What to Expect From Solana (SOL) in August?

Solana reasserted its dominance as one of the resilient large-cap altcoins, riding on the wave of July’s broader market rally. Closely tracking Bitcoin’s upward momentum, SOL surged past the $200 mark to hit a cycle high of $206.19 on July 22.

This price rally triggered a spike in on-chain activity across the Solana ecosystem, pushing up its DeFi total value locked (TVL), DEX trading volumes, and overall chain revenue. However, signs of exhaustion are starting to show. SOL has slipped back below the $190 threshold, facing selling pressure that suggests investors may be rotating out after locking in July’s gains.

SOL’s Rally Powers Network Surge—But Can the Momentum Hold in August?

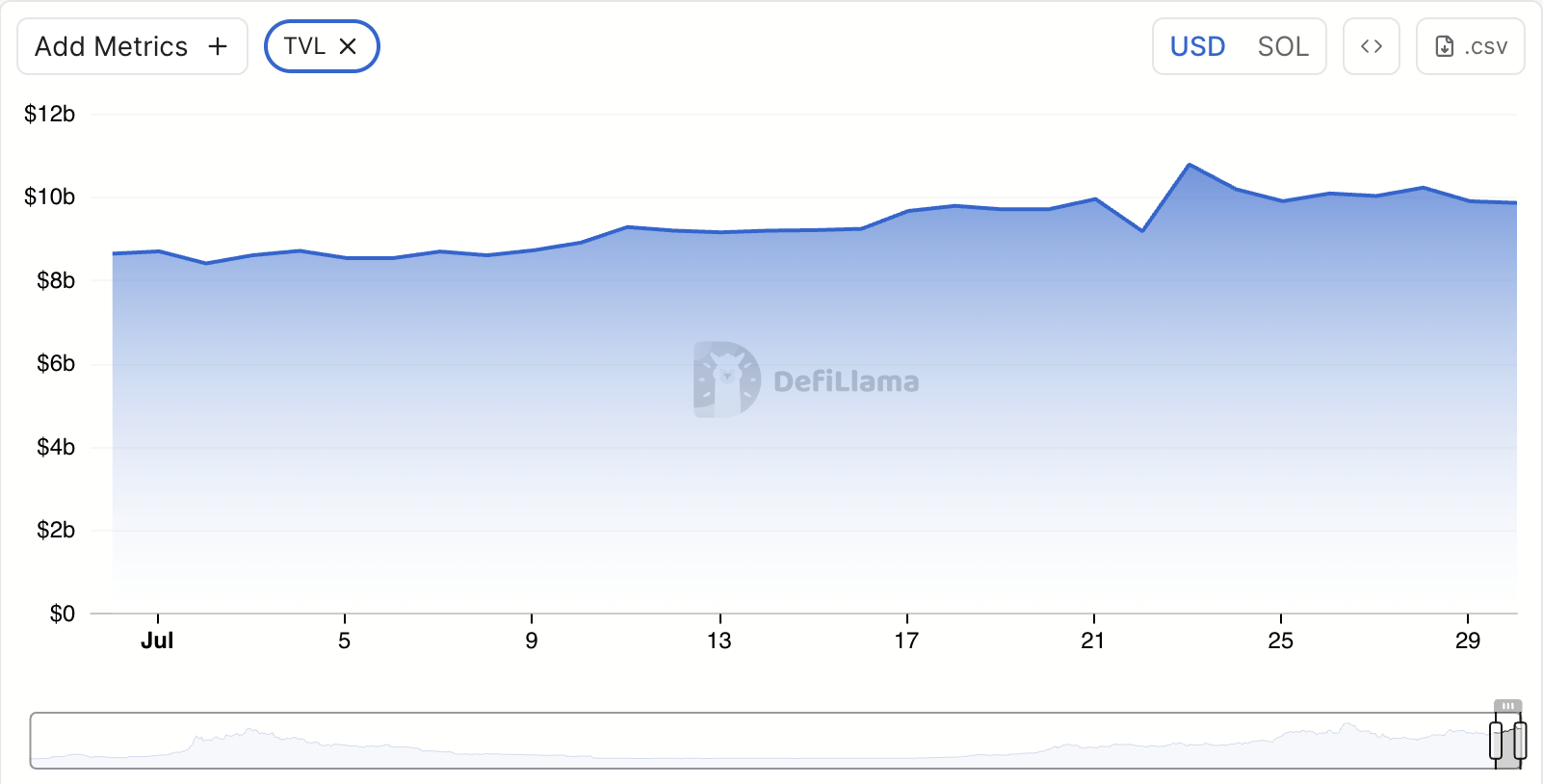

Between July 1 and July 22, SOL maintained a steady rally, pushing its value up by 40%. As SOL’s price surged, the on-chain value of tokens locked in lending pools and vaults across the Solana network rose, boosting the network’s TVL.

At press time, Solana’s TVL sits at $9.85 billion, a 14% increase over the past month.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

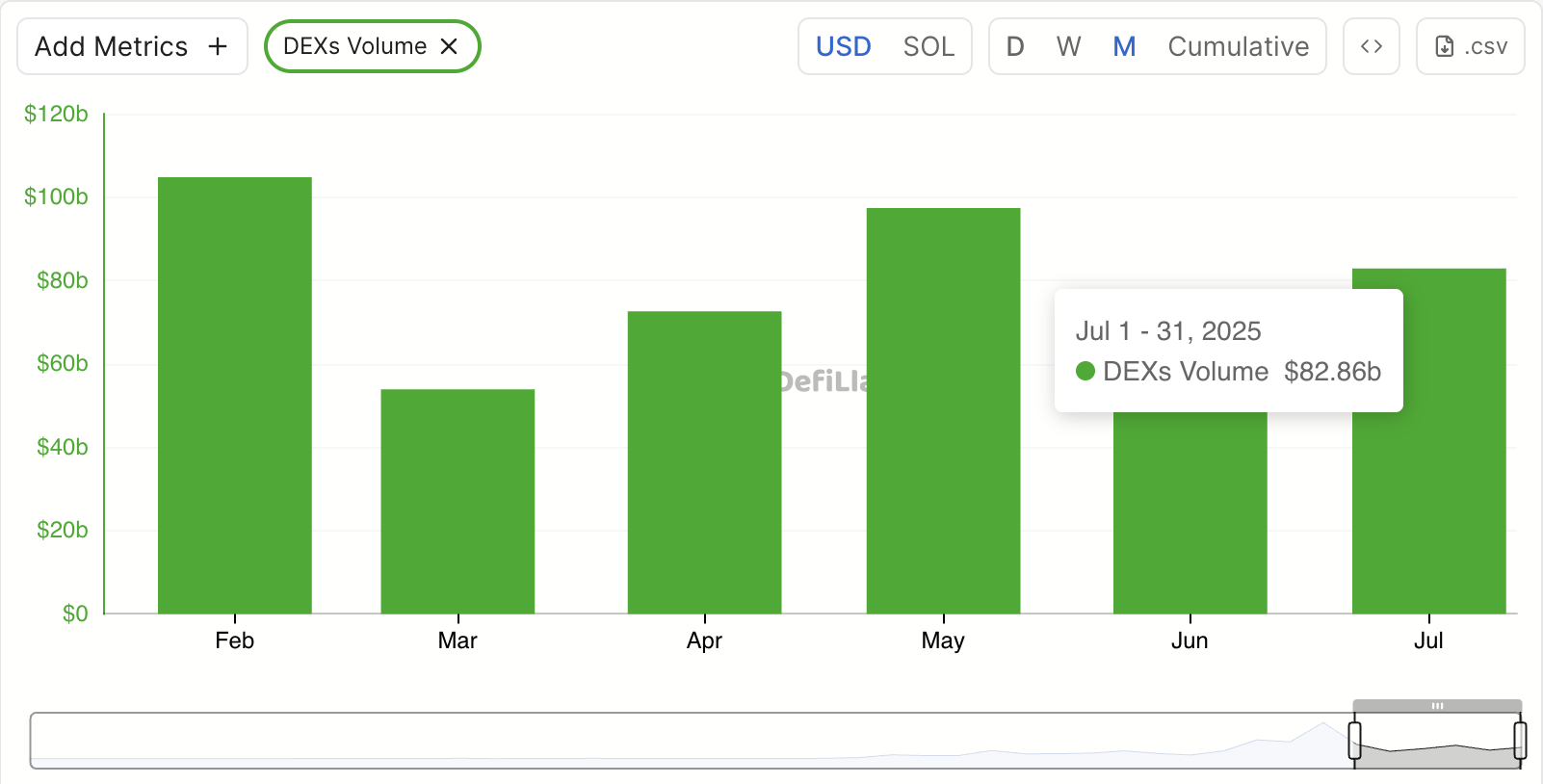

As demand for SOL climbed during that period, trading activity across DEXes on the network also climbed. Over the last 30 days, DEX volume has jumped by 30%, with trade volumes worth more than $82 billion recorded so far this month alone.

This spike in activity translated into higher network revenue. According to DefiLlama, Solana has generated $4.3 million in revenue since the beginning of July, marking a 13% increase from the $3.81 million recorded in June.

Solana’s Ecosystem Cools as Price Dips and User Activity Shrinks

However, as we approach August, momentum is fading on the Solana network. At press time, SOL has dipped to around $180, and signs of weakening demand across the network are emerging.

For example, the daily active address count on Solana has plummeted in the past seven days. According to Artemis, it has declined by 16% during that period.

A drop in a network’s daily active address count signals reduced user engagement and on-chain activity. Fewer active addresses reflect a slowdown in transactions, dApp usage, and overall demand for the network’s services.

In Solana’s case, the 16% decline suggests waning participation, which hints at a broader cooldown in network growth as the new trading month commences.

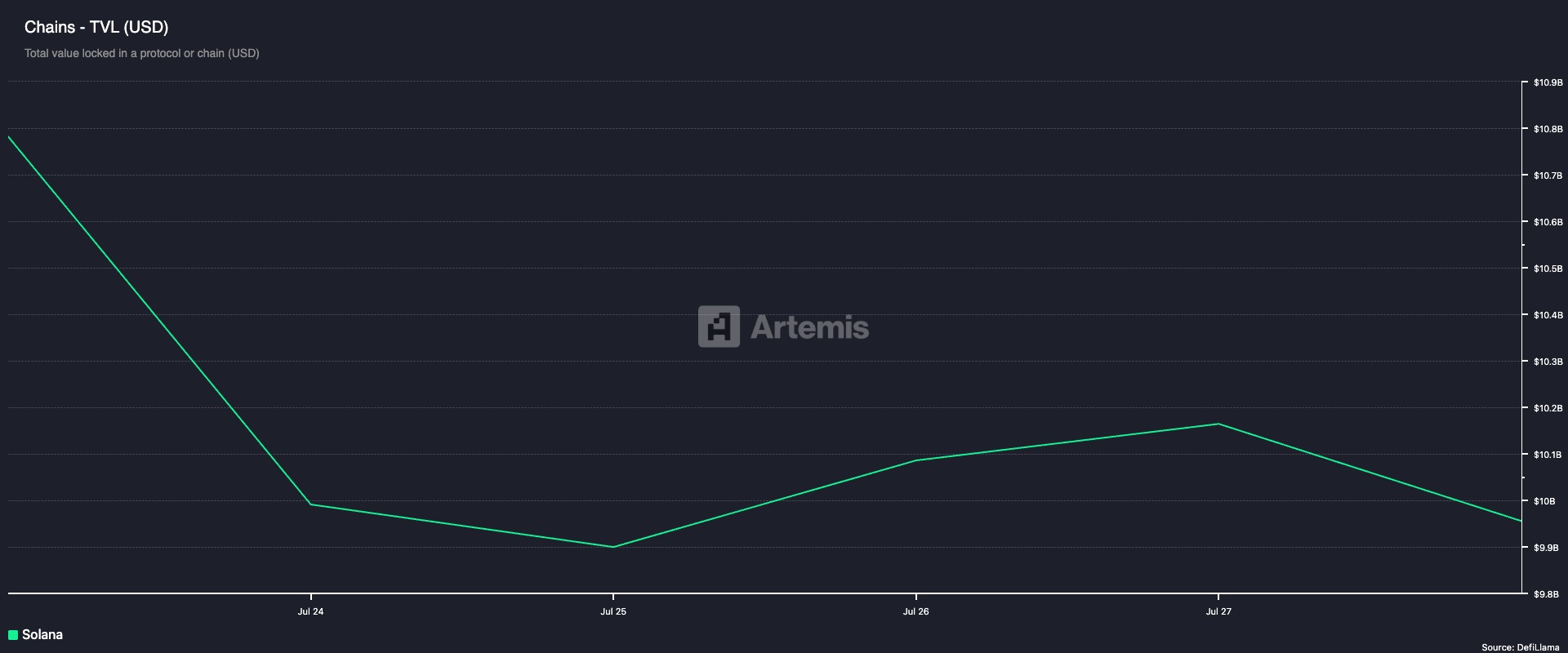

As activity across the network dips, Solana’s DeFi TVL has also begun to pull back. Over the past week, TVL has fallen by 8%.

This signals that users are either withdrawing assets from the DeFi protocols on the network or the value of those assets is declining due to market movements.

Solana Bears Circle as Price Nears Breakdown Point

SOL’s decline over the past few days has pushed its price dangerously close to its 20-day exponential moving average (EMA), which forms a critical dynamic support line at $178.25. For context, SOL currently trades at $180.51.

The 20-day EMA measures an asset’s average trading price over the past 20 trading days, giving more weight to recent prices. A decisive break below this level could potentially open the door for further downside, especially if accompanied by falling volume and network activity.

In this case, SOL’s price could fall to $171.78.

On the other hand, if market sentiment improves, this bearish outlook will be invalidated. In that scenario, the coin’s price could rally to $186.40. A successful breach of this level could propel the coin toward $190.47.

The post What to Expect From Solana (SOL) in August? appeared first on BeInCrypto.