Why Is the Crypto Market Up Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) experienced a recovery in the last 24 hours after US President Donald Trump corrected the issue that caused the crash yesterday announcing a temporary pause on the 25% tariffs on Mexico. This positive shift also extended to altcoins, with Onyxcoin (XCN) rising by 25% during the same period.

In the news today:-

- MicroStrategy ended its 12-week streak of buying Bitcoin without selling shares or using proceeds for BTC purchases. Despite facing potential billions in taxes on unrealized gains, Michael Saylor offered little insight into the firm’s next steps amid Bitcoin’s volatility due to US tariffs and political instability.

- Utah is leading the effort to establish a Bitcoin reserve in the US, according to Satoshi Action Fund CEO Dennis Porter. The state’s short legislative calendar and an active digital asset task force are enabling swift action on the reserve, with plans advancing during both scheduled and unscheduled periods.

The Crypto Market Takes Back

The total crypto market cap has risen by $85 billion in the last 24 hours, currently standing at $3.27 trillion. This upward movement indicates an effort to reclaim the crucial support level of $3.28 trillion. If successful, it could signal a continued market recovery in the short term.

Securing $3.28 trillion as support would enable the market cap to continue its recovery, with the next key target being $3.49 trillion. Reclaiming this level would also support the 200-day EMA, offering further confidence to investors and fostering sustained positive momentum for the broader crypto market.

However, if the crypto market cap fails to hold $3.28 trillion as support, it could experience a pullback. A drop below this level may send the total crypto market cap back to $3.16 trillion, stalling the recovery and potentially signaling further losses.

Bitcoin Recovers Losses

Bitcoin’s price has risen to $100,930, holding above the key support of $100,000 after a 3.3% increase over the past day. This price movement suggests a short-term recovery, and the crypto king remains resilient despite broader market fluctuations, signaling the potential for further gains.

BTC has successfully reclaimed the 200-day EMA as support, now targeting $105,000. Breaking through this resistance level would bring Bitcoin closer to its all-time high of $109,588, a significant milestone for the cryptocurrency. Continued bullish momentum could lead to a potential rally towards these levels.

On the other hand, Bitcoin now faces the challenge of maintaining support at $100,000. If the price drops below this level, the bullish outlook may be invalidated, with BTC potentially falling to $95,668. The ability to sustain this support is crucial for continued upward momentum.

Onyxcoin is Doing Well

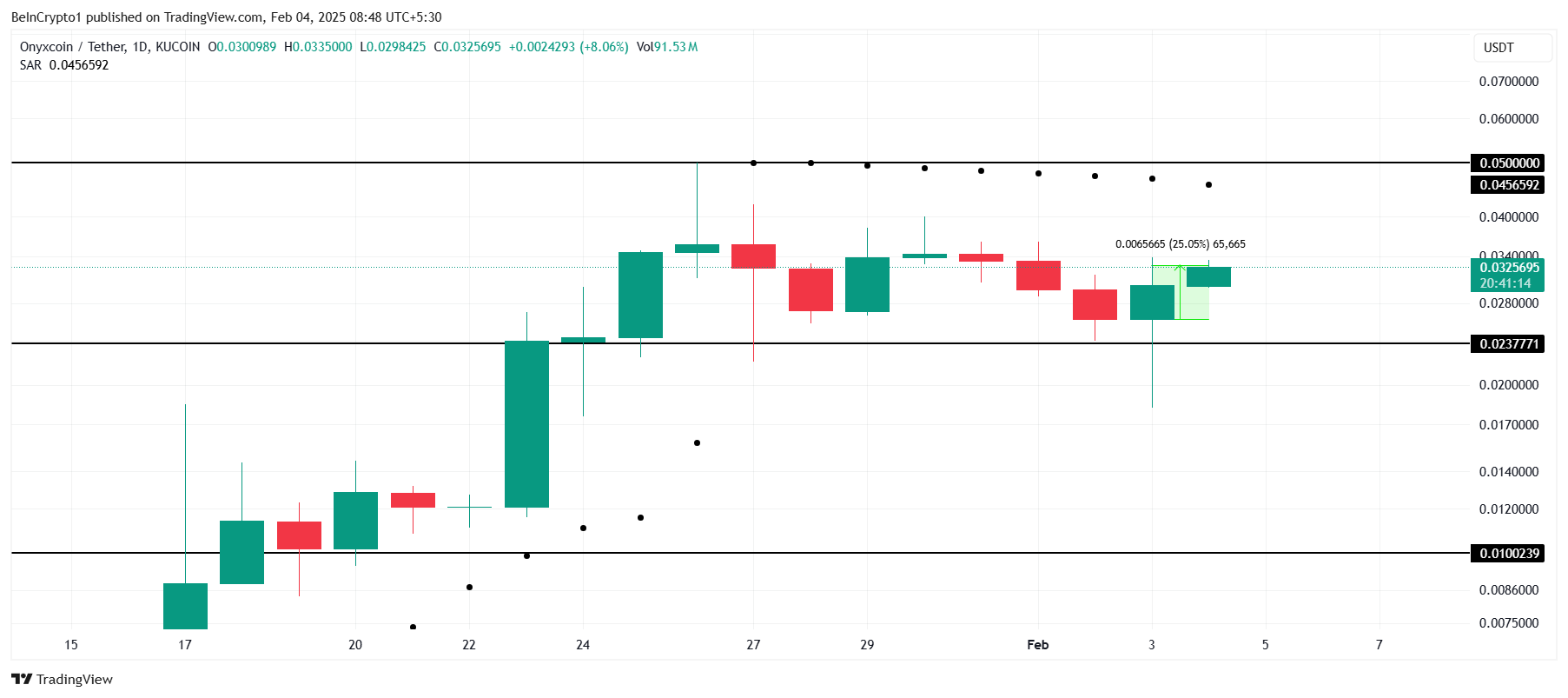

XCN price surged by 25% over the last 24 hours, becoming the best-performing altcoin of the day. Despite the broader market’s decline, XCN managed to hold above the crucial support of $0.0237, signaling resilience amid the market turmoil and offering a glimmer of hope for potential gains.

With the current momentum, XCN is eyeing further recovery, potentially breaking the resistance level of $0.0500. This could set the stage for a strong rally, provided the altcoin maintains its upward trajectory and investor confidence remains intact amid market uncertainty.

However, XCN faces challenges from broader market cues. The Parabolic SAR dots remain above the candlesticks, signaling bearish pressure. If the market continues its downward trend, XCN could fall back to $0.0237, and potentially breach it, invalidating the bullish outlook for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.