What Happens When You Swap 1 Million Euros in CBDCs?

Table of Links

Abstract and 1. Introduction

-

Background

2.1 Layer-2 Blockchains

2.2 Project Mariana

-

Related Work and Contribution

-

System Architecture

-

Model

5.1 Automated Market Makers

5.2 Price Impact

-

Simulation

6.1 Data and Parameters

6.2 Results

-

Discussion

-

Conclusions, Acknowledgements, and References

Graphs and Tables

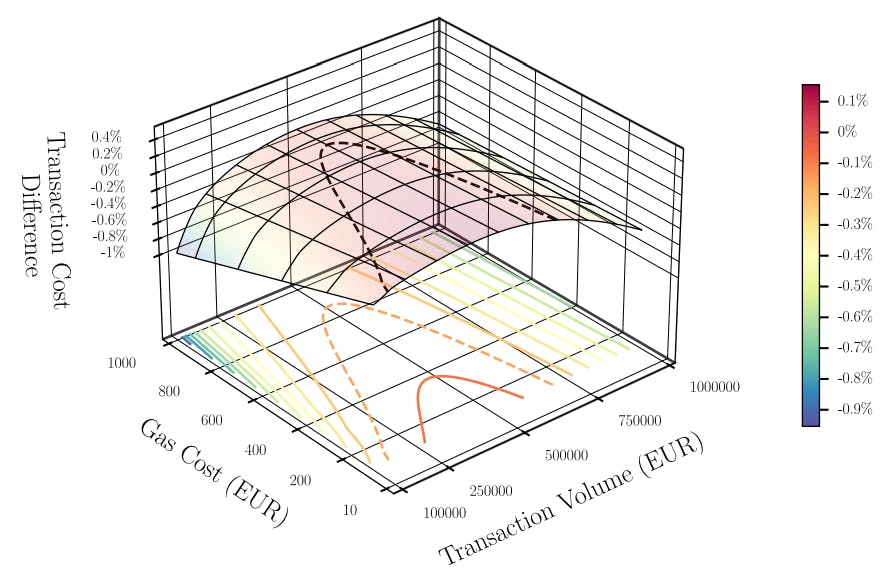

6 Simulation

To ensure comparability with L1-Mariana , we consider three CBDCs: Swiss Franc (CHF), Euro (EUR), and Singaporean Dollar (SGD) and back-test the total costs of CBDCs swaps in L1-Mariana and L2-L3-Exchange systems. We consider the buy transaction of EUR for CHF for volumes ranging from 1 EUR to 1mn EUR. The price impact for CLMMs are calculated based on Eq. 8, and the Newton-Raphson method is applied for Cryptoswap Invariants, both for n = 2 and n = 3. The implementation of all methods is available in a public GitHub repository [17] and was based on the smart contract code of Curve v2.

6.1 Data and Parameters

The analysis uses the historical exchange rates of CHF-EUR and CHF-SGD for the last three years (daily closing values from Yahoo Finance). We assume that arbitrageurs maintain prices aligned between CBDCs in AMMs and the FX market, which allows us to calculate the historical AMM pools’ compositions based on these FX rates.

Liquidity pools. We assume 100mn CHF is provided to each system for liquidity provisions. As L1-Mariana operates Cryptoswap Invariant with one 3-token pool CHF-EUR-SGD, the pool’s value is 100mn CHF. In L2-L3-Exchange, we consider three L3 operators, each running AMM-DEX setup. The 100mn CHF liquidity is equally divided among the L3 operators. The first L3 operator uses a Cryptoswap Invariant with CHF-EUR-SGD pool (like in L1-Mariana), and the pool is valued 100/3 mn CHF. The second L3 also employs Cryptoswap Invariant, but with two 2-token pools: CHF-EUR and CHF-SGD, each valued 100/6 mn CHF. The third L3 operator utilizes CLMM with CHF-EUR and CHF-SGD pools, each valued 100/6 mn CHF. The L2-L3-Exchange pool architecture is illustrated in Fig. 7 in the appendix.

Swap fees. Each liquidity pool charges swap fee of 1bp (i.e., 0.0001) of transaction volume.

Gas costs. Gas fees for swaps on Ethereum, referred to in the Project Mariana, oscillated between 5 EUR and 50 EUR over the last three years [6]. The gas costs on L2s are, on average, 50 times lower compared to the underlying L1 [16], [32]. Based on these facts, we consider 15 EUR gas fees for a swap on L1 and 15EUR/50 on the L2-L3 network.

Authors:

(1) Krzysztof Gogol, University of Zurich ([email protected]);

(2) Johnnatan Messias, Matter Labs;

(3) Malte Schlosser, University of Zurich;

(4) Benjamin Kraner, University of Zurich;

(5) Claudio Tessone, University of Zurich.