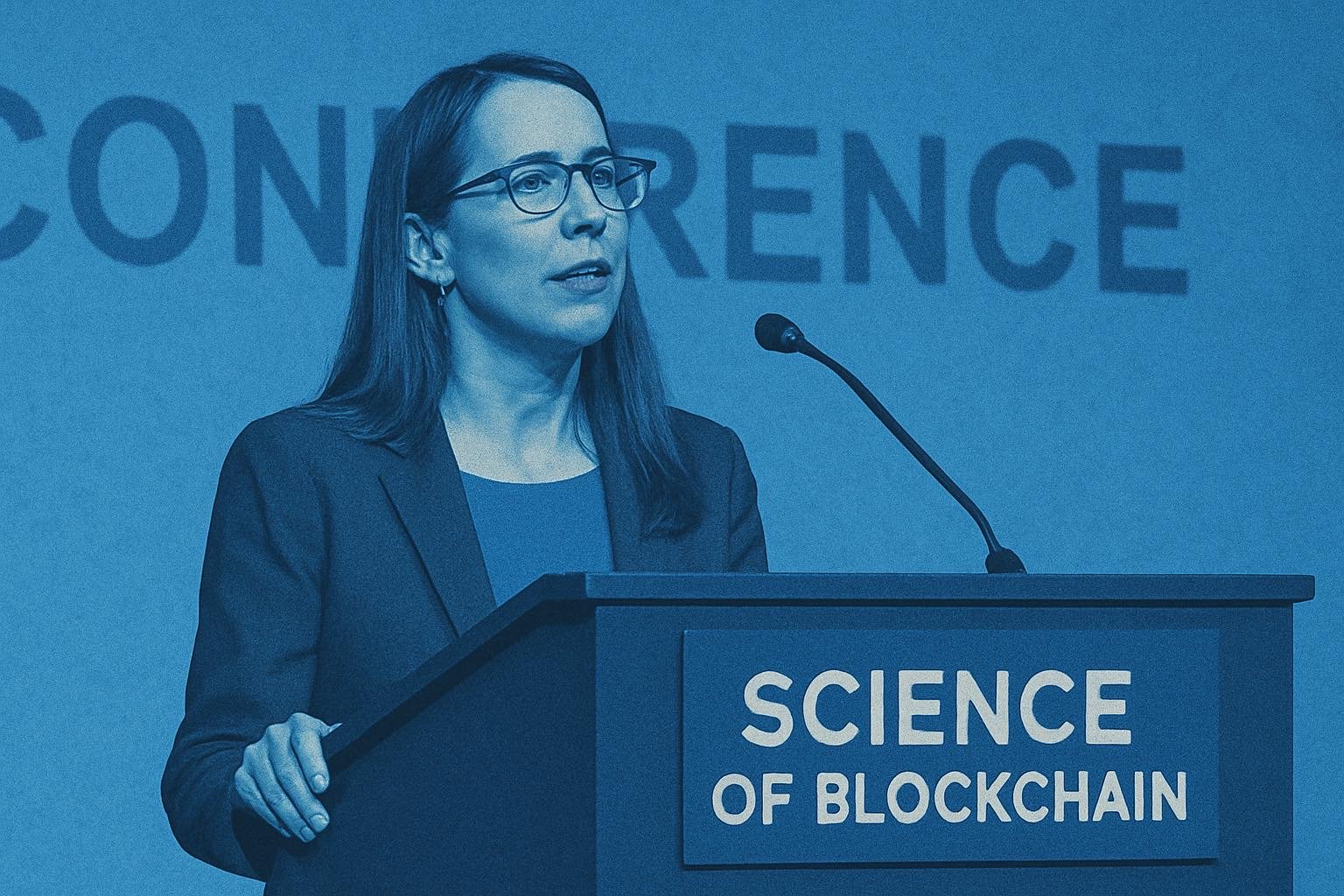

SEC’s Hester Peirce Recommends Non‑Custodial Wallets to Protect Crypto Privacy

SEC Commissioner Hester Peirce is once again standing up for self-custody in crypto. Speaking at the Science of Blockchain Conference on August 4, she made it clear: financial privacy matters, and non-custodial wallets are a big part of that.

“We should welcome privacy-protecting technologies and safeguard the right of individuals to self-custody their crypto assets,” Peirce said.

Her comments come at a time when debates around non-custodial wallets, blockchain surveillance, and user rights are growing louder.

Peirce’s message struck a chord with many in the space: people should be able to control their own money, without relying on third-party intermediaries like exchanges or custodial platforms.

What Are Non-Custodial Wallets?

Non-custodial wallets let you hold and manage your crypto directly: no bank, no exchange, no middleman.

When you use a custodial wallet (like those provided by many exchanges), you’re essentially trusting someone else to keep your funds safe. They hold the keys. With a non-custodial wallet, you hold the keys, and full control.

This distinction is critical because private keys are the fundamental credentials required to access and transfer crypto assets.

And when you hold the keys you’re not at the mercy of withdrawal delays, frozen accounts, or exchange hacks.

The Role of Non-Custodial Wallets in Enhancing Privacy

Non-custodial wallets contribute significantly to protecting financial privacy. By removing third-party custodians, users minimize the amount of personal data shared or stored by external entities.

Because you’re not handing over personal information to a third party, there’s less data floating around that can be tracked, sold, or exposed in a breach. Your transaction history, wallet balances, and other sensitive info stay more private.

Some non-custodial wallets go even further by supporting tools like encryption, DeFi integrations, and privacy-focused features such as biometric logins.

These add extra layers of protection while staying true to crypto’s decentralized roots.

Challenges and Considerations

That said, self-custody isn’t without its challenges.

While non-custodial wallets offer clear benefits in terms of privacy and control, they also place full responsibility for security on the user.

If you lose your private keys, you lose access to your funds permanently. There’s no “forgot password” button. That’s a big hurdle for newcomers, and one reason why some people still prefer the ease (and risk) of custodial services.

There’s also a balancing act regulators have to manage. While self-custody protects user rights, it can also make it harder to track illicit activity like money laundering. The conversation around privacy and regulation is far from settled.

A Push to Protect Crypto’s Core Values

Commissioner Peirce’s emphasis on defending financial privacy highlights the growing recognition of non-custodial wallets as essential tools for user independence in cryptocurrency.

By enabling individuals to control their assets without intermediaries, non-custodial wallets uphold the principles of privacy and decentralization that many view as foundational to cryptocurrency.

Non-custodial wallets empower users to truly own their assets. And in a world where data is increasingly tracked and controlled, that’s a powerful idea.

As regulation catches up with technology, the push for privacy-preserving tools like non-custodial wallets is likely to grow. Developers, users, and policymakers will need to collaborate to build a crypto ecosystem that’s secure, accessible, and respectful of individual freedom.

Best Non-Custodial Wallet with No KYC

With regulators highlighting the importance of self-custody, here’s a look at one of the best non-custodial wallet options that doesn’t require KYC: Best Wallet.

A decentralized, self-custodial solution, Best Wallet is a crypto wallet that caters to all categories of users, including long-term investors and day-to-day traders. Unlike traditional wallets, Best Wallet delivers a full suite of crypto trading features without requiring any KYC.

Currently, it supports five blockchains: Polygon, Bitcoin, Ethereum, Base, and Binance Smart Chain, allowing users to store, swap, and manage digital assets seamlessly across different networks. It will soon be introducing support for Solana, XRP, Dogecoin, and others.

Users can essentially use fiat to buy crypto from this platform without excessive fees. It also features a DEX and bridge aggregator to power in-app swaps and help users get the best exchange rates.

Another key advantage is its robust security system, powered by Fireblocks. This, alongside other vital features like biometric fingerprint, thorough private key encryption, and two-factor authentication are instrumental in securing users and their funds.

The next major attribute that makes Best Wallet different from the rest, however, is the “Upcoming Tokens” feature, designed to let investors discover early-moving opportunities and scoop gains before they become public knowledge.

Additional perks that this wallet offers include staking yields, portfolio management, multi-wallet facility, iGaming bonuses, NFT integration, and a whole lot more. This multi-layered functionality is exactly why leading publications, including the New York Post have dubbed it the best option, especially as investors gravitate towards self-custody.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.