Trump’s press access praised as media figures defend Biden’s absence

NEWYou can now listen to Fox News articles!

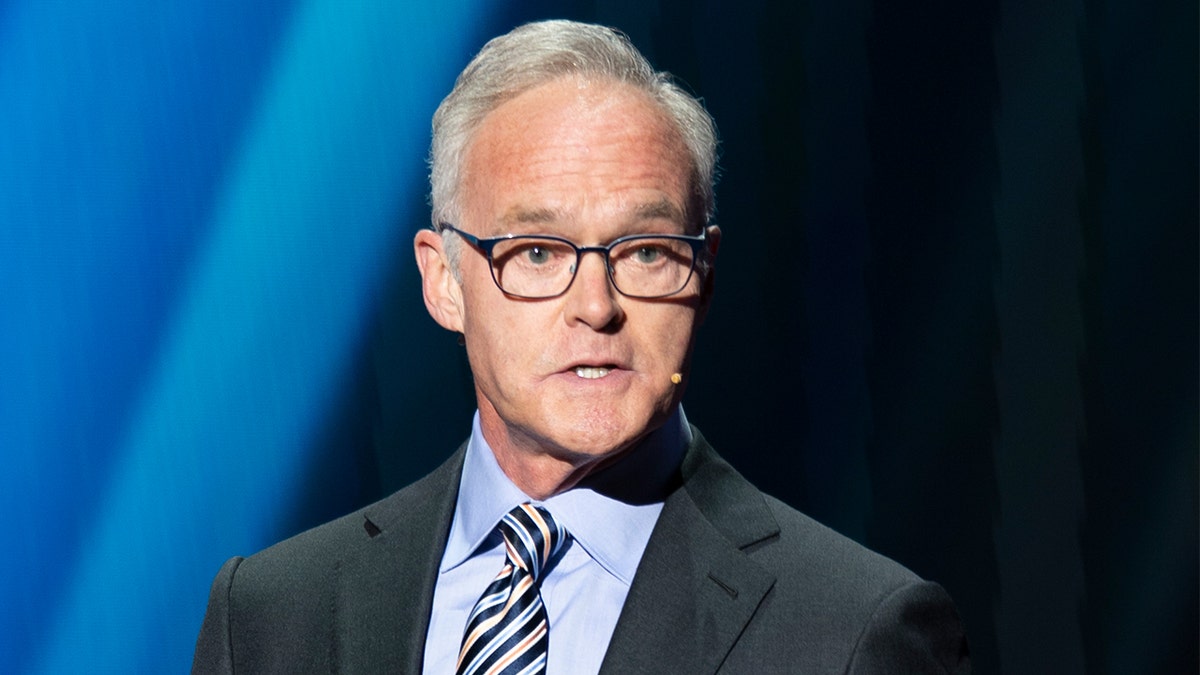

Jack Blanchard at Politico’s Playbook newsletter made the leftists angry by praising President Donald Trump’s energetic availability to the press. While CBS star Scott Pelley wailed at a college commencement that they are “the fierce defenders of democracy,” “the seekers of truth” and “the vanguard against ignorance,” Trump grants them access.

Blanchard wrote on May 28 that by lunchtime, “it will have been 48 hours since Donald Trump stepped in front of a TV camera for a speech or Q&A — the first time that’s happened (outside of the weekends) since he returned to the White House on Jan. 20. Whatever your politics, that’s a remarkable record of public availability, especially when compared to his famously sheltered predecessor.”

THE TRUMP ADMINISTRATION’S TOP MEDIA MOMENTS AND CLASHES OVER FIRST 100 DAYS

Former President Joe Biden was hidden away from the press for four years, and this never drew angry commencement speeches — because Scott Pelley was eager to please Team Biden, which allowed him to join the other privileged Biden softball-throwers like Drew Barrymore and Ryan Seacrest. He didn’t seem to grasp how they make him look by association.

U.S. President Donald Trump, joined by Tesla CEO Elon Musk, speaks to reporters in the Oval Office of the White House on May 30, 2025 in Washington, DC. (Kevin Dietsch/Getty Images)

Blanchard infuriated the Biden boosters by arguing “the Joe Biden experience shows just how important it is that leaders are held up to regular scrutiny. Trump’s answers may sometimes be rambling, erratic — or even downright unpleasant — but every American voter can see where he’s at.”

This is where the Pelleys scream, “But he lies! All the lies!” They will try to sully all this acceptance of hostile questions by disparaging all the answers as dangerous blather.

Brian Stelter, and Oliver Darcy, and their partisan squad adored Pelley’s lecture, but ignored what Blanchard pointed out. They should just deal with his count: “A quick trawl through the archives suggests Trump 2.0 has done media on 111 of his 138 days back in office — an 80 percent hit rate that includes weekends and must put him on course to being just about the most-accessible president in modern history.”

“60 Minutes” correspondent Scott Pelley accused President Trump of creating a culture of fear and censorship in the U.S. during a recent commencement speech at Wake Forest University. (David M. Russell/CBS via Getty Images)

When Trump accepts a hostile interview on NBC’s “Meet the Press,” it’s actually used by NBC to congratulate itself. Incoming “Nightly News” anchor Tom Llamas told an interviewer he accepted this battle “because he knows he’s going to get a fair shake. It’s because Kristen Welker has done a masterful job of helping Americans get information and being fair with President Trump.”

CLICK HERE FOR MORE FOX NEWS OPINION

Trump was sparring with Welker in real time, telling her it was unfair to raise the prospect of empty store shelves in the midst of his global trade disputes. “This is such a dishonest interview already,” he said. But he accepted it. How many times did Biden appear on “Meet the Press”? None, but nobody cares.

NBC’s Krister Welker, the host of “Meet the Press,” has sparred with Trump and most of her Republican guests. (Screenshot/NBC)

They would rather fuss about Trump fighting back against the press by his lawsuits and threats of regulatory scrutiny at the FCC. None of these arrogant media partisans grasp that they boosted every ounce of regulatory scrutiny and lawsuits and lawfare against Trump over the last eight years. Every Trump-trashing tactic they support is automatically defined as “democracy” and “truth-seeking.”

CLICK HERE TO GET THE FOX NEWS APP

They define “independence” and “freedom of the press” as the freedom to smear Trump as a criminal or as Hitler, and any attempt to respond in kind is described as nasty pages in the “authoritarian playbook.” Then they wonder why no one outside their reinforced leftist bubble trusts them as actually objective or nonpartisan.

CLICK HERE TO READ MORE FROM TIM GRAHAM