Stocks advanced again but uncertainty lingers

Will S&P 500 continue higher despite mixed economic data and cautious guidance from tech giants?

The S&P 500 gained 0.63% on Thursday, extending its uptrend after Microsoft and Meta impressive earnings released on Wednesday. The market advanced despite weak economic data suggesting recession concerns following recent trade policy shifts.

This morning, improved jobs data has provided additional support, with Nonfarm Payrolls coming in at +177,000 vs. expected +138,000. The S&P 500 is expected to open 0.7% higher despite yesterday’s after-hours pullback following earnings releases from Amazon and Apple.

The investor sentiment has further worsened, as shown in the Wednesday’s AAII Investor Sentiment Survey, which reported that only 20.9% of individual investors are bullish, while 59.3% are bearish.

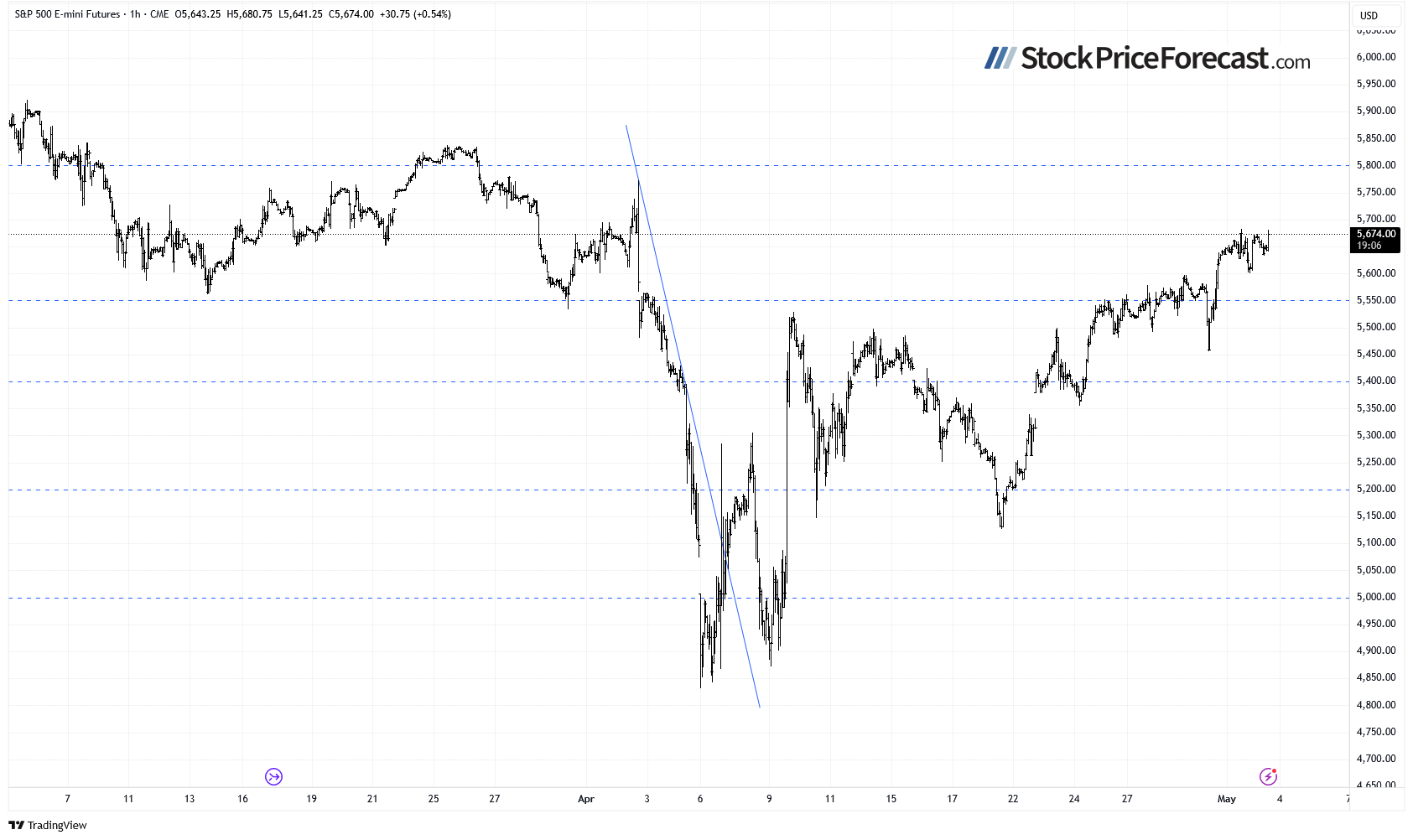

The S&P 500 broke above the 5,600 level, as we can see on the daily chart.

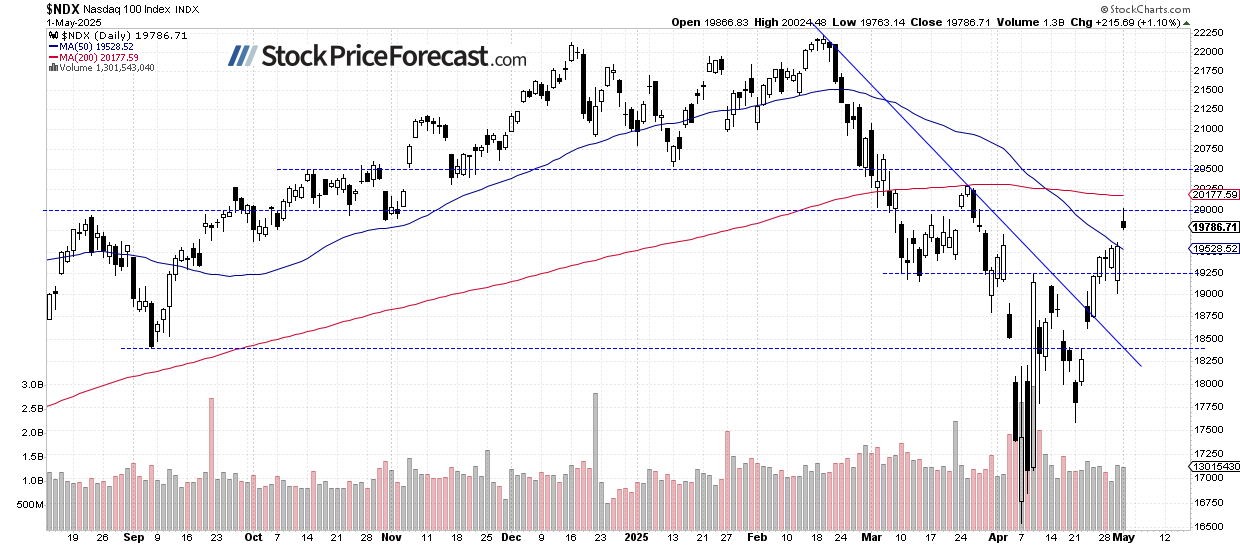

Nasdaq 100 neared 20,000

Yesterday, the tech-heavy Nasdaq 100 closed 1.10% higher but pulled back from the 20,000 level. It remains the nearest resistance. Today, this index is expected to open 0.8% higher following jobs data, however, a pullback in Apple stock could be weighing negatively on the tech sector.

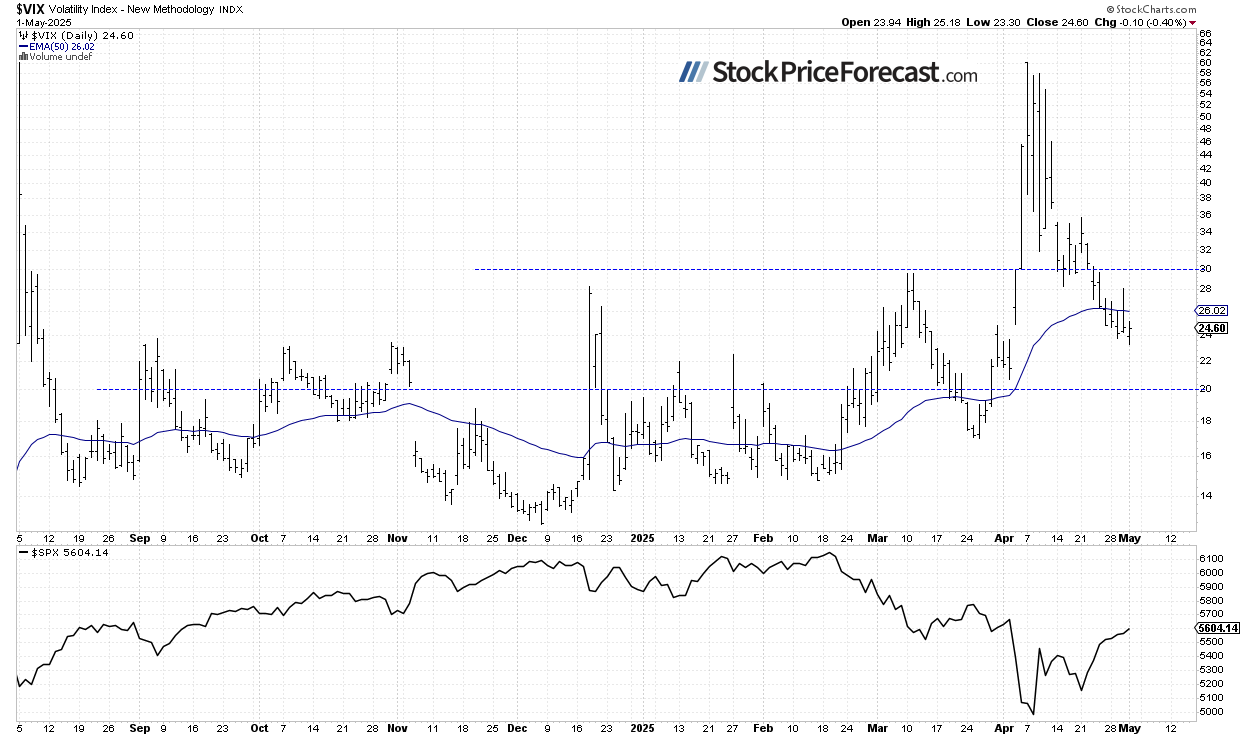

VIX: Lower again

The VIX has been stabilizing at lower levels, suggesting growing investor confidence despite concerns about trade policies and economic growth. Yesterday, the VIX reached as low as 23.30.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Rallying after earnings

This morning, the S&P 500 futures contract is trading along its local highs, retracing its overnight weakness and gaining 0.7%. Resistance level is around the 5,700 mark, while support remains at 5,600.

Conclusion

The S&P 500 is expected to extend its gains following corporate earnings, positive developments in U.S.-China trade relations, and today’s better-than-expected jobs report.

Last week, the market advanced on several positive catalysts, including easing tariff fears, potential peace developments in Ukraine, and anticipated quarterly earnings releases. That said, it remains uncertain whether this is a new uptrend or still merely a correction within the downtrend.

Here’s the breakdown:

S&P 500 gained 0.63% on Thursday, extending its uptrend after Microsoft and Meta earnings on Wednesday.

Market advanced despite weak economic data suggesting a recession following trade policy shift.

Yesterday after the session close, Amazon and Apple released their quarterly earnings; Apple stock is expected to open 3% lower.

With earnings season mainly over, market focus shifts to upcoming economic data and Fed policy decisions.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!