S&P/TSX 60 Index Elliott Wave technical analysis [Video]

S&P/TSX 60 daily chart – Elliott Wave technical analysis

Function: Bullish Trend.

Mode: Impulsive.

Structure: Orange wave 1.

Position: Navy blue wave 3.

Direction next lower degrees: Orange wave 2.

Details: Navy blue wave 2 completed, orange wave 1 of 3 in progress.

Wave invalidation level: 1339

The S&P/TSX 60 daily Elliott Wave analysis highlights a bullish trend with price action showing strong impulsive movement, marking the beginning stages of a significant upward trend. The current wave structure is orange wave 1, within the broader navy blue wave 3, signaling early momentum in a potentially sustained rally.

Completion of navy blue wave 2 indicates the start of orange wave 1, suggesting a bullish continuation. The next expected phase is orange wave 2, a short-term correction before the uptrend resumes. As long as the price remains above the critical invalidation level at 1339, this analysis supports continued upward progression.

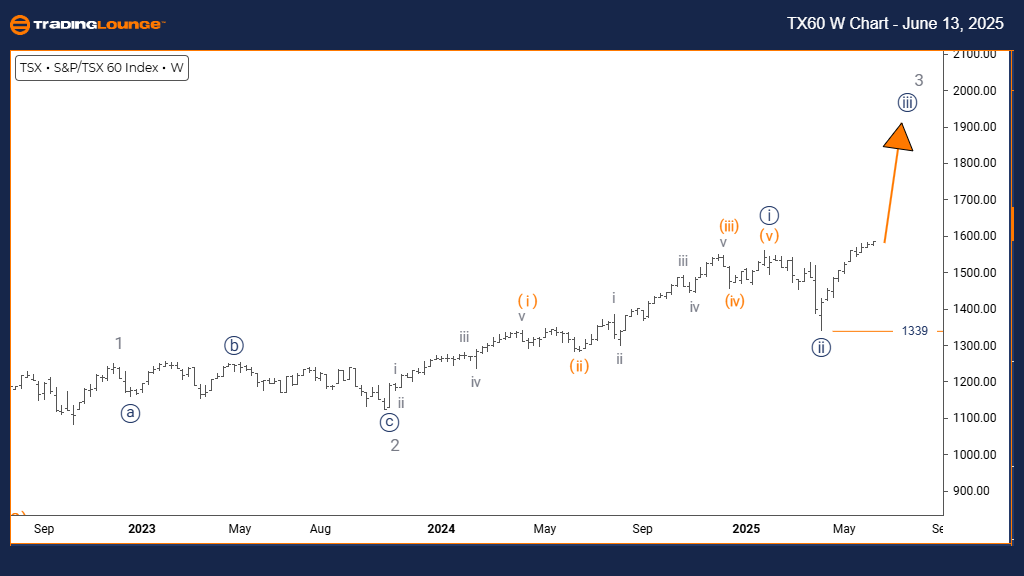

S&P/TSX 60 weekly chart – Elliott Wave technical analysis

Function: Bullish Trend.

Mode: Impulsive.

Structure: Navy blue wave 3.

Position: Gray wave 3.

Direction next lower degrees: Navy blue wave 4.

Details: Navy blue wave 2 completed, navy blue wave 3 of 3 in play.

Wave invalidation level: 1339.

The weekly Elliott Wave analysis of the S&P/TSX 60 confirms a bullish structure supported by impulsive price action, with the index currently in navy blue wave 3, part of the broader gray wave 3. This is typically the strongest phase of the Elliott sequence, known for its sustained and sharp upward movements.

With navy blue wave 2 completed, the market is progressing through navy blue wave 3 of 3, signaling potential for extended gains. A subsequent navy blue wave 4 correction is expected after this leg completes. The wave outlook remains valid as long as price stays above 1339.