these coins being moved is already nearing its 2024 peak. On-chain data show that dormant coins of more than seven years are coming online at a rate that has not been observed since 2024. It is worth noting that there has been a sharp increase in the movement of these coins within the last two years.

This development points to a potentially crucial moment in the dynamics of Bitcoin’s supply and market sentiment, as its price fluctuates near recent highs. CryptoQuant stated that this is not just another bull market phase; it is a structural replacement. The platform further added that the price is only the tip of the iceberg in this cycle; the true shift is in who controls the future.

According to the report shared by CryptoQuant, over 255,000 dormant or lost BTC were reactivated in 2024 alone. Meanwhile, the quantity of dormant coins reactivated has already surpassed 215,000 BTC in 2025, with several months still left in the year.

While a large portion of dormant BTC is being moved, the platform highlighted that the trend goes deeper than total volume. The platform points to a substantial increase in both BTC’s average monthly volume and average transaction size, signaling a strong wave of market participation and growing investor confidence.

In the last two years, Bitcoin’s average monthly volume has surged from 4,927 BTC in 2023 to 30,674 BTC in 2025. Additionally, its average size per transaction has increased from 162 BTC to 1,011 BTC within the same time frame. CryptoQuant claims that these spikes are now planned reallocations of large amounts of capital rather than dispersed retail transactions.

BTC Bull Market Might Be Nearing Its End

While this bull market has been quite remarkable, with Bitcoin achieving several highs, some key indicators suggest that the current bull phase might be approaching its end. The latest signal comes from the key BTC Net Unrealized Profit/Loss by Cohort metric.

After examining the chart, it is observed that long-term holders are exhibiting great commitment and determination to hold as they continue to operate in solid profit territory (NUPL above 0.5). Meanwhile, short-term holders are fluctuating close to lower profit levels, which indicates partial selling or short-term pressure. According to CryptoQuant, long-term holders’ conviction is driving the general trend, which is still bullish, but short-term holders may temporarily exert corrective pressure.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.