Tom Lee’s ETH Treasury Firm BitMine Gives Stunning Ethereum Price Prediction

Legendary Wall Street investor Tom Lee’s ETH treasury firm BitMine has revealed its own Ethereum price prediction.

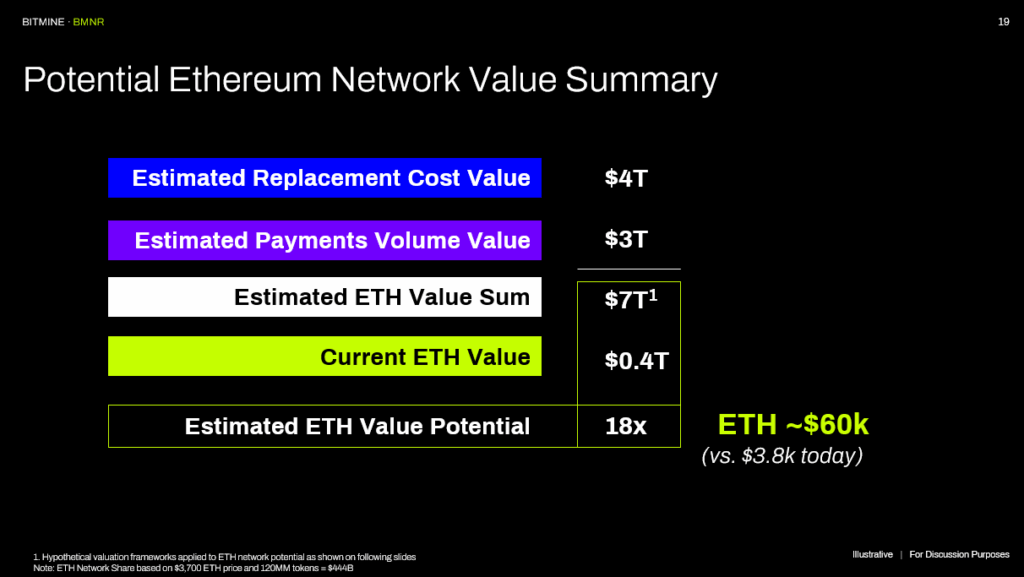

In a series of X posts, BitMine revealed that it consulted multiple research firms to estimate Ethereum’s “replacement” value, i.e. the cost of replicating what ETH does in traditional finance.

Their findings suggest Ethereum’s network could be worth $7 trillion, considering its role in global financial infrastructure and payments, implying that the ETH price could potentially hit $60,000.

With ETH currently trading at $3,850, BitMine’s valuation model points to a potential 15.5x surge in price in the years ahead.

Last week, Tom Lee had revealed his own Ethereum price forecast, projecting the second-largest cryptocurrency to peak between $10,000 and $15,000 this year.

BitMine’s Ethereum Price Prediction: Is $60,000 A Realistic Price Target?

BitMine, a Bitcoin mining firm, announced its Ethereum treasury strategy under the chairmanship of Fundstrat CEO Tom Lee.

Tom Lee was one of the first major Wall Street investors to embrace crypto. Notably, he recommended a 2% allocation into Bitcoin back in 2019, when it was trading at just $5,000. While the recommendation was called “crazy” by one of the CNBC hosts, it has aged remarkably well as Bitcoin has surged more than twenty-fourfold since.

The Fundstrat CEO is now equally bullish on Ethereum. Under his leadership, BitMine has become the largest corporate holder of Ethereum in just over a month, currently holding over $2 billion worth of ETH.

Notably, BitMine is targeting to purchase and stake 5% of the total Ethereum supply.

In its latest X post, called “The Alchemy of The 5%”, BitMine has called ETH “the biggest macro trade of the next decade”.

Tom Lee has long highlighted Ethereum’s key role in the ongoing stablecoin and tokenization movements.

He has repeatedly claimed that stablecoins are the crypto industry’s ChatGPT movement, while also pointing out that 60% of the total stablecoin supply is on Ethereum.

Meanwhile, Wall Street continues to tokenize assets on the network as well.

BitMine asked several research firms to estimate Ethereum’s replacement value, which is the total cost of replicating the infrastructure and utility that the Ethereum network aims to provide.

BitMine estimates Ethereum’s replacement cost at $4 trillion and its projected payments volume value at $3 trillion, bringing the total network valuation to $7 trillion, an 18x multiple over its current $400 billion market cap.

Similarly, the company projects that the Ethereum price could hit $60,000 in the coming years, which is over fifteenfold growth over its current $3,850 price.

This indicates that Ethereum will continue to be an excellent investment in the long term, especially for spot buyers. It also bodes well for beta bets like meme coin, considering they have a strong correlation with ETH.

Ethereum Meme Coins In High Demand As Well

Ethereum meme coins are in high demand. Large caps like Pepe and Floki are excellent beta bets on ETH, with experts projecting that PEPE will hit a $20 billion market cap this year alone.

Smart money investors aren’t sleeping on low-cap meme coins either. For instance, TOKEN6900 has caught the attention of prominent crypto influencers, with many calling it the next 100x crypto.

As the name suggests, TOKEN6900 is an Ethereum-based, small-cap alternative to the popular Solana meme coin, SPX6900.

Much like SPX, the project embraces a no-utility, meme-first identity, deliberately distancing itself from the wave of AI or DeFi-integrated tokens. Instead, it focuses on internet culture, 2000s nostalgia, and the idea of community-driven value.

Like Dogecoin, Pepe and Fartcoin, it values community support over deceptively trying to sell itself on utility and fundamentals.

Unsurprisingly, $T6900 is in high demand, having already raised nearly $1.5 million in its presale. In fact, its ICO has a $5 million hard cap, so over 25% of the entire presale is already sold out.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware that our commercial partners may use affiliate programs to generate revenues through the links in this article.