The Anatomy of a Flash Crash, Modeled to the Millisecond

Table of Links

Abstract, Acknowledgements, and Statements and Declarations

-

Introduction

-

Background and Related Work

2.1 Agent-based Financial Market simulation

2.2 Flash Crash Episodes

-

Model Structure and 3.1 Model Set-up

3.2 Common Trader Behaviours

3.3 Fundamental Trader (FT)

3.4 Momentum Trader (MT)

3.5 Noise Trader (NT)

3.6 Market Maker (MM)

3.7 Simulation Dynamics

-

Model Calibration and Validation and 4.1 Calibration Target: Data and Stylised Facts for Realistic Simulation

4.2 Calibration Workflow and Results

4.3 Model Validation

-

2010 Flash Crash Scenarios and 5.1 Simulating Historical Flash Crash

5.2 Flash Crash Under Different Conditions

-

Mini Flash Crash Scenarios and 6.1 Introduction of Spiking Trader (ST)

6.2 Mini Flash Crash Analysis

6.3 Conditions for Mini Flash Crash Scenarios

-

Conclusion and Future Work

7.1 Summary of Achievements

7.2 Future Works

References and Appendices

7 Conclusion and Future Work

7.1 Summary of Achievements

A novel high-frequency agent-based financial market simulator is implemented to generate a realistic high-frequency simulated financial market. Each simulation step corresponds to 100 milliseconds in the real-world trading environment. Full exchange protocols (limit order books) are implemented to simulate the order matching process. In this way, we provide a microstructure model of a single security traded on a central limit order book in which market participants follow fixed behavioural rules. The model is calibrated using the machine learning surrogate modelling approach. Statistical test and moment coverage ratio results show that the simulation is capable of reproducing realistic stylised facts in financial markets.

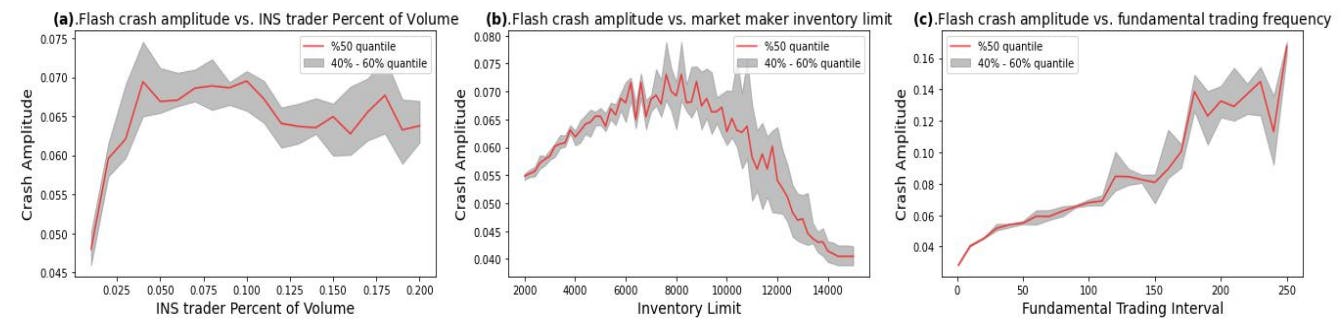

The simulator is then employed to explore the dynamics during flash crash episodes and the conditions that affect flash crash episodes. Under the framework of the proposed high-frequency agent-based financial market simulator, the 2010 Flash Crash is realistically simulated by introducing an institutional trader that mimics the real-world Sell Algorithm on May 6th, 2010. We investigate the market dynamics during the simulated flash crash and show that the simulated dynamics are consistent with what happened in historical flash crash scenarios. We then explore the conditions that could influence the characteristics of the 2010 Flash Crash. It is found that three conditions significantly affect the amplitude of the 2010 Flash Crash: the percentage of volume of the Sell Algorithm, market maker inventory limit, and the trading frequency of fundamental traders. In particular, we found that the relationship between the amplitude of the simulated 2010 Flash Crash and the POV of the Sell Algorithm is not monotonous, and so is the relationship between the amplitude and the market maker inventory limit. For the trading frequency of fundamental traders, the higher the frequency, the smaller the amplitude of the simulated 2010 Flash Crash.

Similar analysis is carried out for mini flash crash events. An innovative type of trader called “Spiking Trader” is introduced to the agent-based financial market simulator, creating more price shock and precipitating more mini flash crash events. Market dynamics for a typical simulated mini flash crash event are analysed. We also explore the conditions that could influence the characteristics of mini flash crash events. Experimental results show that market maker inventory limit significantly affects both the frequency and amplitude of mini flash crash events. However, the trading frequency of fundamental traders shows no obvious influence on mini flash crash events in our experiments.

7.2 Future Work

During the 2010 Flash Crash, there are lots of cross-market arbitrageurs who transferred the selling pressure to the equities markets by opportunistically buying E-Mini contracts and simultaneously selling products like SPY. This cross-market mechanism has not yet been implemented in our agent-based modelling framework. One future direction is to implement simulated markets for two correlated securities and explore the contagion during stressed scenarios. Another extension is to use the proposed agent-based financial market simulation framework for examining how regulatory policy interventions could influence the current market dynamics. For example, whether a circuit breaker in the market would help stabilize financial markets and curb the severity of flash crash scenarios. Last but not the least, an examination of possible indicators of an imminent flash crash event is another interesting future extension of this work.

References

Borkovec, M., Domowitz, I., Serbin, V., and Yegerman, H. (2010). Liquidity and price discovery in exchange-traded funds: One of several possible lessons from the flash crash. The Journal of Index Investing, 1(2):24–42.

Byron, M. Y., Shenoy, K. V., and Sahani, M. (2004). Derivation of kalman filtering and smoothing equations. In Technical report. Stanford University.

Chiarella, C. (1992). The dynamics of speculative behaviour. Annals of operations research, 37(1):101–123.

Cont, R. (2007). Volatility clustering in financial markets: Empirical facts and agent-based models. In Long memory in economics, pages 289–309. Springer.

Darley, V. and Outkin, A. (2007). A NASDAQ market simulation: insights on a major market from the science of complex adaptive systems, volume 1. World Scientific.

Franke, R. and Westerhoff, F. (2012). Structural stochastic volatility in asset pricing dynamics: Estimation and model contest. Journal of Economic Dynamics and Control, 36(8):1193–1211.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of political economy, 101(1):119–137.

Golub, A., Keane, J., and Poon, S. (2012). High frequency trading and mini flash crashes. Available at SSRN 2182097.

Hayes, R., Todd, A., Chaidarun, N., Tepsuporn, S., Beling, P., and Scherer, W. (2014). An agent-based financial simulation for use by researchers. In Proceedings of the Winter Simulation Conference 2014, pages 300–309.

Hill, J. B. (2010). On tail index estimation for dependent, heterogeneous data. Econometric Theory, 26(5):1398–1436.

Johnson, N., Zhao, G., Hunsader, E., Meng, J., Ravindar, A., Carran, S., and Tivnan, B. (2012). Financial black swans driven by ultrafast machine ecology. arXiv preprint arXiv:1202.1448.

Karvik, G., Noss, J., Worlidge, J., and Beale, D. (2018). The deeds of speed: an agent-based model of market liquidity and flash episodes. Bank of England Working Paper.

Kirilenko, A., Kyle, A. S., Samadi, M., and Tuzun, T. (2017). The flash crash: High-frequency trading in an electronic market. The Journal of Finance, 72(3):967–998.

Kyle, A. S. and Obižaeva, A. (2020). Large bets and stock market crashes. CEFIR.

Lamperti, F., Roventini, A., and Sani, A. (2018). Agent-based model calibration using machine learning surrogates. Journal of Economic Dynamics and Control, 90:366–389.

LeBaron, B. (2001). A builder’s guide to agent-based financial markets. Quantitative finance, 1:254–261.

Madhavan, A. (2012). Exchange-traded funds, market structure, and the flash crash. Financial Analysts Journal, 68(4):20–35.

Majewski, A., Ciliberti, S., and Bouchaud, J. P. (2020). Co-existence of trend and value in financial markets: Estimating an extended chiarella model. Journal of Economic Dynamics and Control, 112:103791.

McGroarty, F., Booth, A., Gerding, E., and Chinthalapati, V. R. (2019). High frequency trading strategies, market fragility and price spikes: An agent based model perspective. Annals of Operations Research, 282(1):217–244.

Menkveld, A. (2013). High frequency trading and the new market makers. Journal of financial Markets, 16(4):712–740.

Menkveld, A. and Yueshen, B. Z. (2019). The flash crash: A cautionary tale about highly fragmented markets. Management Science, 65(10):4470–4488.

O’Hara, M. (1995). Market Microstructure Theory. Wiley.

Paddrik, M., Hayes, R., Scherer, W., and Beling, P. (2017). Effects of limit order book information level on market stability metrics. Journal of Economic Interaction and Coordination, 12(2):221–247.

Paddrik, M., Hayes, R., Todd, A., Yang, S., Beling, P., and Scherer, W. (2012). An agent based model of the e-mini s&p 500 applied to flash crash analysis. In 2012 IEEE Conference on Computational Intelligence for Financial Engineering and Economics (CIFEr), pages 1–8.

Paulin, J., Calinescu, A., and Wooldridge, M. (2019). Understanding flash crash contagion and systemic risk: A micro–macro agent-based approach. Journal of Economic Dynamics and Control, 100:200–229.

Ralaivola, L. and d’Alche Buc, F. (2005). Time series filtering, smoothing and learning using the kernel kalman filter. Proceedings of 2005 IEEE International Joint Conference on Neural Networks, 3:1449–1454.

SEC and CFTC (2010). Findings regarding the market events of may 6, 2010. Washington DC.

Sewell, M. (2011). Characterization of financial time series. Research Note, 11(01):01.

Todd, A., Beling, P., Scherer, W., and Yang, S. Y. (2016). Agent-based financial markets: A review of the methodology and domain. In 2016 IEEE Symposium Series on Computational Intelligence (SSCI), pages 1–5.

Virtanen, P., Gommers, R., Oliphant, T. E., Haberland, M., Reddy, T., Cournapeau, D., Burovski, E., Peterson, P., Weckesser, W., Bright, J., van der Walt, S. J., Brett, M., Wilson, J., Millman, K. J., Mayorov, N., Nelson, A. R. J., Jones, E., Kern, R., Larson, E., Carey, C. J., Polat, ˙I., Feng, Y., Moore, E. W., VanderPlas, J., Laxalde, D., Perktold, J., Cimrman, R., Henriksen, I., Quintero, E. A., Harris, C. R., Archibald, A. M., Ribeiro, A. H., Pedregosa, F., van Mulbregt, P., and SciPy 1.0 Contributors (2020). SciPy 1.0: Fundamental Algorithms for Scientific Computing in Python. Nature Methods, 17:261–272.

Appendices

A Descriptions for All Model Parameters

B Values for Fixed Model Parameters in Calibration

C Values for Model Parameters in 2010 Flash Crash Simulation

Authors:

(1) Kang Gao, Department of Computing, Imperial College London, London SW7 2AZ, UK and Simudyne Limited, London EC3V 9DS, UK ([email protected]);

(2) Perukrishnen Vytelingum, Simudyne Limited, London EC3V 9DS, UK;

(3) Stephen Weston, Department of Computing, Imperial College London, London SW7 2AZ, UK;

(4) Wayne Luk, Department of Computing, Imperial College London, London SW7 2AZ, UK;

(5) Ce Guo, Department of Computing, Imperial College London, London SW7 2AZ, UK.