Why Bitcoin Miners Are Winning Right Now

Bitcoin’s mining difficulty surged to an all-time high of 127.6 trillion in August 2025. The move reflects a continued expansion of global computational power, securing the network.

However, despite the increased technical challenge, miner profitability is quietly climbing, a rare dynamic analysts say could signal a new phase in the Bitcoin (BTC) market cycle.

Bitcoin Mining Difficulty Hits Record High

The next mining difficulty adjustment, expected on August 9, is projected to lower the metric slightly to around 124.71 trillion.

This adjustment aims to bring the average block time back to the 10-minute target, down from the current 10 minutes and 23 seconds.

These periodic recalibrations are fundamental to Bitcoin’s design. They maintain consistent issuance and network stability despite fluctuations in hash rate.

The anomaly, however, is that higher Bitcoin mining difficulty has not translated into squeezed margins for miners.

Quite the opposite, network data showing miner revenues have reached a post-halving peak of $52.63 million per exahash daily.

“Bitcoin Miners Revenue Per Day is at a current level of 52.63M, down from 56.35M yesterday and up from 25.64M one year ago. This is a change of -6.61% from yesterday and 105.3% from one year ago,” analysts at ychart.com indicated.

This is a strong signal, considering rising energy costs and an increasingly competitive mining playing field.

In a recent post, Blockware Intelligence, a Bitcoin mining analytics firm, highlighted this divergence.

“The bull case for Bitcoin mining? BTC/USD increasing faster than mining difficulty. Over the past 12 months: > BTC/USD +75% > Mining Difficulty: +53%. Profit margins for Bitcoin miners are increasing,” the firm stated in a recent post.

Rising Profit Margins Signal Bullish Shift

Historically, such a dynamic, where the Bitcoin price rises faster than mining difficulty, has occurred during the early stages of bullish market cycles. Similar patterns were observed in 2016 and again in mid-2020, which preceded major price rallies.

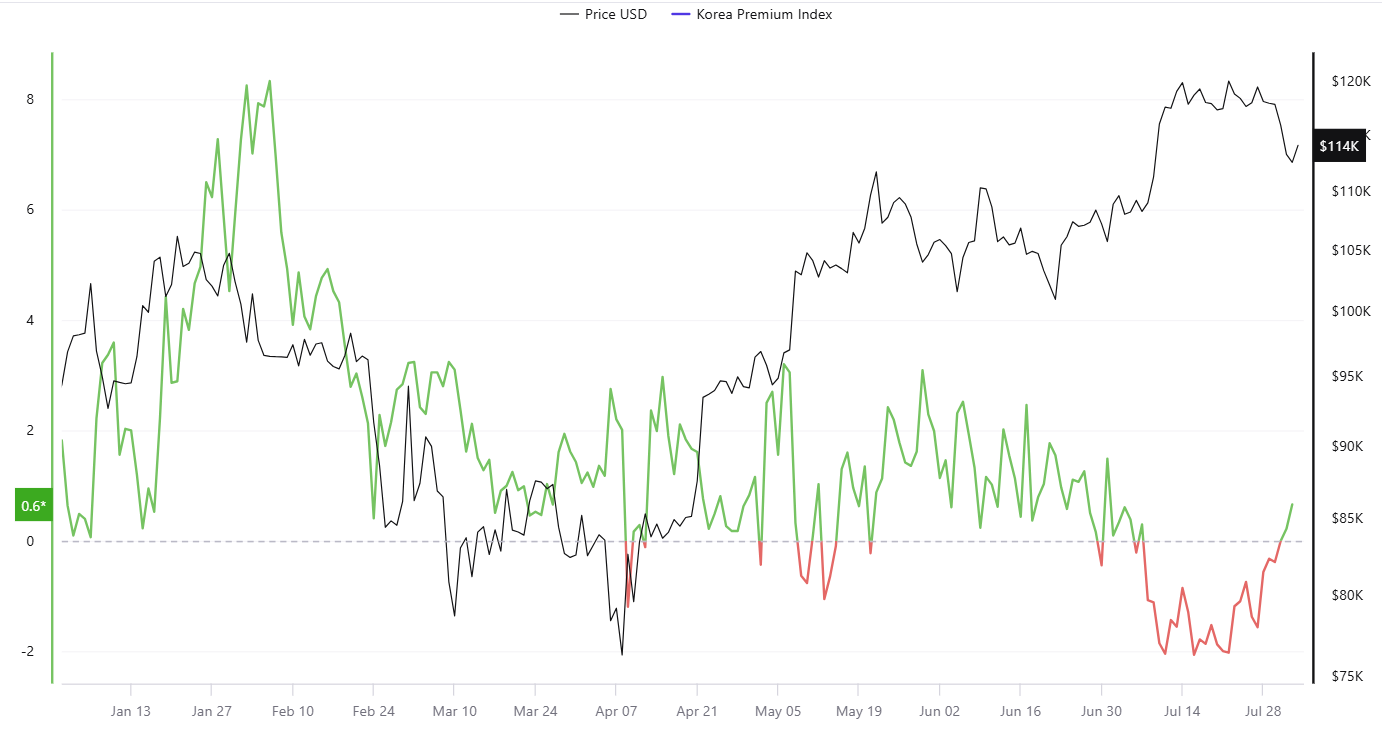

The growing profitability also reflects deeper demand dynamics, with data showing the current Kimchi premium in South Korea stands at +0.6%. Notably, this indicates a strong regional appetite for BTC.

Kimchi premium represents the price difference between local exchanges and global spot markets.

That, paired with the deployment of more efficient ASIC machines and rising institutional mining investments, suggests the mining sector is both healthy and optimistic about Bitcoin’s medium-term trajectory.

Beyond miner margins, Bitcoin’s scarcity narrative remains intact. With over 94% of the total 21 million BTC already mined, the pioneer crypto’s stock-to-flow ratio now stands at approximately 120, double that of gold.

This long-term scarcity positions Bitcoin as a hedge against inflation and monetary debasement, even as short-term price action remains subdued.

Still, the broader market has yet to price in the network’s improving fundamentals. After the July highs, Bitcoin retraced to levels below $115,000, signaling a temporary decoupling between on-chain technical health and investor sentiment.

Analysts attribute this disconnect to macroeconomic headwinds, trade policies, and shifting capital flows. Meanwhile, miners appear to be front-running the rest of the market.

The combination of rising difficulty, increasing margins, and strong regional demand could mark a turning point in mining economics and Bitcoin’s broader cycle. If history rhymes, the network’s growing strength may soon echo in price.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.